This post was originally published on this site

The current bull market has been a largely one-way arrow, pointing up and to the right.

Julian Emanuel, a strategist at Evercore, says this is the year where the swim upstream continues but the river gets wider.

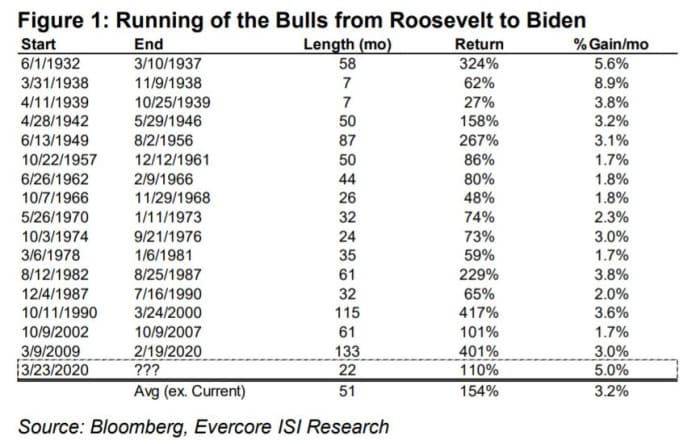

Historically, bull markets don’t see such impressively large gains per month as the current 5% pace. “Average” in this current bull market would move the S&P 500

SPX,

to 5,567.32, with gains topping out in June 2024, he said in a note to clients.

His forecast for 2022 is for the S&P 500 to reach 5,100. But he flags two scenarios that could either lead to stellar gains or a swift tumble.

First for the optimists: if sentiment could reach the peaks of 2000, in cyclically adjusted price-to-earnings terms, then the S&P 500 could rally all the way to 5,509.

For the bears, either a prolonged pandemic, or a spending/debt/economic hangover akin to post-World War II or the end of the Spanish flu pandemic, opens downside to 3,575.

This wide range of potential outcomes means investors will have to manage volatility, understand valuation, and embrace value, he says. The last time the Fed reduced its balance sheet, there was elevated stock market volatility

VIX,

While the price-to-earnings multiples may compress, declining valuations in and of themselves are not a reason to sell stocks, he said. When the trailing multiple rises to 45% above its 5-year moving average, stocks were higher in 24 months, albeit with more muted returns and higher volatility.

The firm expects that the shift in value over growth is still in its early days. “Value stocks historically thrive in an environment of high growth, inflation and rising interest rates,” he said, with the firm preferring financials. Utilities, however, are exposed to higher interest rates with an unattractive return on equity profile.

The Dow Jones Industrial Average

DJIA,

ended Tuesday with a 183-point gain, and has climbed 95% from its bear-market low.