This post was originally published on this site

Welcome to the second article on undervalued international stocks. While it’s impossible for me to cover all of the undervalued stocks that exist across the world, or that I follow, my ambition is to showcase the opportunities I view as significant – or most significant.

For those of you hailing from the US, I want to once again point out that I understand it to be tricky to invest in these companies – and any international company, that’s not directly traded on the NYSE or Nasdaq. Were I to live in the US, I haven’t yet decided if I would own these companies through ADRs, or only stick to companies that are actually properly listed on the exchange. While returns and dividends on many of these companies are excellent – and actually way above their American counterparts, the fact is that there is currency risk, political risk, withholding/dividend tax issues, and other headwinds which preclude many from even considering ownership of such stocks.

This makes me quite happy that I have the current luxury of investing quite freely in a large number of geographies. Swedish taxation laws regarding both foreign dividend investments as well as domestic taxation are, surprisingly and as I’ve pointed out in other articles, extremely generous. This also means that I actually achieve much better results than by simply investing domestically.

Nor am I unique in this approach. Most “serious” Swedish dividend investors I follow or know of actually diversify at least to NA, and usually to other nations in Europe as well. I’ve received many a message that wonders why I diversify as I do, and what motivates me to look at other nations like I do – and this diversification is part of the reason.

In my first article, I pointed out five companies that I consider to currently be at excellent value. In this article, we move on and point out five more. Five companies with an even better undervaluation – all of them not in nations with small currencies, but rather in euro. I know many of you are leery of investing in smaller currencies such as the SEK – and this is understandable. In deference to this, I’ve tried focusing on euro-companies more in this article.

Let’s look at 1-5 of my current International undervalued stock list.

5. Banco Bilbao Vizcaya Argentaria (BBVA) (OTCPK:BBVXF) – 66%

5. Banco Bilbao Vizcaya Argentaria (BBVA) (OTCPK:BBVXF) – 66%

I’ve not yet written an article on BBVA, but this global bank should be interesting to you for a number of reasons. Markets are global, with primary markets being Mexico, Spain, the US, Turkey, and South America. While political risk and exposure remain a factor, I believe the bank’s fundamentals at this point at the very least justify a look at the company from your side.

While BBVA is based in Madrid and is inherently Spanish, its global operations are more extensive than many of its domestic counterparts. Apart from being the second-largest bank in Spain, it has an over 150-year history and manages assets of over €675 billion. The company has almost 8000 offices across the globe, over 125,000 employees, and a customer base that exceeds 75 million. In terms of global banking, BBVA is the 42nd largest bank in the entire world and makes every single Swedish bank in my portfolio look like peanuts.

COVID-19 has impacted BBVA. 1Q20 came in at a loss, though in large part this was because of US-focused goodwill impairment. However, despite COVID and goodwill impairment, the bank’s fundamental value, including Tangible book value per share, has remained near-constant/stable on a YoY-basis.

Some comment on the dividend, because in actuality and in difference to other European banks, BBVA has already approved the dividend on the AGM back in March. If BBVA were to go back on this, it would get into a legal quagmire due to the AGM’s decision. On the flip side, there’s the EU-wide ECB recommendation that European banks not pay any dividends during the year as long as the pandemic is ongoing and balance sheets effects become clearer. BBVA has stated its intention to follow this, and to be conservative, I believe investors should not expect the currently-announced 10% dividend to be paid out as though everything was normal, but rather expect a smaller interim dividend perhaps towards the fall or winter.

The fact is, BBVA is an excellent bank with well-working core operations and an annualized operating income of €12-14B. The bank can theoretically handle a full dividend payout if it so chose, as current levels of shares outstanding and the proposed dividend come to around €1.7B. Rather than expecting the dividend, however, I say this for illustrative purposes, on what results to expect going forward.

