This post was originally published on this site

Thesis Summary

The latest market correction has perhaps been the most divisive in our recent history. Divisive in terms of bulls/bears, but also divisive in terms of Main Street/Wall Street. My stance is bullish mid-term and very, very bearish long term. “Fundamentals” are indeed worse than ever, but don’t underestimate the power of the Fed to maintain this rally for the next few years. The music will stop once inflation forces higher rates, which will unwind the damage done by the last 20+ years of fiscal/monetary “stimulus.”

Source: News.bitcoin.com

Setting the stage

What we have witnessed since the 2008 crash is a three-act play directed by the Fed and starring Mr. Market. Since the beginning of the Millennium, the Fed has been putting out fires and interest rates have been near 0 for the past decade. Every time though, it seems to take more. The financial bust caused some shakes, but two years later we were up and running. In this time the Fed and other central banks carried out what were then “unprecedented” and “one-off” actions such as the TARP in the U.S. and outright bond-buying in Europe. Fast forward to 2020 and the “coronavirus crash” pushed central banks to even more easing and more “unprecedented” actions. It seems that economists and investors are quickly getting used to the “new normal.”

Just wait till we get to the third act…

Since 2008 we have seen the biggest decade-plus bull market run. Why? One reason may be the fact that the “Market” has been pulled along by the big tech giants. If you are looking for a “fundamentals” explanation, we can’t deny that companies like Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) have created tonnes of value for consumers and businesses. But there is no doubt that this has been amplified by the practically free-flowing stream of credit coming from the world’s central banks. Since the 1980s, the Keynesian school of thought has pretty much directed monetary and fiscal policy. With the cold dark days of the gold standard behind us, governments and central banks were now free to use their “Monetary toolbag.”

Many economists have been sounding the alarm bell since 2008 and before. These economists defend that you can’t print yourself out of a recession, and while I believe they are certainly right, this bearish stance won’t have helped increase their financial wealth in the last decade. There are two “predictions” made by those working under this paradigm. One has certainly come to pass, while the other, perhaps inexplicably, hasn’t.

Interest Rates and Inflation

The first prediction was that once central banks pushed interest rates to 0, we would be stuck there forever. I believe it was Peter Schiff, amongst others, who back in the early days of QE tentatively nicknamed “QE4” as “QE 4ever.” 12 years later, I believe it is hard to deny that this has happened. Europe has been in negative territory since the 2011 sovereign-debt crisis and the slightest of back-peddling in QE and rates sent the market into jitters in 2018.

But what these economists seem to have completely got wrong was inflation. The simple argument is that printing money means more money chasing the same amount of goods, hence inflation. However, this hasn’t materialized at all. If anything, we have seen “below average” inflation over the last decade.

The conventional way of thinking would be that lower interest rates or more money would lead to higher inflation, but this has not been the case in the last decade or even the last 50 years.

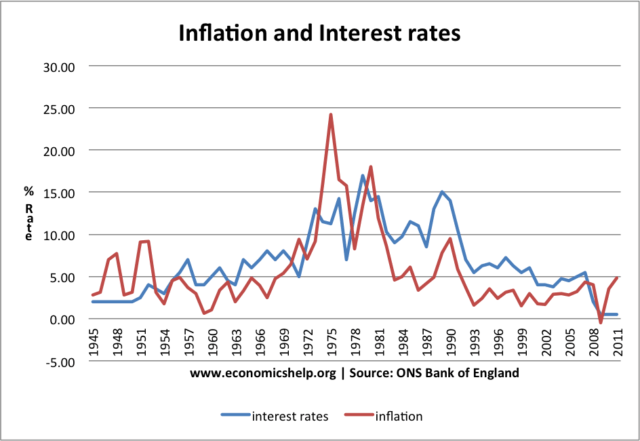

Source: ONS Bank of England

What we see is a positive correlation between interest rates and inflation. One explanation for this could be that there is a lag between rates and inflation. But another explanation proposed by Irving Fisher is that, ultimately, the Fed cannot control the real rate of interest. The real rate of interest is equal to nominal interest rates minus inflation. If we were to take the real interest rate as a constant, then we can see that any increase/decrease in the interest rate will be met with an equivalent increase/decrease in inflation.

But one has to wonder: What is the problem then? The Fed can keep printing money with no real negative consequences. What we have seen is simply some moderate deflation, which some economists would argue is great as the value of your money is higher. We print more money and it becomes more valuable. On the surface, this statement seems ludicrous, and it is.

