This post was originally published on this site

Investors should buy the dip in copper over the next three months to benefit from a “supercycle” for the industrial metal that will be driven by decarbonization trends such as the electrification of vehicles and the build-out of the renewable energy grid, according to Citigroup.

Prices for industrial metal copper

HG00,

are down 0.3% over the past three months, with the commodity up around 22% so far in 2021, FactSet data show.

“We continue to call for a copper ‘supercycle’ based on our expectation of strong producer margins over the next 5 years, relative to historical standards,” Citi Research analysts said in a commodities market outlook report Sunday. “Buy the dip over the coming quarter.”

During the final months of 2021, copper may be weighed down by “a further slowing in Chinese activity” that follows “a significant decline in sentiment” towards global growth, according to the report. Prices will probably “grind lower” as demand for the metal is constricted by global chip and container shortages in the pandemic, the analysts said, while also pointing to their concern over “signs of weakening construction activity in China.”

But these bearish factors may soon be overcome.

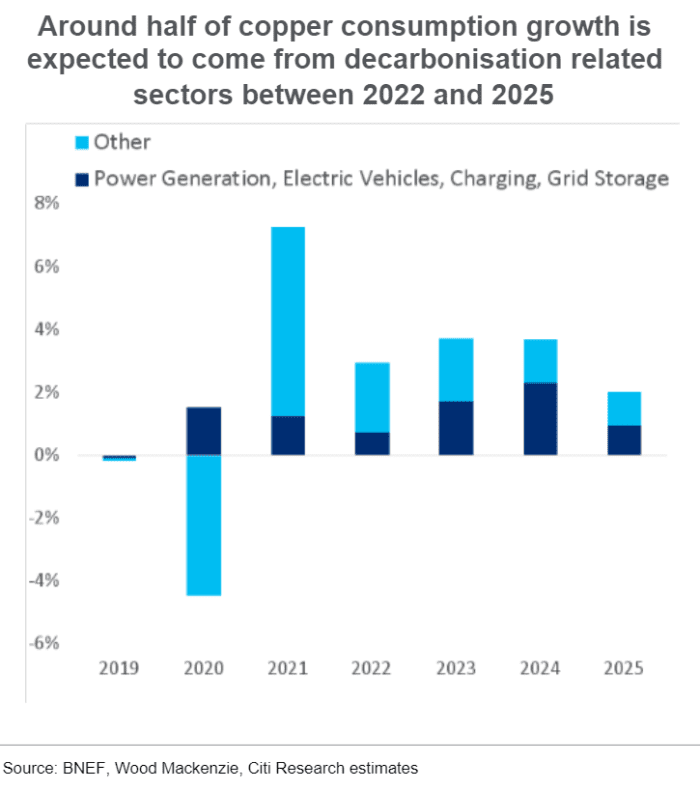

“We are increasingly bullish medium to long term,” the Citi analysts wrote. The analysts wrote the build-out of renewable power generation, electric vehicles, and related infrastructure as “driving around ~50% of consumption growth between now and 2025.”

CITI RESEARCH REPORT DATED SEPT. 26, 2021

Growth should also come from a recovery in global auto output beyond electric vehicles as supply chains are restocked, according to the Citi report. “Alongside a recovery in China, this is set to support metals prices at high levels in 2022.”

Meanwhile, copper supply remains a concern.

“Solid copper consumption growth through 2025 is set against relatively strong but still insufficient mine supply growth,” the Citi analysts said. “‘Old’ copper scrap has to respond if copper is to avoid a major deficit.”

As for the mining of the metal, supply growth should come from countries including Democratic Republic of the Congo and Peru over the next two years, according to Citi. The bank’s commodities analysts estimated that “mine supply growth is set to be around trend in 2022, and above trend in 2023.”

See also: Electric vehicle market growth is a blessing for some metals — and not a big worry for oil