My future company-specific article will do more of a deep-dive into operations, but a word on current quality. BBVA is a clear class 4 stock with an A- rating, an unsafe dividend (given the suspension/cut), and a current earnings yield of 20.62%. The streak is zero, and dividend growth, until now, had been 7% but is now unreliable given the cut. Current valuation means that it trades at a P/E of 4.85X which investors need to ask themselves is really “fair” for a bank of this caliber. Analysts estimate an EPS of €0.12/share for the full year, impacted by COVID and operations, but expect this to go up to €0.43/share in 2021 (Source: S&P Global). My fair value estimate remains conservative, but I consider BBVA given its geographies and the scope of its operations to be worth at least 10 times earnings on a longer perspective, giving the bank a current upside of over 60%. Make no mistake, this is a higher-risk investment than other banks, and my position is small – but at this price, I love BBVA and what operations it represents. It is after all, a Spanish bank but one that generates profit across the world.

BBVA is a “Buy.”

4. Crédit Agricole (OTCPK:CRARF) (OTCPK:CRARY) – 67%

Most of my readers have probably never heard of the large French bank, Crédit Agricole – or the “Green Bank” due to its ties to agriculture.

Credit Agricole is the world’s largest cooperative financial institution. It consists of 39 regional banks, and a central institute, which in 1990 became an international, full-service bank and was fully set up in 1998, listed on the market as an acquisition company for the-then mutual banking network. Generally, international investors overlook Crédit Agricole in favor of other banks (more on that later), but I believe that this one nonetheless offers compelling arguments.

I’ve yet to do a deep-dive on this bank – so only a small indicator in its favor. Credit Agricole has outperformed peers on a 5-year basis, and by peers I mean other French banks. And by outperform, I don’t mean by 3-5%, I mean that the company has grown 55% in valuation while peers have either fallen or grown less than 20%.

Also, COVID-19 impacts on the bank have been low. 1Q20 saw a rise in the bank’s operating income due to managed loans, loan growth, insurance and asset management – in short, every business segment saw growth. There was some drop in net income due to rising risks costs, but the overall ratios and fundamental measures were excellent, and revenues saw nearly 5% YoY growth in the first quarter.

A word on the dividend. The bank is clearer than others in its communication, and specifies without ambiguity that the dividend will be allocated to the company reserves “following requests from the ECB.” The bank, as such, follows recommendations, but it should be noted that the 10% dividend prior to ECB recommendation and COVID was covered by earnings of a factor of nearly 2x, giving the company an LTM payout ratio of ~50%.

There is in fact much positive to be said of this bank – and it’s the reason I own a small position in it which I intend to grow – but that’s for the company-specific article.

Quality at this juncture is undeniable – unfortunately, so is the simple fact that it’s a class 4 stock due to the dividend cut. The company sports a P/E of 4.57X, and a current EPS yield of nearly 22%. It’s more undervalued, as I see it, than peers such as BNP Paribas (OTCQX:BNPQF). Streak is zero and dividend growth is none at this time following the cut, but I do want to point out that the bank sports a credit rating of A+, on the level with Swedish peers, and an excellent, nearly 16% CET1 ratio, again on par with European first-class peers. My price target for the bank is conservative given its wealth management and insurance making up 25% of operations, and I’d pay no more than 10X earnings for the bank, marking a target of around €11/share, giving us a current potential upside of 67%.

3. Societe Generale (OTCPK:SCGLF) – 93%

As much as I like Crédit Agricole, this bank is more undervalued than the former. Unlike the former, which is typically viewed as “very French” by investors, SocGen is the epitome of a global investment bank and financial services company. It’s France’s third-largest bank by total assets and seventh-largest in all of Europe. It is known as one of the Trois Vieilles (“Old Three”) of French banking, along with BNP Paribas and now-defunct/M&A’ed Crédit Lyonnais. At one point, the bank probably had one of the longest names in the world – Société Générale pour favoriser le développement du commerce et de l’industrie en France (English: General Company to Support the Development of Commerce and Industry in France) – and it can trace its roots back to 1864.

