This post was originally published on this site

Shares of Tesla Inc. rallied Friday, to extend the previous session’s more-than $100 bounce, after Daiwa Capital analyst Jairam Nathan said it’s finally time to start buying again, as supply chain concerns and rising oil prices weigh on legacy auto makers.

The electric-vehicle market leader’s stock

TSLA,

climbed 3.0% in premarket trading Friday.

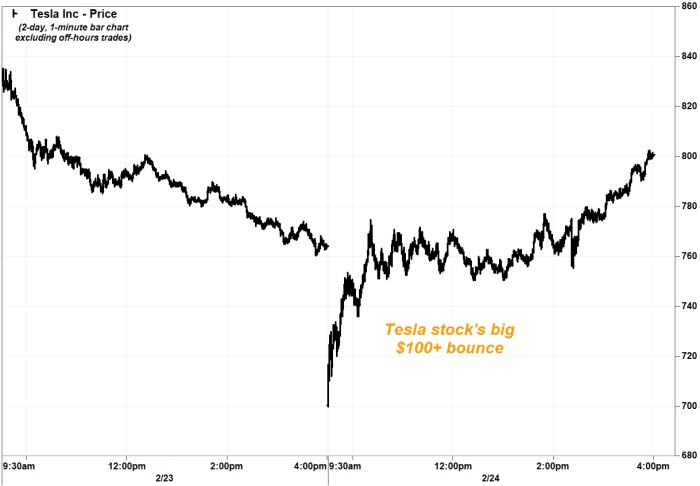

On Thursday, the stock had tumbled as much as 8.3% to a six-month low of $700.00 in intraday trading, as Russia’s invasion of Ukraine sparked an early broad-market selloff, but then it pulled a sharp U-turn to close up 4.8% at $800.77. See Market Snapshot.

FactSet, MarketWatch

Daiwa’s Nathan upgraded Tesla to outperform, after being at neutral since July 2020. He cut his stock price target to $900 from $980, but his new target implies 12.4% upside from Thursday’s closing price.

Nathan believes renewed supply chain concerns, combined with higher oil prices, enhance the company’s competitive advantage over legacy internal combustion engine (ICE) rivals. Read more about Tesla’s latest earnings report.

“Tesla’s ability to export out of cost-efficient China and history of better managing chip shortages in 2021 could strengthen its competitive position under the current Russia/Ukraine situation,” Nathan wrote in a note to clients. “At the same time, higher oil prices and potential scenario of fuel shortages, especially in Europe, could accelerate the shift to EVs.”

Crude oil futures

CL00,

slipped 0.5% on Friday, after trading above $100 a barrel in intraday trading on Thursday for the first time since July 2014.

Nathan said the resulting decline in profit contribution from ICE vehicles, as uncertainties over new vehicle supplies and fuel prices weigh on demand, “could slow down investments into EV expansion” that is being targeted by Tesla’s competition.

In this environment, he believes Tesla is “best positioned” to satisfy higher EV demand, with capacity expansion in China and the U.S.

Don’t miss: Ford sales stumbled on ‘persistent’ supply problems.

Read more: GM’s Q4 sales fall short, but renewed focus on EV growth gets investors excited.

Tesla’s stock has tumbled 28.3% over the past three months through Thursday, while shares of rivals Ford Motor Co.

F,

have dropped 15.3% and General Motors Co.

GM,

have slumped 25.5%. The S&P 500 index

SPX,

has lost 8.8% over the same time.