This post was originally published on this site

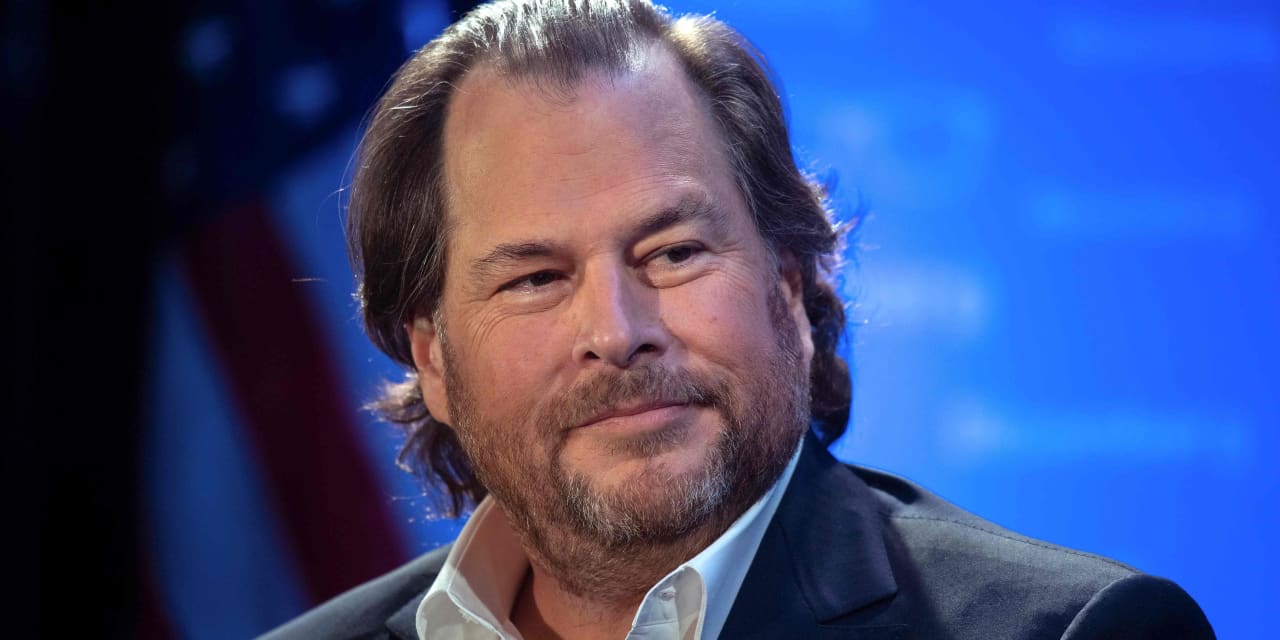

I wrote Tuesday that Marc Benioff faced the end of a very happy era at Salesforce Inc., with Wall Street ganging up on the software company as layoffs rile employees.

Benioff reached out to say it was “quite a headline,” agreeing to an interview Wednesday afternoon. He took the opportunity to remind me that I had been the first reporter to write about Salesforce

CRM,

when he asked Larry Ellison to leave his board in 2000, and used that fact to make a point — that he has dealt with more than one boom-and-bust cycle over the past 24 years, meaning this is not the first time he has had to “reshape” Salesforce.

“This isn’t my first recession,” Benioff said in our phone interview.

“Every year we constantly reshape the company,” he told MarketWatch. “We have gone from zero to $35 billion, we have added a lot, we have lost a lot, we reshaped over 24 years.” (Salesforce is projected to hit $35 billion in fiscal 2024 revenue.)

Yesterday’s column: Marc Benioff’s fairy tale is crumbling down and around him

Benioff was chatty and seemed in good spirits as his stock spiked toward its best day in more than two years, after a blowout earnings report and a forecast that showed what cost cuts could do for Salesforce’s bottom line. While booming stock prices satisfy Wall Street, my concern was not just for the stock: An evidently deteriorating workplace culture amid massive layoffs and the activist investors swarming into the stock in an unprecedented manner represent serious, twin threats.

Benioff brushed off any concern about the activists, saying “they made a lot of money today,” and forcefully argued that Salesforce’s culture is “still very strong.”