The bank’s current undervaluation is a direct result of SocGen not taking the steps to de-risk assets as quickly as its peers during the years following the financial crisis. This expressed itself through a weaker capital position and a comparatively unfavorable CET1 ratio which persisted until late 2019. Unlike the other banks, SocGen is still in the process of exiting franchises and an overall restructuring of certain parts of the operation, explaining perhaps even further the comparatively lower valuation we’re seeing.

4th quarter and FY19 results were excellent, with 5% revenue increases and 70 bps cost decreases. The company delivered on savings, and reduced its non-performing loans to 3.2% (down from 5.3% in 2015). The bank still has work to do, but it’s getting done. CET1 is worse than peers, coming in at 12.8% at the end of 2019. When investing, we also need to consider that SocGen has not-insignificant exposure to geographies like Russia and Africa. While these provided excellent growth in FY19, they can become risk factors/geographies in times like these. Overall, pre-COVID results were good, and things looked promising. Of course, it’s different now.

SocGen cut the dividend, which was previously in line with the company’s new dividend policy of 50% of group net income. Based on EPS, we could have expected a €1.5-1.6/share dividend, which would have put the yield at 13% based on today’s share price. Like its peers and despite its CET1-ratio, SocGen merits an A+ credit rating and currently trades at a P/E of 3.76X. The company no longer has dividend stability or a record of growth, but nonetheless trades at a very appealing earnings yield. Bank valuation based on tangible book has always been low based on SocGen’s higher risk-taking and unfavorable exposure, but has dropped ridiculously since the crisis and now stands close to 0.15X. (Versus closer to 0.4-0.5X). Despite all the risk, SocGen is a profitable and improving bank – and while unwilling to value it at 10X P/E, I would pay 7X, to represent the higher risk premium found here. This puts us at around €22-24/share based on an average of 2019 results and 2020/2021 expectations – though, during a good year, SocGen has shown itself capable of generating profits closer to €4-5/share.

In the big picture, I’d go with Crédit Agricole before SocGen – the latter’s unfavorable exposure to risky geographies as well as its ongoing restructuring in the midst of a crisis is a problem. This article is about undervalued stocks, however, and no matter how I personally feel about the company, I do believe that long term, SocGen is an excellent bet in French banking, and its value is appealing.

Societé Generale is a “Buy.”

2. MERLIN Properties (OTC:MRPRF) – 100%

We move from finance into Spanish real estate. It’s relatively young, and due to it being founded by former executives of Deutsche Bank (DB) of all things, it certainly merits a bit of care. I’m writing the company-specific article as my next article, but to put it simply, it had the support of international investment funds including BlackRock (BLK), Invesco, Marketfield, and money from Principal Financial Group (PFG). It started out acquiring 1000 properties/offices from BBVA, as well as the real estate divisions of Sacyr, a Spanish construction company, and Metrovacesa.

