This post was originally published on this site

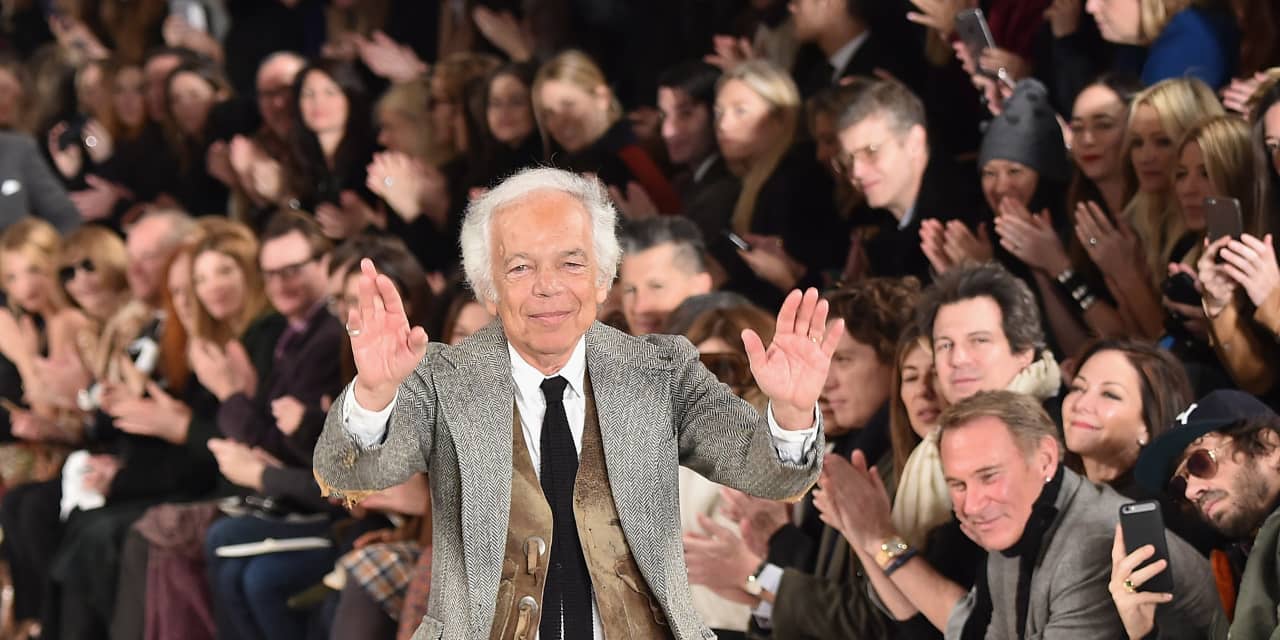

Ralph Lauren Corp. and PVH Corp. were downgraded to neutral from outperform at Wedbush, with analysts expressing concern that demand in Europe could fall after the Russian invasion of Ukraine.

Wedbush cut Ralph Lauren’s

RL,

stock price target to $127 from $150. And PVH

PVH,

which includes Calvin Klein and Tommy Hilfiger in its lineup, had its target cut to $85 from $140.

Analysts reviewed the companies it tracks across the footwear and apparel categories, finding that PVH has the highest European penetration with 45%, and Ralph Lauren’s exposure is also elevated at 28%.

“While it’s unclear how this situation will play out long-term, we think that exposure to Europe could be viewed negatively by the market in the near-term,” analysts led by Tom Nikic wrote.

“While Russia and Ukraine themselves are small markets for most of our group […], there’s reasonable scenarios where this situation could begin to affect the rest of Europe (due to a sentiment overhang stifling consumer spending).”

One company that called out its Russia exposure was Farfetch Ltd.

FTCH,

which said in a filing that 6% of its gross merchandise value (GMV) for the year ending Dec. 31, 2021 was in Russia.

Read: Farfetch stock soars as the luxury e-retailer moves away from markdowns, swings to full-year profit

Other companies in the analyst group’s coverage saw their price targets cut including: Ugg parent Deckers Outdoor Corp.

DECK,

(down to $313 from $390); Nike Inc.

NKE,

(down to $163 from $185); and Skechers USA Inc.

SKX,

(cut to $48 from $54).

“Since there was little direct exposure to Russia and Ukraine, there was a possibility that this could have been a non-factor for most of our companies,” analysts said.

“However, as the situation has escalated, it’s becoming increasingly likely that the war could spill over into consumer sentiment across the European continent, particularly in light of the news last week that fighting had taken place at the largest nuclear reactor in Europe.”

Carter’s Inc.

CRI,

was upgraded to outperform from neutral at Wedbush based on its limited exposure.

“In addition to its defensive characteristics, we see tailwinds from the accelerating birthrate and marriage rate in the U.S.,” analysts said.

Ralph Lauren stock is down 5% over the past year. PVH stock has tumbled 24.2%. And Carter’s is up 10.6%.

The S&P 500 index

SPX,

has gained 12.7% over the last 12 months.