This post was originally published on this site

Wall Street analysts and investors don’t seem to “love” Elon Musk’s buyout offer for Twitter Inc. as much as Musk believes they should.

While some analysts said Musk’s per-share bid of $54.20 to buy Twitter’s stock

TWTR,

that he doesn’t already own was “fair,” or even “generous,” at least two analysts downgraded the stock, with one even recommending investors sell.

Musk, who is “Technoking,” or chief executive of Tesla Inc.

TSLA,

said in a letter to Twitter Chairman Bret Taylor that his “best and final” bid was “a high price and your shareholders will love it.”

But based on the stock’s reaction to the bid, it appears investors are skeptical that a deal will get done. Keep in mind that Musk said if a deal doesn’t work, “I would need to reconsider my position as a shareholder,” which sounds like a warning he that he might sell his stake.

The stock fell 1.7% to $45.08 Thursday — reversing an intraday regular-session gain of as much as 5.8%, and a premarket gain of as much as 17.8% — to trade 16.8% below Musk’s bid price. Read about the reaction on social media to Musk’s proposal.

Analyst reactions were also very mixed.

Wedbush’s Dan Ives, who covers Tesla, said he believed a deal “likely happens,” as Twitter’s board will may be forced to accept Musk’s bid as it would be difficult for other bidders to emerge.

But Ives’ colleague at Webush who covers Twitter, Ygal Arounian, said he didn’t believe a deal gets done “at this level,” and said it’s possible that Musk concedes by making a “higher” bid.

“That said, valuation here is generous and a premium to where [Twitter] shares are trading relative to peers,” Arounian said. He’s had a neutral rating on Twitter’s stock for at least three years.

Also read: Here’s how Elon Musk’s buyout offer for Twitter stacks up to what he paid for his stake.

Read more: If Musk’s $43 billion Twitter takeover falls apart, who else has enough money to buy the company?

Stifel Nicolaus analyst Mark Kelley downgraded Twitter to sell from hold, while reiterating his $39 stock price target.

“We believe [Musk’s bid] sets a near-term ceiling on shares, detaches the company from fundamentals and offers significant downside risk if Mr. Musk decides to abandon his offer or sell down his stake,” Kelley wrote.

Read more: Twitter employees blanch at prospect of Musk ownership.

Oppenheimer’s Jason Helfstein also downgraded Twitter, but to perform from outperform, following Musk’s bid. He suspended his $60 stock price target, which was 10.7% above Musk’s bid. Based on current valuations, he now believes the stock is valued on a relative basis in the $48-to-$54 range.

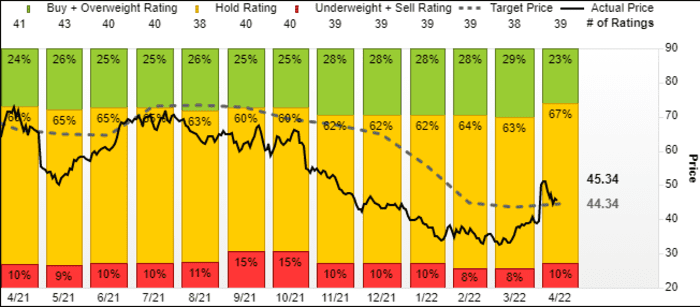

Of the 39 analysts surveyed by FactSet who cover Twitter, two-thirds rate the company the equivalent of neutral, while only about a quarter are bullish and about four analysts are bearish. The average stock price target of all the analysts is $44.34, or 18.2% below Musk’s bid price.

FactSet

Raymond James analysts believe the Musk’s bid is “attractive,” but that Twitter will likely pursue “a go-alone route for now.” Piper Sandler’s Thomas Champion said Musk’s offer “seems reasonable,” and sees a counter-offer as unlikely.

Analyst Colin Sebastien at Baird, who has been neutral on Twitter’s stock for at least the past three years, said he believes Musk’s bid represents “a fair valuation” for the company. He said that while the bid is “a bit less” than historical valuation multiples, those multiples arguably embedded “outsized” expectations for growth.

Twitter’s stock has run up 17.3% over the past three months, but has tumbled 35.4% over the past 12 months. Meanwhile, the S&P 500 index

SPX,

has slipped 5.8% the past three months but has gained 6.5% the past year.