This post was originally published on this site

Bank of America’s Michael Hartnett said investors have started piling money back into stocks following the biggest outflow this year. But they pulled money from bonds at the same time, resulting in the largest weekly outflow since March.

That is according to the latest weekly “Flow Show” report published by Hartnett and his team regularly on Fridays. According to data on exchange-traded fund and mutual-fund flows from EPFR cited by the team, investors put $11.7 billion to work in global stocks, while pulling $3.6 billion from bonds, and $12.9 billion from cash during the week through Wednesday.

That follows an equity-market outflow of $16.9 billion during the week ended Sept. 20, the biggest outflow since December.

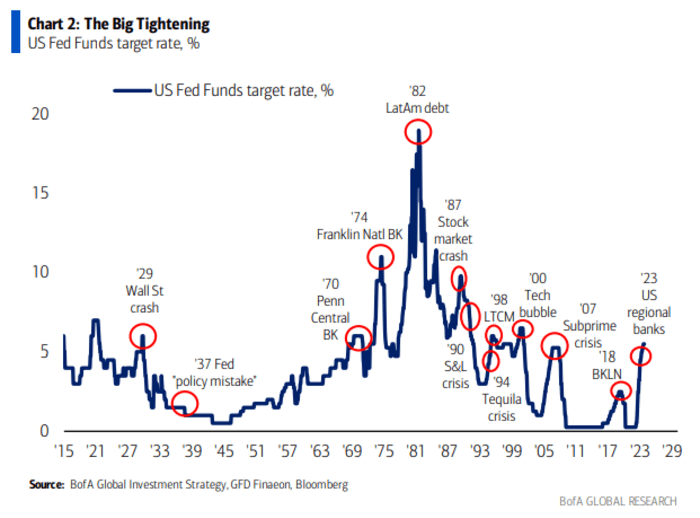

In addition to his roundup of fund flows, the longtime BofA equity strategist shared some interesting charts supporting his case for remaining bearish on stocks, and why his clients should “stay bearish/defensive and sell the last hike.”

Apparently, he expects the Fed will break something else with its interest-rate hikes, and that the March regional banking turmoil might not be the end of it.

BANK OF AMERICA

Fed officials signaled earlier this month that they expect to raise interest rates once more before the end of the year, before keeping rates on hold, albeit at higher levels than investors had previously expected, during 2024.

Hartnett also included a warning about the Bank of Japan, which could send a shock wave through global markets if and when it abandons its policy of keeping a tight grip on Japanese government bond yields. That is looking increasingly likely as consumer-price inflation in the country surges to its highest level in decades.

According to Hartnett, a 20% surge in the value of the yen, which currently sits at a 52-year low against the U.S. dollar in real terms, according to Hartnett, would trigger a “global credit event.”

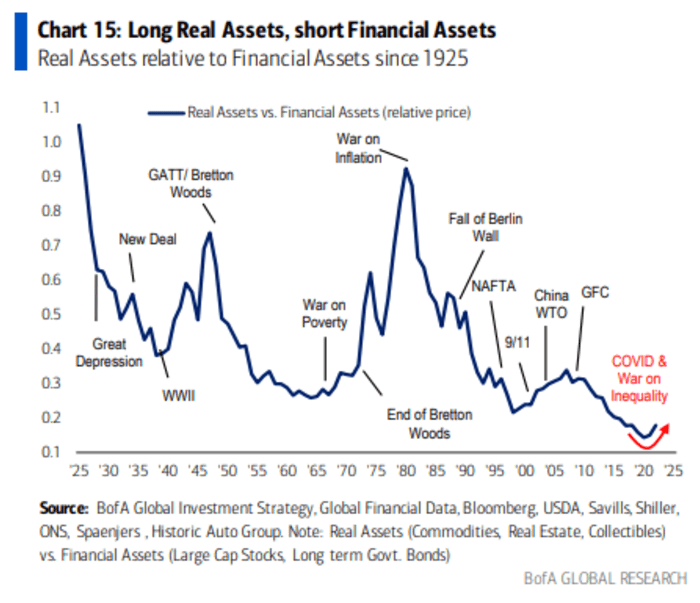

Over the long term, Hartnett still expects “cash, commodities, real assets” will outperform financial assets like bonds and stocks during the 2020s.

“Real assets are…scarce…cheap (relative to financial assets close to 100-year lows) under-owned…a hedge against Inflation…diversify portfolios,” Hartnett said in his note.

“All individual real assets are positively correlated with inflation since 1950 diamonds, U.S. farmland and gold have the highest correlation between change in the price and the U.S. CPI inflation rate.”

BOFA

So far in 2023, commodities have outperformed stocks, most notably crude oil. West Texas Intermediate crude

CL.1,

CL00,

has risen more than 13% since the start of 2023 to trade at $90.84 a barrel. The S&P 500

SPX,

by comparison, has gained 11.7% year-to-date through Friday afternoon, according to FactSet data. The index was down 10.93 points, or 0.3%, at 4,288 in recent trade.