This post was originally published on this site

U.S. stocks could be gearing up for a relief rally capable of lifting the S&P 500 index back toward 4,400, but don’t expect it to last, warned a veteran market strategist who called the index’s first-quarter slide.

“We see an S&P 500 relief rally to 4,400 by [April 30, 2022], but thereafter we see risk of a more prolonged slowdown that should cause the S&P 500 to weaken again May to October 2022,” wrote Barry Bannister, chief equity strategist at Stifel, in a Tuesday note.

A bounce to 4,400 would take the S&P 500

SPX,

up 5.4% from its Monday close at 4,173.11. The large-cap benchmark, which previously entered correction territory with a pullback of more than 10% from its early January high, was up 1.3% on Tuesday near 4,226. The Dow Jones Industrial Average

DJIA,

jumped around 360 points, or 1.1%.

Bannister in February reiterated a call for an S&P 500 pullback that would test the 4,200 level in the first quarter after an earlier call for a summer 2021 correction missed the mark. He called for a test of 4,050 on Feb. 27, three days after the invasion of Ukraine.

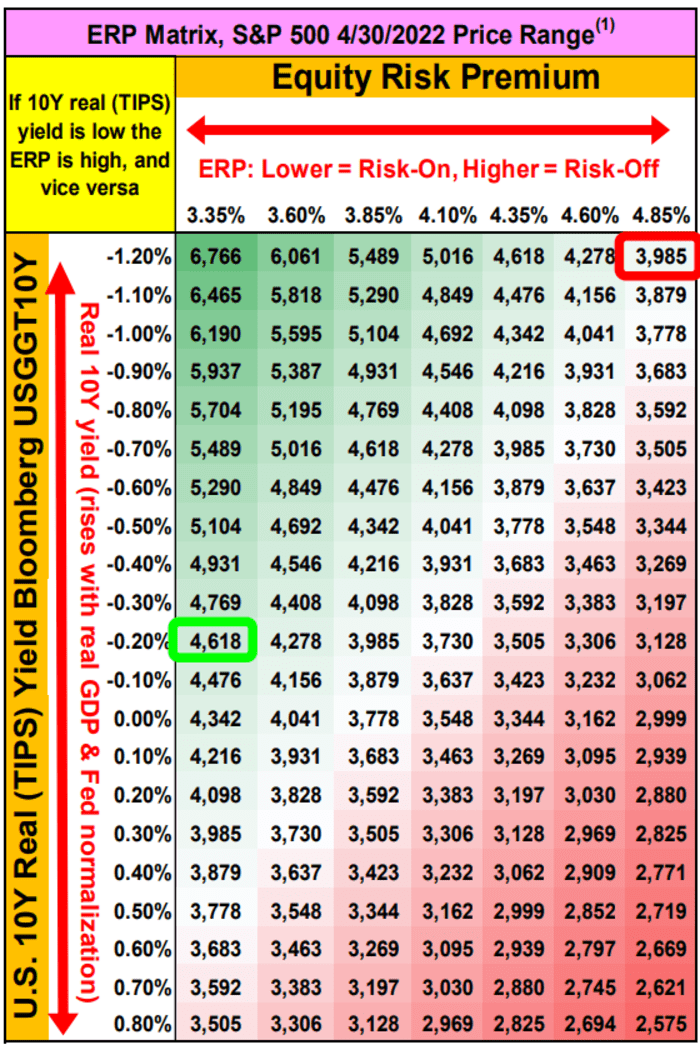

Bannister based the range on a look at the equity risk premium, which refers to the extra yield that investors require to hold equities over risk-free Treasurys. Stifel calculates the premium as the “normalized” S&P 500 earnings yield (earnings per share divided by price) above or below the risk-free, real 10-year Treasury yield (see chart below).

Stifel

That analysis indicates an admittedly wide range for the S&P 500 between 4,200 and 4,600, he wrote.

Stifel sees the S&P 500 in the upper end of that spread through the end of April and at the lower end between May and October. Positive seasonal factors are part of the reason for the expectation for the near-term relief rally, Bannister said, arguing that the “only way a rally does not occur by the end of April 2022 is if current events are the seasonally worst market environment in 71 years (which we do not view as likely).”

Bannister said he now expects the March 8 low at 4,158 to hold if there is a peace deal between Russia and Ukraine and signs of sanctions on Moscow ending.

Without an unwind of sanctions, a “supply-shock” recession is possible, he said.

“If sanctions on Russia do not end after a peace deal, then 2-way economic warfare means sanctions [plus] Russian commodity embargoes targeting Western GDP,” Bannister wrote. “Russia’s Black Sea fleet and other capabilities control a large share of oil and gas, nickel (batteries, steel), palladium and platinum (auto emission OEM, electronics), wheat, corn, fertilizer, aluminum, semiconductor neon, etc.”

See: Invasion of Ukraine stokes stagflation fears because Russia is a ‘commodity superstore’