This post was originally published on this site

The U.S. and its allies are ramping up sanctions against Moscow in response to Vladimir Putin’s decision to wage war on Ukraine, putting a spotlight on countries with the biggest trade and financial exposure to the Russian economy.

Monday certainly marked a day of shock and awe in terms of the financial market response to sanctions. Russia’s ruble

USDRUB,

plunged to an all-time low and authorities decided to close the country’s stock market for at least two days after the U.S. and its allies over the weekend moved to remove more Russian banks from the Swift interbank messaging system, albeit with exemptions for energy transactions, and took aim at the ability of Russia’s central bank to tap massive foreign reserves it could otherwise use to defend its currency.

The moves sent ripples through global financial markets, with U.S. stocks posting a mixed finish after a volatile day of trading. The Dow Jones Industrial Average

DJIA,

finished the day with a loss of 166.15 points, or 0.5%, while the S&P 500

SPX,

edged down 0.2%.

“The entire Russian economy could be crippled if businesses in the country are unable to make and receive payments from foreigners,” wrote Wells Fargo economists Jay H. Bryson and Nicole Cervi, in a Monday note.

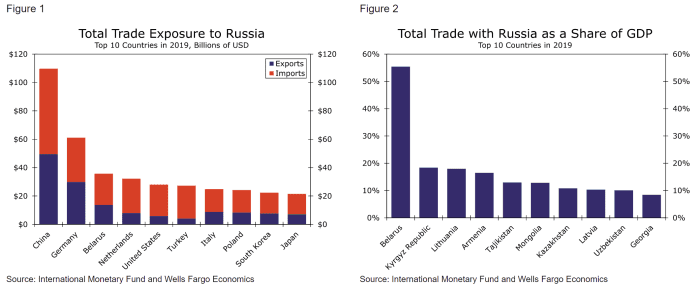

But countries that have meaningful economic and financial exposure to the Russian economy could also be in for some pain if Russia falls into a sharp economic contraction, they warned. In the charts below, they detailed the country’s with the biggest trade exposure to Russia in terms of both total dollars (at left) and as a percentage of gross domestic product (at right):

Wells Fargo

It’s the chart on the right that shows where the most pain would likely be felt, and they’re made up mostly of former Soviet republics, with bilateral trade between Russia and Belarus topping the list at 50% of Belarusian GDP in 2019. Since much of that trade is likely in oil and gas, any measures that ultimately target Russia’s energy exports, which have so far been spared, could have big ramifications for Belarus and other major trading partners, the economists said.

They noted, however, that bilateral trade between Ukraine and Russia amounted to only $10 billion in 2019, equivalent to just 7% of Ukrainian GDP. In comparison, bilateral trade between Ukraine and the European Union was nearly $45 billion, or equivalent to around 29% of Ukrainian GDP.

“This intensification of trade ties between Ukraine and the West has been years in the making. In the immediate aftermath of the dissolution of the Soviet Union, the amount of bilateral trade between Ukraine and Russia was roughly three times as large as the amount of Ukraine-European Union trade,” the economists noted.

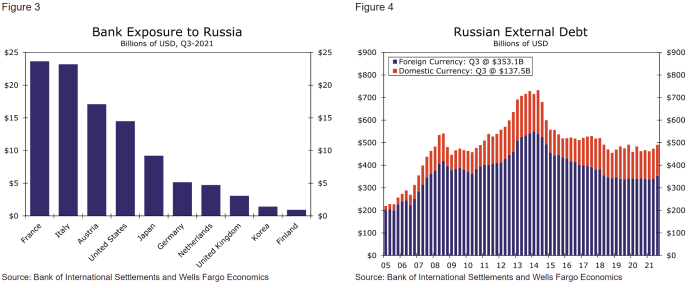

When it comes to financial exposure, Western Europe has the most to worry about, the economists said.

Wells Fargo

Data from the Bank for International Settlements show that the French and Italian banking systems each had around $23 billion of aggregate exposure to Russia at the end of the third quarter of 2021 (left-hand chart), which means banks in France and Italy could suffer losses if their loans to Russian entities and households were to become nonperforming, they said.

The Austrian banking system places third with $17 billion of aggregate exposure, though that’s significantly smaller than its French and Italian counterparts, But that $17 billion is equivalent to about 1.5% of the Austrian banking system’s assets, making it the most financially exposed to Russia on a relative basis, the economists said, while the $15 billion of exposure that American banks have to Russia is equivalent to less than 0.1% of U.S. banking system assets.

“Even if all of this exposure were to sour, the overall American banking system would not be materially affected,” they said.