This post was originally published on this site

Shares of Okta Inc. surged toward a fifth straight gain Wednesday, after Raymond James analyst Adam Tindle said he was more than just bullish on the cloud-software company, saying Wall Street has punished it enough following a “perfect storm of negativity” this year.

Tindle raised his rating to strong buy, after initiatiing coverage of Okta in April with an outperform rating. He lifted his stock price target to $310, which implies a roughly 19% gain from current levels, from $300.

The stock

OKTA,

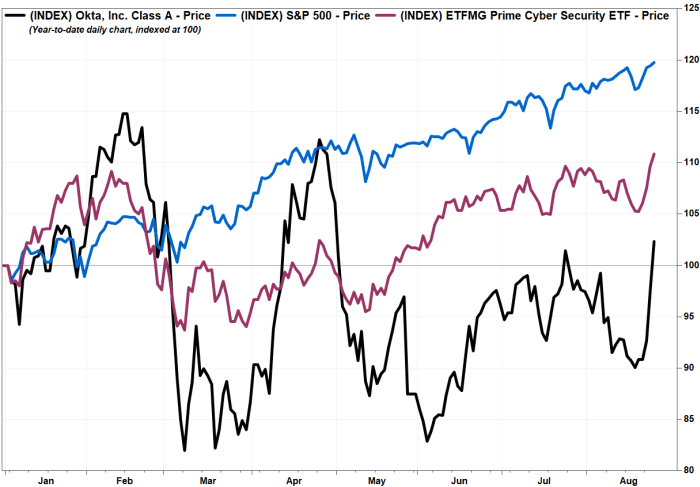

rose 5.2% in afternoon trading, and has now climbed 13.8% over the past five days. The stock, which was on track to close at the highest price since April 30, has edged up 2.4% year to date while the ETFMG Prime Cyber Security exchange-traded fund

HACK,

has rallied 10.8% and the S&P 500 index

SPX,

has run up 19.8%.

Among the issues that have weighed down the stock this year, Tindle said, are the closing of the $6.5 billion AuthO acquisition, which was viewed as a defensive move; a second transition of the chief financial officer position and a big drop in relative valuation.

FactSet, MarketWatch

“While the market has punished the stock, our work via proprietary surveys at recent industry events, and strategic discussions with senior channel executives (due to our Supply Chain coverage) suggest this former angel has fallen far enough, and should regain its wing[s],” Tindle wrote in a note to clients.

Among reasons for his increased conviction:

- An acceleration of organic trends as the surveys suggest identity access management (IAM) is a top three area of future spending for customers.

- An inflection in the secure customer identity and access management (CIAM) market, as channel checks suggest deal count and deal sizes are increasing.

- Recent hires in senior management indicate a “strong talent pool” for an imminent new CFO.

- A “re-rating” in valuation, on core acceleration alongside beta products for the second half of 2021 in privileged access management (PAM) and identity governance and administration (IGA), where checks suggest customer desire for consolidation.

“While we have been biding our time since launching coverage earlier this year due to our below-Street model at the time, Okta has since cleared the decks, and now is the time to get ahead of the groundswell of catalysts beginning with our above-Street model into 2Q results,” Tindle wrote.

Okta is scheduled to report fiscal second-quarter results on Sept. 1, after the closing bell. Tindle expects adjusted earnings per share for the quarter of 7 cents, while the FactSet consensus is for a per-share loss of 35 cents.