This post was originally published on this site

The Dow Jones Industrial Average briefly traded above 36,000 early Monday, a level forecast in a subsequently ridiculed 1999 book that had predicted a much faster rise to that milestone.

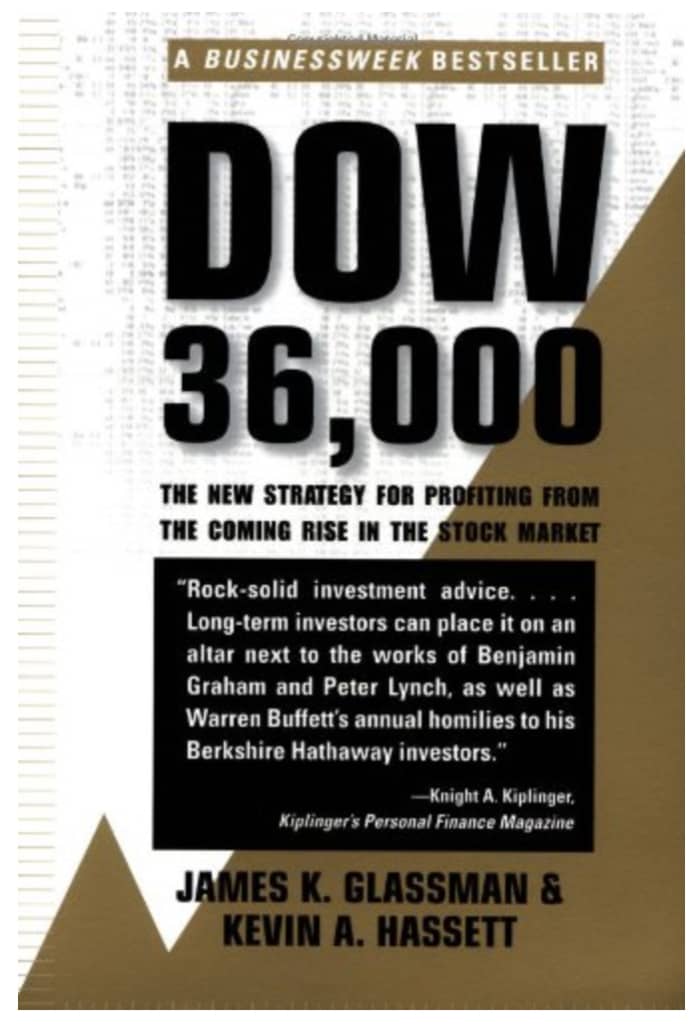

“Dow 36,000″ by journalist James K. Glassman and economist Kevin Hassett argued that stocks in 1999 were sharply undervalued and poised to quadruple. The rub, noted Jason Zweig in The Wall Street Journal on Monday, was that the book, published with the Dow trading above 10,000, said the move should occur “very quickly” or even “today,” while acknowledging it could take “three to five years.”

Uncredited

Glassman told Bloomberg that he believed he and his co-author had been mistaken to believe “that investors were ‘wrong’ in demanding high returns to compensate for extra risk that equities, in truth did not possess. Our mistake was to define risk in only one way — volatility of stock prices. I have learned a lot about risk since writing the book, as have all Americans with such events as 9/11 and the COVID pandemic.”

Glassman went on to serve as undersecretary of state for public affairs and public diplomacy in the George W. Bush administration and as the founding executive director of the George W. Bush Institute. Hassett, a former Federal Reserve economist, served as chairman of the Council of Economic Advisers during the Trump administration.

Economist Kenneth Rogoff, in a guest column in The Wall Street Journal in September, said that while Glassman and Hassett indeed misjudged investor perceptions around risk, they “also got something very right.”

Rogoff said the pair’s “extreme take” on the puzzle presented by the equity-risk premium, which is the mystery of why average stock returns seem high relative to safe bonds, underlined an important point:

Those with the wealth and liquidity to ride out short- and medium-run fluctuations have an enormous advantage. For those with little wealth, the advice to invest in stocks is not very helpful. Yet for the majority of middle-income Americans, who certainly understand long-term investing when it comes to housing, the equity premium is something they should know about and make their own decisions.

For its part, the blue-chip gauge

DJIA,

was clinging to a gain of around 8 points, or less than 0.1%, near 35,835 after trading as high as 36,009.74 in early activity Monday. The S&P 500

SPX,

drifted 0.1% lower, while the Nasdaq Composite

COMP,

was up 0.1%.

All three major indexes traded at intraday records in Monday’s session after logging record finishes Friday.

If the Dow were to close above 36,000 on Monday it would be 70 trading days since its last 1,000-point milestone, the longest such stretch since the move from 29,000 to 30,000, according to Dow Jones Market Data.

It would also mark the sixth 1,000-point milestone of 2021, the most in a single year on record, though such milestones are obviously less impressive on a percentage basis as the index rises.