This post was originally published on this site

The lack of financial literacy is a problem for America’s adults, and for the nation’s youth it could be even worse.

Isaac Hertenstein, 16, wants to help fix that before kids his age and younger face serious money decisions.

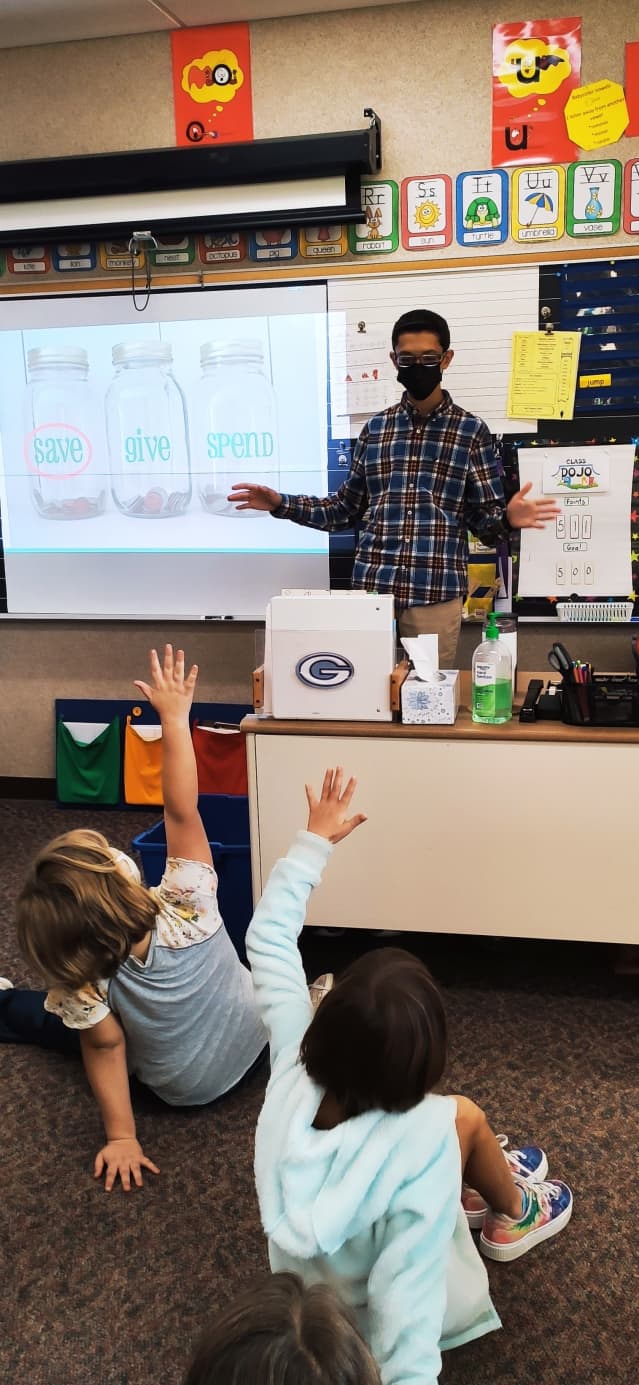

Thinking big and starting small, the Greencastle, Ind. sophomore created financial literacy lessons he teaches to elementary- and middle-school students in his district.

Since the start of the school year, he’s talked to 375 students, ranging from first- to eighth-graders. He’s made trips to 14 different classrooms and has more visits lined up. Next month, he talking to 150 fifth graders about supply and demand.

It starts simple, with lessons to elementary school kids about the difference between needs and wants, as well as saving, giving and spending. For older students, the content turns to compound interest and why long-term investment can be so meaningful.

Before and during the pandemic, Hertenstein told MarketWatch that he saw the ways money seeped into the lives of friends. He cites this overheard remark: “Oh I wish I could do it, but unfortunately my family cannot afford it.”

“This knowledge is extremely important and will affect students when they grow up,” Hertenstein added.

“‘This knowledge is extremely important and will affect students when they grow up.’”

