This post was originally published on this site

Companies that benefited significantly from the inflationary spike in the past two years may lose the power to charge higher prices for their goods and services, a headwind for their stocks and the equity markets in the remainder of 2023, according to strategists at JPMorgan Chase & Co.

A team of strategists led by Mislav Matejka, head of global and European equity strategy at JPMorgan, said companies in the retail, automotive, airline and hotel industries are expected to be most impacted by cooling inflation as they may lose their pricing power.

The ominous uptick in consumer prices began in the spring of 2021 with the world’s biggest economies seeing their highest inflation rates in decades, pushed up by rising household demand and supply-chain shortages in the wake of the COVID crisis, the war in Ukraine and the presence of a strong labor market.

The general sentiment was that the 40-year-high inflation rate would hurt corporate profitability as a range of input costs spiked. However, that didn’t materialize in the past two years because corporations managed to use elevated input costs as a source of pricing power, and consumers were willing to accept it, Matejka and his team said, in a Monday note.

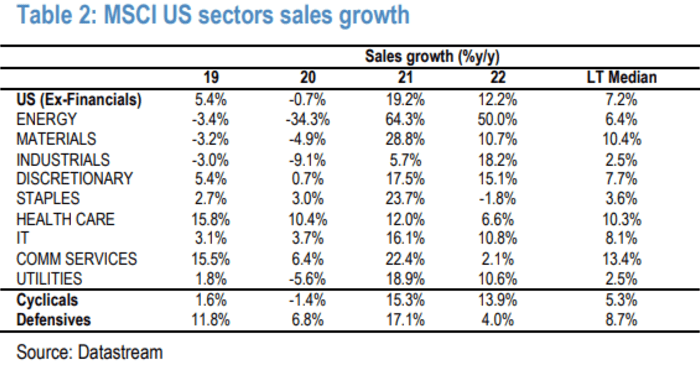

As a result, nearly all sectors in the U.S. and European stock markets saw double-digit sales growth in 2021 and 2022, and companies’ operating margins were well above pre-pandemic levels (see chart below).

SOURCE: DATASTREAM

“Sectors such as discretionary, industrials and tech are higher [in their operating margins], in addition to energy and materials, while defensives such as healthcare, staples and utilities are the only sectors that are lower,” which makes them less affected by cooling inflation. Therefore, the defensive sector have a bid into year-end, Matejka and his team said.

“There is a risk of reversal, especially if final demand stalls, potentially if countries’ PMI softness continues, and as supply chains have normalized,” they added.

Meanwhile, rising oil prices could lead to demand destruction, which is another headwind for corporates’ pricing power, the strategists wrote in the note.

Energy prices soared to right above the $90-a-barrel threshold from around $70 per barrel for both the West Texas Intermediate crude and Brent crude in late June.

JPMorgan economists said only a quarter of the jump in oil is demand driven, owing to strong jet fuel demand and better-than-expected economic growth. However, they attribute the bulk of the spike to the sharp supply cutbacks by OPEC+, and estimate a resulting 0.5% drag to GDP.

If oil sustains the rally, Matejka and his team think the impact will be different to what transpired in 2021 and 2022, when commodity price increases were replicated in most other sectors, likely attributed to pent-up demand and post-COVID liquidity. But this time, companies might not be able to pass on rising input costs as easily as they did in the past two years, the strategists said.

See: Oil could hit $150, sending ‘shock through system,’ says top shale CEO

West Texas Intermediate crude for November delivery

CL00,

CLX23,

rose 71 cents, or 0.8%, to settle at $90.39 a barrel on the New York Mercantile Exchange, while the November Brent crude

BRNX23,

the global benchmark, gained 67 cents, or 0.7%, to $93.96 a barrel on ICE Futures Europe.

U.S. stocks finished lower on Tuesday as long-term Treasury yields

BX:TMUBMUSD10Y

remained near their highest levels in 16 years. The S&P 500

SPX

was off 1.5% and the Dow Jones Industrial Average

DJIA

was down 1.1%, while the Nasdaq Composite

COMP

ended 1.6% lower, according to FactSet data.