This post was originally published on this site

Offshore money centers like the Cayman Islands and the small, self-governing territory of Jersey in the Channel Islands contributed to the $75.3 billion poured into long-term Treasurys during February, just as the 10-year Treasury broke above 2%, according to Deutsche Bank researchers, citing government data released Friday.

That monthly data, known as TIC for Treasury International Capital and released by the Treasury Department, shows that the Cayman Islands purchased a net total of $49 billion in long-dated U.S. government debt that month — surpassing the second-largest buyer, the U.K., which had $40 billion. Jersey, located off the French and English coasts, purchased a net total of $2 billion.

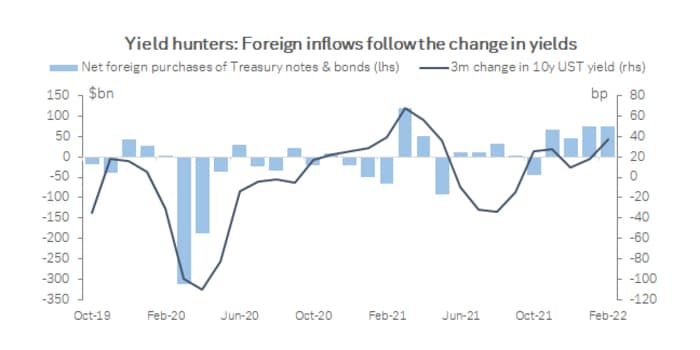

February’s net foreign inflows into long-term Treasurys were the largest since March 2021 and rank as the third-largest in the past 10 years, Deutsche Bank strategist Steven Zeng, research analyst Aleksandar Kocic and others wrote in a note Monday. What’s more, the team suggested that Russia might have been an off-the-book buyer since international sanctions against Moscow began in late February as a result of the war on Ukraine, “and the source of inflows were concentrated in a few offshore centers that could in theory be used to evade those measures.”

To be sure, the Cayman Islands has ranked as a Top 10 foreign holder of Treasury securities for some time, according to government data. The tax haven also has served as a favored place for Wall Street to register complex funds, including opaque collateralized debt obligations, or CDOs, that helped fuel the pre-2008 subprime mortgage boom.

The Treasury Department’s public affairs office did not immediately respond to an email from MarketWatch, asking about the possible link between Russia and the purchase of Treasurys from offshore money centers.

Interestingly, fears of a Russian invasion of Ukraine are what led to a perceived flight to safety into Treasurys by investors even before the Feb. 24 incursion, and such government-bond buying helped put a lid on what might have otherwise been a more significant increase in Treasury yields. Earlier that month, a sharp rise in U.S. inflation had led traders to largely price in a half-point rate hike by the Federal Reserve in May, and had pushed the 10-year yield above 2% for the first time since 2019 amid an aggressive selloff on Feb. 10.

Market-based rates rise during selloffs of government debt and fall when investors are buying because yields and bond prices move in opposite directions.

“The simplest explanation for the strong February inflows is that Treasury yields

became more attractive,” said the team at Deutsche Bank

DBK,

While foreign inflows tend to track the change in the 10-year yield, “it’s also possible that global geopolitics added to the foreign activity” in Treasurys, they said.

Source: U.S. Treasury, Deutsche Bank

February’s moves extend the trend of solid inflows into long-dated government debt that began in November, Zeng and the others said.

On Monday afternoon, Treasury yields moved higher as investors returned from the three-day Good Friday holiday, with the 10-year rate

TMUBMUSD10Y,

hovering around 2.86% and the 30-year rate

TMUBMUSD30Y,

at 2.97%.