This post was originally published on this site

The worst four-month start of the year for the S&P 500

SPX,

since 1939 was bad enough, but this week’s volatility in the stock market was shocking: a 932-point increase for the Dow Jones Industrial Average

DJIA,

on May 4 followed by a 1,063-point decline the next day.

There were signs of panic selling on the New York Stock Exchange on Thursday, and corporate insiders have been accelerating their selling activity, rather than scooping up discounted shares of their companies.

What now? Is there anything you can do to protect your investment portfolio or take advantage of the volatility? Jeff Reeves outlines eight defensive strategies.

If you are looking to bail, Hayes Martin of Market Extremes expects a bounceback rally that might provide that opportunity to sell.

For a longer-term view, Brett Arends spoke with Ben Inker, co-head of Asset Allocation at GMO in Boston, who has specific advice about where investors building retirement nest eggs should put their money.

More about the moody stock market:

Protecting your money as interest rates rise

The Federal Reserve made two important policy moves this week to fight inflation by reducing liquidity. Bond investors anticipating the Fed’s actions had already sent interest rates much higher, fueling this year’s slide in stock and bond prices and leading to concerns of a near-term recession.

Here’s recent coverage and advice on how to navigate tough times for your wallet, savings and investments:

A reality check following the bull market

FactSet

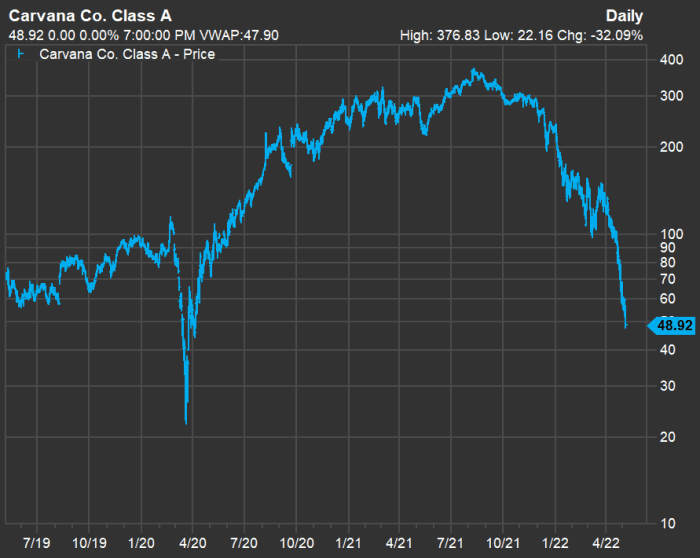

“Unicorn” startup companies — those valued at $1 billion or more — were hot items during the long bull market. One example was Carvana

CVNA,

which disrupted the used-car market with streamlined service. Times have changed, as you can see on the chart, above. Here’s how Carvana’s desperate situation applies to other unicorns.

Another post-bull-market reality check: IPO ETF slides 8% amid market carnage ahead of expected Bausch + Lomb pricing

Zillow underlines the uncertainty

Zillow

In November, Zillow

Z,

said it would exit its home buying and selling business to focus on its core online home listing and agency services, and mortgage lending. The company reported its first-quarter results after the close on May 5 and said revenue in its core Internet, Media & Technology rose 10%, ahead of its expectations.

It was certainly a good quarter — better than analysts had expected. But in this market, all eyes are on companies’ forecasts during earnings season. Zillow’s shares plunged 15% in pre-market trading on May 6 after CEO Rich Barton said the outlook for the U.S. housing market “may be choppy in the near term.”

Retirement locations for every need and desire

State Capitol Building in Dover, Del. .

Getty Images/iStockphoto

Silvia Ascarelli writes the “Where Should I Retire?” column. This week she helps a couple that is planning ahead for a retirement move and wants space for a large garden, goats and chickens. Here are three possible locations.

Check out MarketWatch’s retirement location tool for your own custom search. It includes data for more than 3,000 U.S. counties and incorporates climate risk.

Once you get there: 5 tips for finding meaningful part-time work in retirement

The results of studies of physical activity may surprise you.

A threat to Apple

MarketWatch photo illustration/iStockphoto

Apple

AAPL,

has an incredible loyal following, and not only because iPhones are so reliable. The company says it protects consumers with tight control of the software running on its devices. But politicians and regulators are taking aim at some of the restrictions, as Jon Swartz reports.

An amazing thrift-store find

Laura Young made a new old friend at Goodwill for $34.99.

San Antonio Museum of Art

“Shopping” doesn’t necessarily mean looking at the latest fashions and high price tags. Digging around can highlight a genuine bargain, as it did at a Goodwill store for this art collector in Texas.

Forget investing fads and read this book — or spread the word

Getty Images

The problem with reading a book that gives well-measured advice about investing is that it is best read by someone who is more prone to following fads than tried-and-true methods for building wealth. The tortoise beats the hare.

Here are 11 critical money and investment lessons from Brian Feroldi, author of “Why Does the Stock Market Go Up? Everything you should have been taught about investing in school, but weren’t.”

The effects of the tight labor market

Have you been waiting longer for food to be delivered?

Brandon Bell/Getty Images

High inflation and a tight labor market make it very difficult for companies to balance pricing and expenses. Shares of Lyft

LYFT,

plunged after the company said it would increase spending to attract more drivers. Ride-sharing rival Uber

UBER,

tried to forestall a similar market reaction by moving up its earnings announcement, but its stock tumbled as well.

Domino’s Pizza

DPZ,

is also suffering from a shortage of drivers.

Starbucks

SBUX,

is also in transition as part of its labor force unionizes. Another challenge for the company is changing consumer tastes, as Tonya Garcia reports.

How useful is your fitness tracker?

Getty Images

It’s not nudging you to move more.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.