This post was originally published on this site

Previously surging commodity prices were retreating in August, with the blame being placed partly on a slowdown in China’s voracious appetite for imports that may be here to stay, according to one economist.

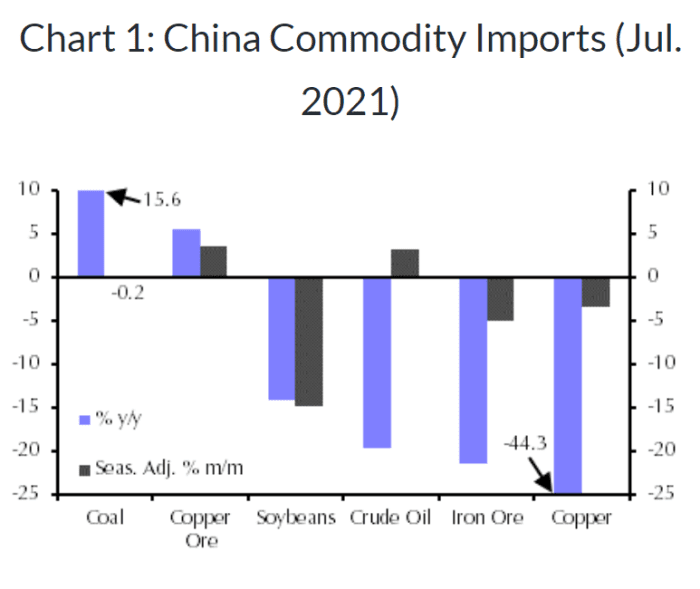

“The latest trade data out of China adds to the evidence that demand growth in the world’s key commodity consumer is slowing,” said Kieran Clancy, a commodities economist at Capital Economics, in a Monday note (see chart below).

Capital Economics

“This supports our view that the broad-based rally in commodity prices from their pandemic-induced lows has run its course, and that most prices are set to edge down from here,” he said.

Oil futures were in the spotlight Monday, with both the U.S.

CL00,

CLU21,

and global

BRN00,

BRNV21,

benchmarks tumbling more than 4% at session lows as China further tightened restrictions on activity and travel. Over the weekend, data out of China showed July crude imports of 9.7 million barrels a day, roughly in line with June and remaining below 10 million barrels a day for a fourth consecutive month, according to Commerzbank.

The S&P GSCI Index

SPGSCI,

which tracks prices for 28 commodities, was down 0.7% Monday. Like oil, it traded at its lowest intraday level since July 20. The index is down more than 3% so far in August but remains up more than 27% so far in 2021 after hitting another record high in July.

China’s demand for iron ore has cooled significantly as Beijing cracked down on excess steel production. CME iron-ore futures

TIOU21,

are down 26% in August, according to FactSet.

Steel mills in several provinces have reportedly been ordered to keep production within 2020 levels, Clancy noted, and most of the rebates on value-added tax available on steel exports from China have been removed. That helps to explain why China’s steel exports have slumped even as aluminum exports have risen in line with stronger external demand, he said.

But beyond individual commodities, “the overall picture is one of weaker demand, which is a trend we see intensifying in the months ahead,” Clancy said.

He noted that recent survey data pointed to a slowdown in commodity-intensive manufacturing and construction activity, which may be blamed for the broad-based fall in import volumes in recent trade data.

Meanwhile, Goldman Sachs on Monday cut its 2021 China growth forecast as a result of the efforts to contain the spread of the delta variant, though the bank expects a rebound later in the year.

Goldman slashed its third-quarter real gross domestic product forecast to 2.3% from 5.8%, but boosted its fourth-quarter growth forecast to 8.5% from 5.8%, leaving the full-year 2021 projection at 8.3% from a previous 8.6%.

Real, or inflation-adjusted, import momentum is likely to remain muted in the near term as domestic demand is weakened by the spread of the delta variant, wrote economists Tommy Wu and Louis Kuijs of Oxford Economics, in a Monday note.

They expect import volumes to expand sequentially in the latter part of the second half as domestic growth regains momentum. While imports related to supply chains will be less affected, they expect domestic consumption to suffer a setback in the third quarter that will weigh on overall import demand in the near term.

Wu and Kuijs also expect Chinese authorities to keep reining in borrowing by property developers, cooling import demand tied to real-estate investment. Infrastructure investment, however, is likely to gain steam in the second half as local government special-bond issuance resumes after a slow start to the year, though the pace may remain lukewarm.

The researchers were more upbeat, however, on the outlook for corporate investment, but argued that overall, a shift in the domestic growth pattern would support imports of capital goods, “while commodity imports look set to slow.”