The Global Dollar Glut

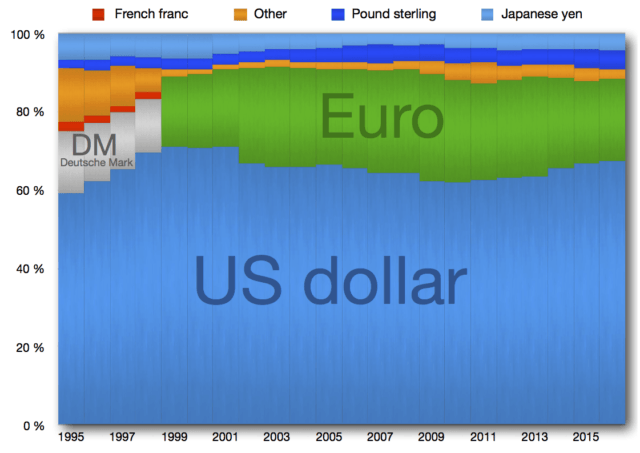

But why is it that the U.S. can keep printing dollars without any loss of value? If an African country like Zimbabwe or Venezuela does this, inflation quickly ensues, as one would expect. The U.S. doesn’t suffer this same fate as the dollar holds a privileged and unique position in the monetary system – reserve currency.

Source: Wikipedia

Two forces are coming into play here, in my opinion. Internationally, the U.S. is the reserve currency, which means that other countries use it to trade and settle balances. This means that, ironically, the dollar has tended to go up during times of market turmoil, despite the Fed’s actions. This is because the dollar is still considered a safe-haven asset. In bad times, countries prefer to hold dollars more than anything else, perhaps except one thing – gold.

Domestically, though, the money printing has also failed to create any inflation because it has been flowing upstream, instead of down. The money doesn’t go into the hands of people but rather flows into equities and bond markets. P/Es in the S&P have certainly suffered from “inflation,” but this does not translate to the real economy.

Of course, this will eventually change. The U.S. certainly has some leeway to continue to print money but one day the music will stop, and it will no doubt do so suddenly and abruptly, leaving many with nowhere to sit, or in this case hide.

First off, the gold market is throwing some pretty strong signals that what was once the final destination for investors and countries looking for safety, the U.S. dollar, has now become just the stop before the end of the line: Gold.

If the fact that gold futures have been trading at lower prices than spot gold, something known as backwardation which is an anomaly in the gold market, doesn’t already scare you, there is plenty of hard evidence that countries don’t want dollars. China, Russia and India have been hoarding gold for a long time now and are increasingly settling trade in yuan.

The U.S. dollar does, however, hold one advantage over gold, which is that one can achieve a theoretically “safe” return through Treasuries. Gold will sit in the bank and do nothing while dollars can still fetch 1-3%.

The final straw

Despite this, we have already seen people fleeing into gold. The catalyst towards people completely not even holding dollars would be if gold could offer a better return than dollars, which could materialize in one of two ways:

One way this could happen would be if Treasuries fell into negative rates, which is why the Fed will try to avoid this at all costs. The other scenario, which is already a reality, is that someone, most likely a foreign government, begins to offer gold bonds. Debt denominated in gold which pays a return; in gold of course. This has already been done by Turkey.

This change in how we view the dollar will happen very suddenly. Take the coronavirus experience. It seems like within days the whole world was suddenly locked up. We went from DEFCON 1 to 5 in no time at all. Similarly, this change in trend will occur quickly.

Moving forward, I expect that this process, which has already begun, will begin to spur inflation in the western economies. As inflation picks up, interest rates will no doubt follow suit. Not because the Fed wants to prevent inflation, but because I believe it can’t avoid this. The Fed can control a very specific form of interest rate, which is the interbank rate, but it can’t control the real rate of the economy. The real rate at which businesses borrow money.

As rates increase, we will get what we have been avoiding since 2008, or even before. Massive defaults. This won’t be a particular sector, it will be economy and worldwide. Zombie companies and banks that are only being kept alive through low interest rates will fail. Unemployment will sky-rocket and everything from car loans to mortgages to student loans will suffer a huge default. Thus will finally begin the true bear market. At this point, we may well enter into a deflationary spiral. So I guess what we will see is something like – inflation, stagflation and then deflation.

Takeaway

I believe this theory is sound, the only problem as an investor is timing this. What I have said here held 20 years ago, and yet the Fed and the U.S. sustained the appearance that everything is fine and stocks delivered massive returns. I expect the Fed and the U.S. will continue to do this for the next few years. We will likely see even higher highs in the stock market. As mentioned in the introduction, we are now setting up for the third act. One last bubble left to burst.

For now, the risk is low. Equities and especially technology are a good investment. Precious metals and miners I believe are set to deliver great returns in the next 5 years. Be wary, though. One of my favorite technical analysts and a fellow SA contributor predicts we will see this multi-decade long bear market begin after the S&P hits the $4500-6000 range. This technical analysis makes sense with the timing and fundamentals I have laid out. Be wary but also pragmatic, there is still money to be made in this crazy market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.