This post was originally published on this site

Booming U.S. house prices are is likely to benefit municipalities dependent on property taxes, but not immediately and not evenly, according to a report out Monday.

The report, from Fitch Ratings, notes that while the national aggregate gain in home prices has been in the double digits through the pandemic, some areas have done better than others.

In addition, home prices and property taxes don’t move in a precise ratio, given the long lag time for property tax changes based on appraisal data and local policies may mitigate or delay the impact to municipal revenues.

“The completion of the property tax revenue cycle lags home price trends by 18–24 months,” in most cases, the report points out.

Related: The way local governments raise their money needs to change

“Many states have tax regimes that temper the impact of the volatility of home prices on property tax receipts,” the report notes. “This moderates the tax burden on homeowners in times of robust home price growth, while protecting the government’s financial flexibility when home prices decline.”

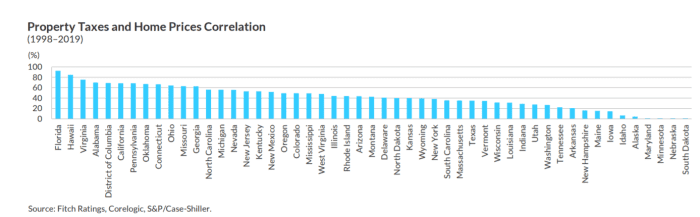

The report captures the historical relationship between a lagged home price index and property tax collections for all municipalities by state.

Florida has the strongest correlation between prices and taxes, followed by Hawaii, while South Dakota and Nebraska show the weakest.

Over 95% of state and local property taxes accrue to local governments, Fitch analysts write, according to the Bureau of Economic Analysis. And for most local governments, residential property taxes are “by far the dominant revenue source” within all forms of tax revenues, “often more than 60%,” the report notes.

Again, the national aggregate conceals some big local differences: 70% of revenues for municipalities in New Hampshire, Vermont and Maine came from property taxes, compared to less than 20% of revenues in Missouri and Kentucky.

Fitch developed a proprietary “tax boost” index which takes into account home price trends, property taxes as a percent of total revenues, and the historical correlation between home prices and property taxes.

Hawaii, Connecticut, and Florida are likely to see the biggest boost to tax collections, while Alaska, Maryland, and Nebraska are at the bottom of the list.

Read next: 3 outside-the-box alternatives for home buyers in a tough housing market