This post was originally published on this site

Only two other points in the roughly 45-year history of the U.S. investment-grade corporate bond market have been this bad for returns, according to BofA Global.

Analysts at the bank pegged the sector’s negative -10.5% return so far this year as its third-worst stretch on record, eclipsed most recently by its minus -14.3% performance from August and October of 2008, following the collapse of fabled Lehman Brothers investment bank.

Before the shock of the global financial crisis, the next-worst period for investment-grade corporate bonds was its minus -11.5% return from January to April of 1980, when former Federal Reserve Chairman Paul Volcker was battling “a 14.5% inflation environment” that quickly spilled over into a recession, according to BofA strategists led by Oleg Melentyev, in a Thursday client note.

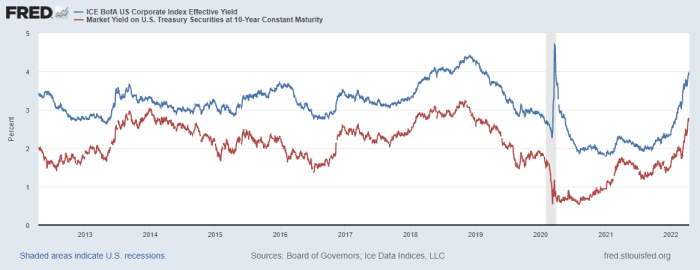

Yields in the investment-grade sector were up sharply this year too, now near 4% on average (blue line, in chart), and approaching prior peaks of the post-global financial crisis period.

Investment-grade bond yields near 4%, near prior post 2008 peaks

Federal Reserve data

The harsh selloff in debt issued by highly rated companies comes as U.S. Treasury yields have shot higher, with the benchmark 10-year

TMUBMUSD10Y,

(red line in chart) rising this week to 2.8%, its highest level since December 2018, according to Dow Jones Market Data. Corporate bonds are priced at a spread, or premium, above the risk-free Treasury yield, to help compensate investors for default risks.

The carnage in bonds comes after a record borrowing spree by many high-grade companies in the S&P 500 index

SPX,

during the pandemic, with the financing frequently used to replace more expensive debt coming due with cheaper funding.

Investors this year, however, have been more acutely focused on dismal returns on debt investments and inflation pressures, with Refinitiv pegging weekly outflows from conventional fixed-income funds at $8.5 billion through Thursday, the bulk from investment-grade corporate funds.

Individual investors can gain exposure to corporate bonds through fixed-income retirement-savings plans, but also from exchange-traded funds, the biggest of which is the iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

With defaults less of a concern in the sector, the hope has been that recent volatility eases, perhaps as the Federal Reserve “front-loads” its interest rate hikes this year, as anticipated, and significantly reduces its near $9 trillion balance sheet to battle hot inflation.

So, has the worst already passed for investment-grade, or even high-yield, corporate bonds?

“We see good reasons for this,” the BofA team wrote, pointing to the near 25% drop in oil

CL00,

prices from their recent peak, and other signs that the 8.5% yearly inflation rate in March could represent the top.

Related: What’s next for gasoline prices?

The team also touched on recession worries.

“As investors get more concerned about a potential recessionary scenario, what would you rather own: a 4% near-guaranteed IG yield or a 5% earnings yield on equities?” they wrote.