This post was originally published on this site

Russia’s invasion of Ukraine is creating an unprecedented commodity shock. That’s bad news for emerging markets that import oil and food, but largely a positive for commodity exporters.

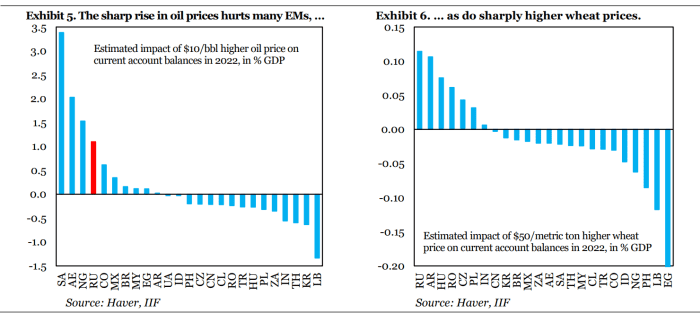

Economists at the Institute for International Finance, a trade group representing the global financial services industry, broke down the impact in a Thursday note featuring the chart below:

Institute of International Finance

The IIF economists estimated, for example, that every $10 rise in oil prices, which they treat as a roughly 10% increase, widens Turkey’s current-account deficit in 2022 by 0.3 percentage point (left chart), raising its dependence on foreign capital inflows at a time when global investors’ appetite for risk is “unsettled.”

The current account is a tally of a nation’s transactions with the rest of the world, including net trade in goods and services, net earnings on cross-border investments and net transfer payments.

It’s a similar story when it comes to wheat (right chart). A $50 rise per metric ton in price for the crucial food grain — also equivalent to a roughly 10% rise — boosts Egypt’s current-account deficit by 0.2% of gross domestic product, the economists found.

Oil, wheat and other commodity prices have soared since Russia’s Feb. 24 invasion of Ukraine. The U.S. and its allies have responded with sweeping sanctions that are expected to decimate Russia’s economy.

The U.S. moved this week to ban imports of Russian crude oil and other products. If the rest of the world follows suit, it would leave a huge hole in supply that analysts have estimated could drive crude prices temporarily above $200 a barrel. The U.S.

CL.1,

and global oil benchmarks

BRN00,

have retreated over the past two days from nearly 14-year highs, but remain up more than 16% since the invasion.

The war has shut Black Sea ports, curtailing grain exports from the region. Russia and Ukraine together account for around a quarter of global wheat exports. U.S. soft red winter wheat futures

W00,

have pulled back 9% this week, but surged more than 40% last week toward an all-time high, logging the biggest weekly gain on record for the commodity.

See: Ukraine invasion stokes stagflation worries because Russia is a ‘commodity superstore’

Rising commodity prices are mostly good news for Latin America because they provide a large lift to the terms of trade of commodity exporters in the region, the economists noted.

The iShares MSCI Emerging Markets exchange-traded fund

EEM,

is down 7% so far in March. The S&P 500

SPX,

-tracking SPDR S&P 500 ETF Trust

SPY,

is down 3% over the same stretch.

The benefits of rising oil and food prices for some emerging markets might not matter much, the IIF economists acknowledged, if a sharp escalation in the Russia-Ukraine war sparks a flight to safety and “indiscriminate” capital outflows from emerging markets.” In that case, there may be nowhere to hide,” they wrote.