This post was originally published on this site

So surely, we’re back in the bad news is good news stage, right?

After Federal Reserve Chair Jerome Powell’s testimony on Tuesday that the central bank is ready to back to more aggressive interest-rate hikes if economic data doesn’t cool off, it would be natural to think that the market prefers to see the data get worse than get better.

Jason Hunter, managing director for technical strategy at JPMorgan, says that would not be enough to boost stocks.

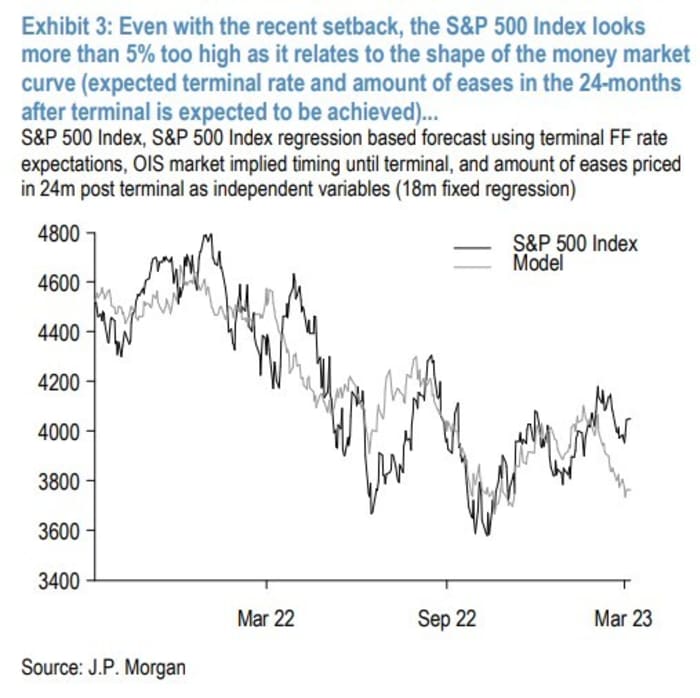

First, he says, the S&P 500 index looks overvalued, given the shape of the money market curve. A model using regression analysis finds the S&P 500 more than 5% overvalued, or more than 1.5 standard deviations too high, he says.

JPMorgan’s models suggest that, actually, worse data will be worse for the stock market.

“Those regression models suggest that a normalization of Fed policy rate expectations via softer than expected data over the near-term can actually see the S&P 500 trade marginally lower, as the excessive residual richness of the index is more extreme than the market’s adjustment to a lower terminal rate as based on the historical sensitivity,” says Hunter.

Put a different way, if JPMorgan’s economic surprise index retraced all of the surge from January and February, the JPMorgan model yields a 3,875 price for the S&P 500

SPX,

The S&P 500 ended Tuesday below 4,000, at 3.986.

Of course, while bad news might not be good news, could good news be even worse? Hunter says that in the supply constrained 1970s, the equity market became positively correlated with the yield curve, and bottomed within a one to five month period after the curve set new cycle lows.

On Tuesday, the yield on the 2-year

TMUBMUSD02Y,

versus the 10-year

TMUBMUSD10Y,

was the most inverted since Sept. 1981. “With the recent hawkish repricing pushing the curve through the Sep 2022 trough, that countdown needs to restart whenever the curve bottoms in the future. As such, we think the probability for a deeper S&P 500 Index slide to next support near 3200 and a bottom later within the first half of 2023 has increased,” he said.