“It’s a culture of volunteerism and giving, it is still very much alive and well,” Benioff said, noting that Hawaiian-shirt Fridays are still a thing at Salesforce, as is the 1-1-1 model, which dedicates 1% of equity, 1% of product and 1% of employee time to the community.

“It is also a performance culture — we also demand high performance, to give back to the company in [employee] performance,” he said, having recently told the Wall Street Journal that employees pushed back against a system for performance-based layoffs through a ranking system. “That is our Ohana culture.”

“Our innovation,” he continued, “is very strong, [and] we are at record-low attrition with our customers. The company has never been stronger.”

While Benioff has no plans to leave his post anytime soon — he said he still loves Salesforce and still loves to be involved, even if he spends most of his time aboard airplanes — he did point out that “I always have a strong successor in place, I always will.”

Benioff has named two co-CEOs in recent years, and neither managed to actually take over from Benioff before leaving in relatively short order. High-profile executive departures have fueled further questions about Salesforce’s trajectory. Co-CEO Bret Taylor was the latest to leave, after just a year of sharing the top spot with Benioff.

More from Therese Poletti on Salesforce: Salesforce had better get used to Marc Benioff in charge, because he keeps chasing off his chosen successors

Also see: Amid layoffs, Salesforce reportedly has been paying Matthew McConaughey more than $10 million a year

Taylor left “because he had a twinkle in his eye when he saw all the changes with AI,” Benioff said Wednesday. “It will be something amazing,” he said, referring to Taylor’s plan to found an artificial-intelligence company with Clay Bavor, a former Google vice president.

On Wednesday’s crucial post-earnings conference call, Benioff was joined by Chief Operating Officer Brian Millham and Chief Financial Officer Amy Weaver, who both have president titles with the company. I mentioned that the structure was similar to that put in place by his mentor, Ellison, at Oracle Corp.

ORCL,

Oracle, where Benioff spent nearly a decade and a half, also had two presidents at one time, Mark Hurd and Safra Katz, who eventually become co-CEOs as Ellison moved to chairman. On the call with analysts, Benioff mentioned having received a text from Ellison right after this latest earnings report came out, saying that Ellison has spent a lot of time “giving me the Oracle playbook.”

Benioff called Millham and Weaver “my top two execs” in our interview, but when asked specifically whether his current succession plan involved them, he said offered only: “I have not talked about it.”

“They have different roles,” Benioff said, “Amy is the CFO, and Brian is the COO. He manages all the distribution and the go-to-market.”

More on the earnings news: Salesforce stock soars as Benioff says goal is to be the ‘most profitable software company in the world’

Asked what was happening with the five activist investors who have bought into his stock, Benioff brought up G. Mason Morfit and ValueAct Capital, saying, “We have been getting to know them over the last year.” Morfit joined the Salesforce board this week, and Benioff said the ValueAct CEO has been sharing with Salesforce a lot of tips and tricks — “probably what he learned on the Microsoft

MSFT,

board” — about, for example, distribution and pricing.

As far as the other activists go, Benioff said that not every activist has enterprise-software expertise, but “we are willing to listen to everyone.”

“I can learn from anyone and everyone. That is what I do every single day,” he said, adding that he practices shoshin, the Zen Buddhist concept of a beginner’s mind. “I try to have a beginner’s mind.”

He hinted that, in his relations with activists, it’s productive to bear in mind their ultimate goals. “They are investors, [and] they want to make money.”

“I think,” he said, as Salesforce shares spiked in after-hours trades, “they made a lot of money today.”

In depth: ‘No one is immune’: Activist investors target tech companies after stocks dive

That money will calm Wall Street down for a little while, but it doesn’t mean the storm is past in the home front.

MarketWatch asked whether more layoffs lie ahead after executives mentioned “short-term and long-term restructuring” on the conference call and multiple investment analysts broached the possibility of more cuts. Benioff would only repeat that Salesforce has been reshaped every year and that the company’s culture of Ohana — that’s the Hawaiian word for family — is still strong.

“As we get bigger, it is more newsy when we make these changes,” he observed.

Benioff still possesses the charm and bluster to dispatch the current challenges, but if cost cuts to boost profits as revenue growth slows become a new norm, Salesforce risks evolving into something more like the company the young Benioff escaped to pursue his own, different dream.

Decades ago, I wrote about Benioff’s desire to break away from Oracle, and now it feels more and more as if he’s walking Ellison’s path.