This post was originally published on this site

One reader of my last post asked me the question:

“John, what happened????”

“Your recent articles no longer mention the “new” modern corporation?”

“Without it, your articles are just not the same anymore!”

My answer is that I have not been speaking explicitly about the “new Modern Corporation, but all that is happening is wrapped up within an environment in which the “new” Modern Corporation plays a huge role.

Let me try to bring all of this together.

Major Transition Under Way

As everyone is aware, the United States… and the world… is going through a major transition period, one going from an industrialized world, one that is dependent upon the manufacturing goods, to an information-based world, one that is dependent upon information technology.

This information-based world is one built upon a foundation of intellectual capital, whereas the previous structure was an industrial-based world built upon a foundation of physical capital.

Moving in this direction, we are moving to a world constructed of platforms or networks, built exhibiting zero- or close-to-zero marginal costs. This structure is subject to enormous economies of scale. And, this “new” Modern Corporation can generate lots and lots of cash, which also allows it to engage in a substantial amount of financial engineering. Debt is not needed.

This restructuring has resulted in a few very large companies dominating the industry, Google – parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), Facebook, Inc. (NASDAQ:FB), and Microsoft Corp. (NASDAQ:MSFT), and lots of other information-based organizations fighting to join the major players.

The world was moving into the information-based world and most agreed that it was only a matter of time before the transition became complete.

China On The Horizon

One looming factor cannot not be kept out of this picture and that is the presence of China as a competitor to dominate the future information-based world. China still has a ways to go, but most analysts believe that the future is going to be dominated by the pressure that China brings to the United States is terms of controlling the technological future.

Innovation in this space will dominate the drive of China and the United States this century.

And Then the Coronavirus Pandemic Hit

As if there was not enough going on in this transitioning world, the COVID-19 pandemic came upon us and almost everything changed.

But, most of all, the pandemic crisis has resulted in us moving even faster into the future. This is not an abnormality. Historically, major plagues and pandemics result in tremendous transitions taking place, in many respects bringing on the future at a faster pace than could be imagined.

This pandemic is having a similar impact on the current age. And, the world is restructuring right before our very eyes. The downside has to do with what we are seeing happening to current “legacy” companies like Hertz (NYSE:HTZ), J.C. Penney (OTCPK:JCPNQ), and Neiman Marcus (NMG) and J. Crew. These are just a part of what it happening to the “old” world structure.

Big Tech Prospers

But, there is the new. I have written several articles on this, but let me bring some others into this discussion. For example, Michael Mackenzie writes in the Financial Times that…

“…disruptive companies in cloud services, digital payments and bioprocessing should play a crucial role in stock selection over the next decade. And focusing on a G2 world of China and the US may be one key takeaway from the great recession of 2020.”

That is the future lies with Big Tech and the competition between China and the US. The stock market is talking to us about this.

“So far big economic shutdowns have rewarded technology, e-commerce and healthcare groups.”

On the other hand, relating to the discussion on “legacy” firms,

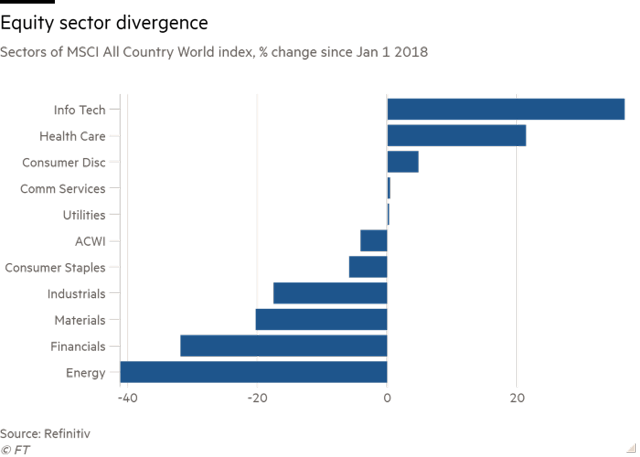

“The laggards include energy, financials, retailers, transports and industrials — along with real estate companies that face slews of missed rental and mortgage payments. The pandemic shock has only enhanced the leadership of technology and healthcare over the past two to three years, leaving other sectors trailing further behind.”

Mr. Mackenzie presents the following chart to support this statement.

Mr. Mackenzie also writes that:

“Big Tech’s biggest advantage — business models which convert cash into innovation, market share and an ever-larger lead over their competitors — is accelerating, thanks to the pandemic.”

And, Big Tech has little or no debt. Intellectual capital requires little or no debt.

Furthermore,

“The tech giants that are thriving aren’t merely doing it by acquiring competitors and dominating markets. Like some monopolists of ages past, these companies spend heavily on research and development.”

These are the representatives of the “new” Modern Corporation.

I have written many articles on how the “old” corporations need to move toward becoming “new.” For example, take a look here and another look here. According to the first part of this article, the pandemic is accelerating the change from the “old” to the “new.” I will continue to follow this.

Final Thoughts

Most analysts reviewing the situation, either looking at the “legacy” companies or the “new” Modern Corporations, conclude that investors are going to have to change the way they look at the situation. The world was changing, causing changes in how investors were looking at things, and now, after the pandemic hit, the world is even changing more and changing more rapidly. Investors must understand this and adapt their investment strategies to the new environment.

The foundation of the new environment will be the “new” Modern Corporation. A major part of understanding this environment will be the understanding of how the “legacy” companies move to become more like the “new” Modern Corporation.

An interesting outcome of such a move would be that corporations would use a lot less debt to finance their operations. Large amounts of physical capital requires a large amount of corporate debt. If corporations become more and more dependent upon intellectual capital, there will be less need for a corporation to rely upon oppressive amounts of financial leverage. This, to my way of thinking, would not be such a bad outcome.

And, then we cannot forget China. Competition is going to be fierce. The “new” Modern Corporation is needed to compete. The United State must be ready!

The final point is that we are going to see a lot of changes taking place. We need to keep loose and prepared, so that we can move with the changes and not have to battle them.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.