This post was originally published on this site

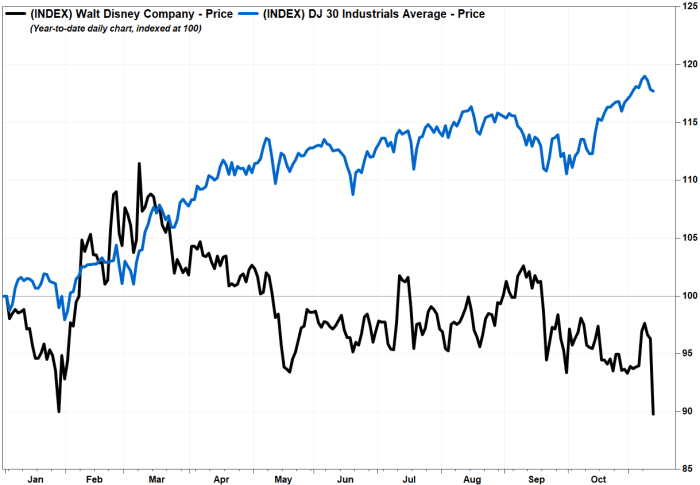

Shares of Walt Disney Co. dove toward an 11-month low Thursday, as multiple analysts cut price their price targets, even the bullish ones, in response to the media and theme-park giant’s disappointing earnings and outlook for Disney+ subscribers.

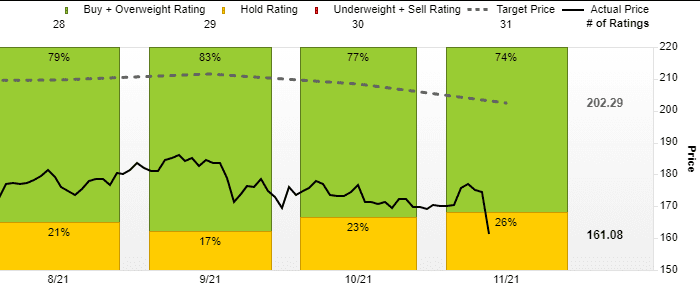

But Wall Street remained overwhelmingly bullish on Disney’s prospects, highlighting the expected continued rebounds in the company’s other businesses, and expectations of an eventual recovery in the streaming business.

The stock

DIS,

tumbled 7.1% in midday trading, putting it on track for the lowest close since Dec. 10, 2020. The stock’s $12.37 price decline was chopping about 82 points off the Dow Jones Industrial Average’s

DJIA,

price, as the Dow fell 53 points, or 0.2%.

That would also be the biggest one-day, post-earnings percentage selloff for the stock in 10 years, since it plunged 9.1% on Aug. 10, 2011 after Disney reported fiscal third-quarter 2011 results.

Bernstein analyst Todd Juenger reiterated the market perform rating he’s had on the stock for at least the past three years, but trimmed his price target to $164 from $167. He said his main takeaway from the earnings report was that the resumed slope of the Disney+ subscriber curve is coming later than investors had expected, “provided it comes at all.”

He questioned Disney’s assumption that re-acceleration will come when the “full cadence” of new content starts hitting the service in late 2022.

“Who is this consumer who wasn’t interested in [Disney+] when it had the library and some original Marvel, Star Wars content, but will become more interested when there is 2x the amount of the same brands of original content?” Juenger wrote in a note to clients. “We have yet to meet the child who says no to one scoop of ice cream, but yes to two.”

FactSet, MarketWatch

Moffett Nathanson’s Michael Nathanson also questioned the assumption that subscriber growth will track increases in content spending, especially if the new content is of the same brands.

“[W]e wonder if Disney+ is too narrow a product and requires much greater investment in non-Disney content to widen out the product’s appeal,” Nathanson wrote.

He kept his rating at neutral but lowered his stock price target to $175 from $180.

Meanwhile, of the 31 analysts surveyed by FactSet, only eight, or 26%, had the equivalent of hold ratings on Disney. The other 23 analysts all had the equivalent of buy ratings.

FactSet

BofA Securities’ Jessica Reif Ehrlich is one of those bulls. She cut her price target to $191 from $223, saying the stock could be in the “penalty box” in the near term following the “tough quarter and outlook,” but she reiterated her buy rating as the new target still implied 18% upside from current levels. Basically, the company’s business will still recover from the COVID-19 pandemic, but the pace of that recovery will be a little slower than originally expected.

“With the worst of the COVID impact seemingly over, Disney operations should rebound in [the second half of fiscal 2022], driven by international visitation, cruise ship ramp, [direct-to-consumer] content uptick, pent-up demand and opportunities in sports betting,” Ehrlich wrote.

Long-time bull Alexia Quadrani at J.P. Morgan dropped her price target to $220, or 36% above current levels, from $230 while reiterating the overweight rating she’s had on Disney for at least the past 2 1/2 years.

She said that while the stock could remain under pressure near term after the disappointing results and downbeat outlook, the company remains her favorite media stock in 2022.

“Despite this disappointment, we are encouraged by the additional clarity around subscriber growth and the affirmation in the longer-term sub target,” Quadrani wrote. “The stock may stay rangebound following a weaker opening for a while as investors rebuild confidence in the longer-term subscriber growth story after two recent quarters of softer results.”

The potential positive catalysts she sees include a bounce back in subscriber growth, as early as the current quarter, and better-than-expected results in the theme-park business.

Disney’s stock has shed 10.5% year to date, while shares of rival streaming giant Netflix Inc.

NFLX,

have rallied 22.6% and the Dow has advanced 17.7%.