This post was originally published on this site

Shares of Peloton Interactive Inc. dropped Wednesday, after Wedbush analyst James Hardiman backed away from his long-time bullish stance, citing uncertainty over the at-home-fitness company’s ability to navigate a more competitive post-pandemic world.

Hardiman cut his rating to neutral, after being at outperform since a pre-pandemic January 2020. He trimmed his stock price target to $115.

The stock

PTON,

slid 4.0% in morning trading, putting it on track for the lowest close in about four weeks.

“[Peloton] is now embarking on the next leg of its growth story, one that in a post-pandemic era will require the company to generate its own momentum through savvy marketing and compelling new products, as consumers will not only have the full complement of in-person workout options again available to them, but also an unprecedented and ever-growing list of digital/at-home choices,” Hardiman wrote in a note to clients.

With that in mind, Hardiman said moving to neutral on the stock “makes sense,” until he has a better idea on underlying demand growth and has more visibility on what investors are willing to pay for that growth.

What also worries Hardiman is that a series of engagement data he tracks across various social media platforms suggests the buzz surrounding the product may be wearing off.

“[T]he y/y growth [in engagement] in the June quarter has seen substantial deceleration, which should not be surprising given seasonal and reopening headwinds, but nonetheless would seem to mark a turning point for a company that has continually defied gravity since its IPO, and presents evidence that the law of large numbers is finally catching up,” Hardiman wrote.

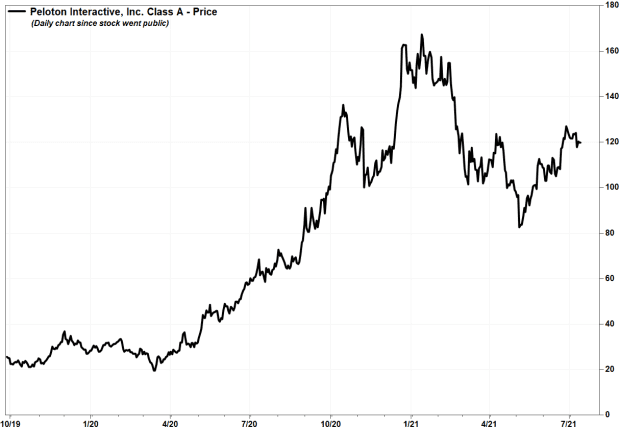

Peloton went public in September 2019, with the stock closing its first day 11% below its initial public offering price of $29, and ending 2019 still down at $28.49. But then the COVID-19 pandemic hit, and the stock skyrocketed 434% in 2020 as gym closures boosted demand for at-home workout equipment.

FactSet, MarketWatch

So far this year, however, as COVID-19 restrictions have lifted, Peloton’s stock has shed 24.1%, while the SPDR Consumer Discretionary Select Sector exchange-traded fund

XLY,

has gained 13.5% and the S&P 500 index

SPX,

has climbed 16.8%.

Also weighing on Peloton’s stock in 2021 was a public-relations blunder in which the company initially refused a request by the U.S. Consumer Product Safety Commission to recall its Tread+ treadmills after one child died and more than 29 reports of injuries. The company eventually issued a voluntary recall of the treadmills, and Chief Executive John Foley apologized, saying the company “made a mistake” by waiting so long.

Don’t miss: Peloton stock sinks to 8-month low after 125,000 treadmills recalled for ‘risk of injury or death.’

The stock suffered a year-to-date loss of as much as 45.5% when it closed at $82.62 on May 5, but has run up 39.3% since then.

“While we believed that the Street had overreacted to the Tread+ safety issues’ impact on the business (leaving the stock in the low $80s), the snap back runs the risk of underappreciating the potential impairment to the growth prospects to the new Tread, which has always represented a significant portion of our bull thesis, and will therefore be the focus of our research during the upcoming (hopefully) relaunch,” Hardiman wrote.

He said beyond Peloton’s core bike business, the next leg of growth could be in the form of new products, whether that’s the new Tread product or the “long-anticipated” rower.