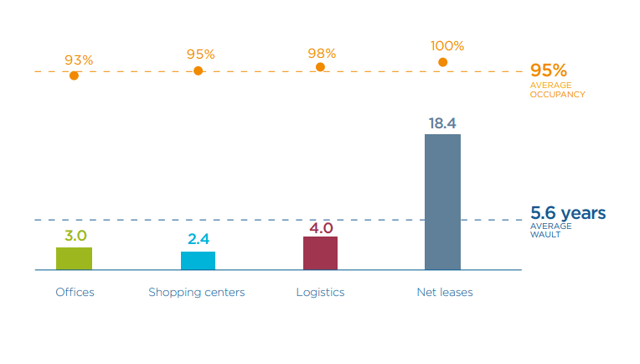

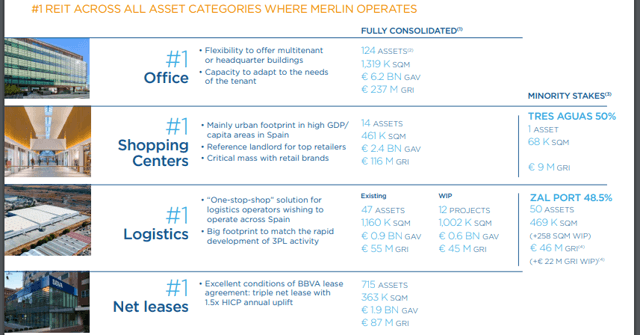

MERLIN (Merlin) is a Spanish REIT, and it’s one of the leading, Top-10 European REITs. It’s the largest Spanish REIT with over €12.8B in GAV and 4.3 million square meters with a 95% occupancy rate as of March 2020. It has a market cap of > €6B, is investment-grade BBB rated by Standard & Poor’s as well as Baa2 by Moody’s.

As I’m writing this article, Merlin trades at less than 50% of its EPRA NAV value, which comes to €15.60/share. This is held in a company with a 40.6% Loan-to-Value ratio, and a 6.4-year average debt maturity, with debt interest at an average of 2.09%, which is substantially better than virtually all American REITs. Sector-wise, Merlin owns around 46% offices, 23% shopping centers, 17% net-lease and 11% logistics with 3% “other” properties remaining.

(Source: Company 3M20 Presentation)

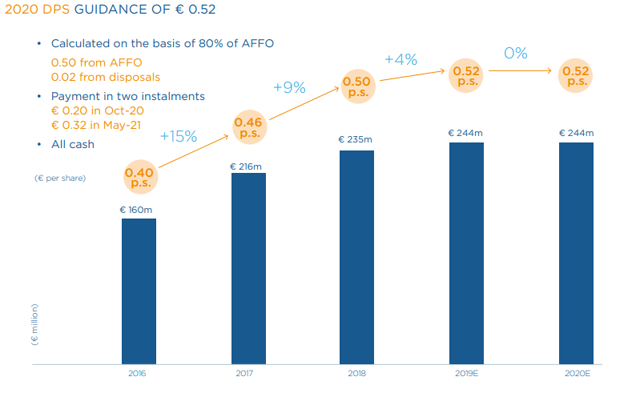

More company-specific information will come in the Merlin article, so a word on valuation and company quality. The current dividend payout is around €0.30-0.35/share, giving us a current yield of 5% per annum, but the formulation and payout are somewhat different than you may be used to. The company AGM is in June, and the initial company payout will amount to €0.2/share in October 2020. The company plans to distribute €0.2/share in cash, with plans to distribute another €0.32/share to be distributed but not until May 2021, and at the discretion of the board after following up on COVID impacts.

As of 3M 2020, the company’s FFO and AFFO declined less than expected YoY, at a rate of 5.6% and 10%, respectively, but still coming to an AFFO of €0.14/share post-COVID impacts. Merlin currently trades at a 0.45X to EPRA NAV. The company is too new to have a dividend growth streak or record, but S&P global expectation is for the dividend to remain stable going forward and for things to recover swiftly during 2020.

(Source: Company 3M20 Presentation)

I view Merlin to be worth at least somewhat below EPRA NAV given its property locations, occupancies, and exposure and set my price target around €14/share, or 0.8-0.9X to EPRA NAV. This gets us a potential upside of 100% from the current share price – and it’s important to recall that a Merlin share cost more than €13/share less than 3 months ago.

Merlin Properties is a “Buy.”

1. Leonardo (OTCPK:FINMF) (OTCPK:FINMY) – 110%

Chances are, you’ve never even heard of one of the largest European multinational aerospace, defense, and security companies. With over 180 sites worldwide, the company is actually the 8th-largest defense contractor on the planet in terms of revenues. Things also get state-owned here, as the Italian government owns 30% of the company through the Ministero dell’ Economia e delle Finanze.

