This post was originally published on this site

U.S. stocks slumped after a surprisingly hot reading on inflation in October. Consumer prices jumped 0.9%, and the core measure also accelerated.

While the Dow Jones Industrial Average

DJIA,

dropped sharply after the data, one strategist argues the hot reading removes a key argument against equities.

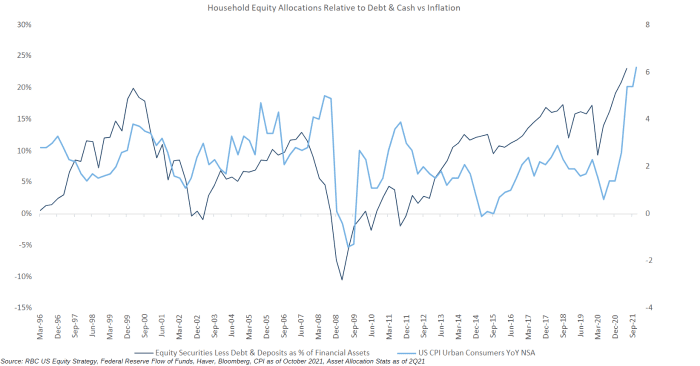

The household allocation to stocks vs. bonds and cash has moved closely to inflation since 1996.

“We think it’s important to keep in mind that inflation has, historically, tended to keep households invested in equities at the expense of bonds and cash,” says Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets. She points out, historically, allocations to stocks relative to bonds and cash rise as inflation increases. “Nominal non-inflation linked bonds and cash are poor hedges for inflation as their capital returns do not fluctuate with increases in the price of goods and services.”

That’s important to consider because one of the key bearish arguments for U.S. equities is the fact they’re overowned on positional studies. “With inflation still running hot, it’s hard to see what will cause that equity exposure to come down near-term,” she says.

RBC just lifted its price target for the S&P 500

SPX,

in 2022 to 5,050 from 4,900.

The brokerage still has the same expectations on earnings, but it’s more constructive on the economy, corporate tax hikes are less of a threat, and individual investor sentiment has been pessimistic.

“We are not ignoring the challenges posed by inflation and supply chains, but are trying to keep them in their proper context. We’ve just exited a reporting season in which companies reminded us that underlying demand and appetite remain healthy and that most are still able to manage through,” she writes.

RBC has been optimistic on small-caps, value and cyclicals since August, and the Russell 2000

RUT,

has been hitting new highs and outperforming large-caps. “We wouldn’t get too comfortable in either trade, but we think small-caps aren’t done leading yet and Value has some catching up to do,” Calvasina adds.