This post was originally published on this site

Maybe you should question the home-price estimates you see online.

When Zillow Group Inc. announced after the market close on Nov. 2 that it was exiting its home-flipping business (and laying off 25% of its workforce), the company’s co-founder Richard Barton said the change in strategy resulted from “unpredictability in forecasting home prices.” The stock dropped 25% on Nov. 3 and has dropped 48% for 2021 through Nov. 4.

Following Barton’s bombshell, Jacob Passy explored a fascinating question about Zillow’s core real-estate listing business: How reliable can Zillow’s home price estimates be?

More coverage of Zillow and the housing market:

Looking for stock bargains? Here you go

In a prolonged bull market, there’s no end of warnings that we’re due for a pullback. Don’t worry — it will happen at some point, and we cannot predict the timing. Citing data going back to the 1920s, John Buckingham, editor of the Prudent Speculator wrote on Nov. 2 that “10% corrections occur every 11 months on average.”

Regardless of when pullbacks occur, this portion of the stock market is trading very low relative to the benchmark S&P 500 index, and following previous periods of low valuations, it has soared.

Another stock group that has outperformed: This new fund gives an ESG flavor to the tech-heavy Nasdaq-100 — and beats the index

Important rules for retirement savers and their loved ones

iStockphoto

Alessandra Malito covers the new limits on tax-deferred retirement account contributions for 2022.

And now for a more complicated set of rules that may be very important to you: Anyone with an IRA or other tax-deferred retirement account will withdraw as little as possible over the years, to avoid paying income taxes. But what if you inherit a retirement account? Here’s when you will have to withdraw money and pay taxes..

The harm that might come from following cliché career advice

An artistic endeavor can also be hard physical labor.

Scott Olson/Getty Images

How often have you heard speakers at graduation ceremonies advise successful students to “follow their hearts” when pursuing careers? It’s easy to say do something you “love,” but it can also have a downside, leading to overwork, burnout and financial stress.

Erin Cech, an associate professor of sociology at the University of Michigan, shares the results of her research into “the exploitation of passion-fueled labor” as people pursue their dreams.

A brutal day for Peloton

A company whose sales soared during the pandemic as people were forced to stay home is bound to suffer from some difficult year-over-year comparisons. But Peloton Interactive Inc.

PTON,

still surprised investors late on Nov. 4 when the company said it expected holiday sales of its exercise bikes and related services to be a third lower than analysts had estimated. The stock was down as much as 35% on Nov. 5, after falling 43% during 2021 through Nov. 4.

Here’s how analysts reacted to Peloton’s bombshell.

Meme stock mania

Avis became a very hot meme stock as investors jumped.

AFP via Getty Images

Meme stocks are those that move wildly on the news, as traders try for instant gains as they try to catch the wave. The phenomenon began with individual traders working together to drive up prices of heavily-shorted stocks, such as GameStop Corp.

GME,

and AMC Entertainment Holdings Inc.

AMC,

But even after that action cools, the meme label can remain as traders react to any good or bad news surrounding certain companies.

Thorton McEnery described the flurry of meme-stock action on Nov. 4 and the new enthusiasm for Avis Budget Group Inc.

CAR,

this week.

More meme-stock coverage:

Stock picks for the long term

On the other end of the investing spectrum, Michael Brush lists 10 stocks that may rebound after tax-loss selling. And here’s a list of four solar stocks for long-term investors from Andrew Wetzel of F.L.Putnam Investment Management Co.

Taking the lead for action by corporations to improve society

MarketWatch photo illustration/PwC, Getty Images

As part of MarketWatch’s Value Gap series, Ciara Linnane interviews Tim Ryan, senior partner and chairman of PwC U.S., after thousands of executives signed onto his CEO Action for Diversity & Inclusion initiative.

A happy retirement doesn’t only spring from money

Richard Eisenberg lists financial and mental traits of the happiest retirees.

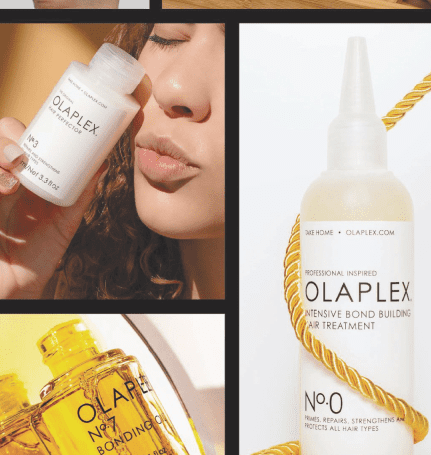

A haircare IPO success

Olaplex Holdings Inc.

OLPX,

says its customers have been willing to pay a premium for products, treating it as self-care during the pandemic. The stock price has climbed since the company went public more than a month ago, and Tonya Garcia describes the company’s approach to distributing its products, the support it has among Wall Street analysts and the financial risk the stock poses for investors.

A reminder to examine and fight medical bills

The billing dispute seems likely to be settled in her favor; however, it is another reminder to learn more about medical billing practices in advance.

Don’t have a cow, man

A surprising comment in a CNN news segment about a couple’s propensity for purchasing milk set up a flurry of amusing Twitter postings.

Getty Images

The Consumer Price Index was up 5.4% in September from a year earlier. That’s a high rate of inflation, but you have probably been shocked at much larger increases for certain food items. But sometimes a news story meant to add color to an economic phenomenon can backfire. Katherine Wiles shares some of the amusing reaction to a CNN news segment, in which a couple said they were suffering from the rise in milk prices because they buy a dozen gallons a week.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.