(Source: Wikipedia)

There will be a specific article here of course, but I still wanted to point to this undervalued gem, as I see it, of a company and the most undervalued company I follow in the EU today. Leonardo researches, develops, and produces aeronautics, helicopters, Electronics/Defense security systems, and Space Systems/satellite launches. Over 150 nations in the world use the company’s products, and main production activities are found in Italy, the UK, Poland, and the US. Moreover, the company provides parts for the ITER project, an experimental tokamak nuclear fusion reactor being built in France slated to achieve first plasma in 2025.

(Source: Wikipedia)

COVID-19 has not provided any sort of back-breaking negative, long-term financial effects for Leonardo to date, though the company characterizes the FY20 impact as “significant.”

While the company has moved fast to protect people they employ, it’s important to note that Leonardo’s operations are classified as crucial, and therefore the company was never truly “closed,” merely reduced. A few effects were delays in deliveries of helicopters and lower productivity in some program executions. EBITDA took a hit during 1Q20 due to expected lower productivity, and revenue was also affected by the slowdown.

However, 1Q20 provided a 36% order growth increase YoY, with a book-to-bill ratio of 1X. The company has a solid 2.5-year production backlog valued at €37B, ensuring plenty of work available across its operations. While the company has suspended the 2020 guidance, the overall picture going forward is one of positive nature, as I see it.

(Source: Leonardo Presentation)

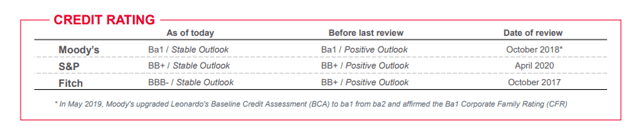

Leonardo has plenty of cash available, with €714M in hand, €1.8B in a revolver, and $2B in a new credit facility. Together with unconfirmed credit lines, Leonardo has a little north of €5B in available liquidity, should it need it. The company has no maturities in 2020, and only a €739M maturity in 2021. Debt is otherwise well-laddered, and credit ratings, while not up to par with international peers, are decent.

A word on quality then. The company, as seen above, is investment-grade rated by only one agency. This, among other things, makes it a class 4 stock. However, the company hasn’t suspended dividends and at 2.7% yield is in line with international peers. It’s also a weapons manufacturer that trades at a measly 4X earnings, and earnings are set to recover next year. At this value, we’re looking at an earnings yield of 25%, and the company dividend consumes barely 10% of LTM earnings, marking it safe unless the company was to follow suit with other European businesses – which it hasn’t yet.

Even accounting for the risks, I value Leonardo at a minimum of 10-11X earnings (well below international peers), which gives the company a current upside of 110%, making it the highest on the list I follow.

Leonardo, at such a price, is a “Buy.”

Wrapping up

The companies presented here are likely some you have never considered investing in – and that may be for a good reason. My own European exposure, despite living in Europe, is actually far smaller than my American/NA exposure, which should be indicative of my own thinking in these matters. That, however, doesn’t mean that attractive businesses don’t exist this side of the pond.

In this article, I’ve tried picking out the top 5 of them. There are 3 banks, one real estate and one industrial in the list – and while there are many, many more attractive investments available, I do believe these present genuine opportunities for long-term, risk-conscious investors willing to invest internationally.

Any investment into international stocks such as these, however, should be made after consulting with a professional to make sure that you understand the tax ramifications of doing so. Many of these stocks are only traded in ADRs in the US, making buying/selling them tricky due to the securities not being all that liquid at certain times. I would say also that they’re only viable as truly long-term investments – the same way I treat my own Spanish, French and Italian investments.

Even I, living in Europe, actually need to place orders by the phone when buying these companies, with a minimum position size of around $2500. This is significantly above my typical position size of $500. However, over the long term, I want geographical diversification, and I already own several of the companies mentioned in this article series, with the intention of buying more in all of them (and more).

If you share this interest and find these companies interesting or appealing, then this is a great time to do more research and consider investing to diversify your portfolio.

If you have comments, questions or disagree with the list or the companies therein, let me know in a message or comments!

Thank you for reading.

Disclosure: I am/we are long BBVA, CRARF, BLK, PFG, MRPRF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.