The next step is finding fellow volunteers who can bring their big-kid credibility to the classroom and engage students. The material’s ready to go at the website he pulled together for the organization he founded, Students Teaching Finance.

Hertenstein already has a friend an hour away who’s arranging to do the lessons in his school district. “The goal is to continue partnering with other change makers,” he said.

There’s still plenty of need for change, financial literacy experts say.

Almost half of the states, 23, have a personal finance instruction requirement for graduation, according to the Council for Economic Education. That’s an encouraging two-state increase since the organization’s last count in 2020, it said. Economic instruction is at a “standstill,” with 25 states requiring the topic for high school graduation, the same amount as 2020.

Don’t miss: Take MarketWatch’s 2022 Financial Literacy Quiz. Will you get 10/10?

“Absent exposure to both subjects, America’s young people are denied full access to the knowledge they need to successfully navigate their lives,” Council for Economic Education researchers wrote last month. In Indiana, economic and personal-finance courses are part of the Kindergarten-12th grade standards, but economics is the only graduation requirement.

Considering the preparation Hertenstein puts into his lessons, it’s easy to let him find time during school days to speak with younger students, said Chad Rodgers, principal of Greencastle High School. The school has an elective personal finance component in addition to the senior-level economics course.

Hertenstein is sparking much-needed interest in this subject, Rodgers said. “When kids get to choose what they want to learn, they are way more engaged in learning,” he said.

Hertenstein has chores, homework and extracurriculars. That includes playing trumpet in jazz band and concert band, cross country, DECA , a club for high schoolers interested in business, and “ethics bowl” where students debate the right’s and wrong’s within real-life scenarios. That, he said, has helped him forment and apply the idea of “everyone having dignity with finances.”

Given all that, he estimates he’s put more than 200 hours into the project, including the time to research lessons and work with principals and teachers to arrange his visits.

Hertenstein has already talked to 375 students in his district.

Courtesy Isaac Hertenstein

What’s the motivation? It’s the human toll of the economic divides between the have’s and have-not’s that Hertenstein sees and hears in his rural city, which is a college town for DePauw University.

Greencastle’s median annual household income is $45,759, according to 2020 Census Bureau data. That’s almost $12,500 less than the state’s median income and nearly $20,000 less than the national number.

Roughly half of the students in the district were eligible for free or reduced school meals in the 2020-2021 school year, Indiana education statistics show.

A lot of factors contribute to a paycheck-to-paycheck life. That includes steep living costs in an era of high inflation and gaps in household wealth and opportunity, or lack thereof. The aftermath of unforeseen events, like the pandemic’s initial shockwaves that suddenly forced millions to the jobless line, is another challenge for household finances.

But research also suggests there’s a link between shaky finances and a lack of money understanding. That’s the link Hertenstein and so many others, no matter their age, hope to shatter when they teach personal finance topics.

One example: The people deemed “financially fragile” in a 3,000-person survey conducted from April 2020 to May 2020 on average scored lower on a financial literacy quiz, according to researchers at North Carolina State University, George Washington University and the University of Pennsylvania.

In a way, Hertenstein is replicating the financial lessons his parents gave him. “They catalyzed my interest,” Hertenstein said, and then he kept at it himself.

“Hertenstein’s parents started talking to him about money topics in early elementary school. ”

His mother, a first-grade teacher, and his father, a DePauw University psychology professor, started talking to Hertenstein about money topics early in elementary school.

Those teachable moments included concepts like the idea that “whatever you take home, it’s not how much you make, it’s how much you keep and what you give,” said Matthew Hertenstein, a DePauw University psychology professor.

Their mission was to avoid any taboo in talking about money, Matthew Hertenstein told MarketWatch. “What we tried to communicate to him is money and financial literacy gives people options.”

“What I’m happy about is he wants to make a difference, that he’s motivated to help others,” his father added.

Earlier this year, Prudential Financial

PRU,

picked Hertenstein as one of its Prudential Emerging Visionaries, a group of 25 teenagers working on new approaches to longstanding financial and societal challenges. This weekend, the selected teens will participate in an awards event at Prudential’s Newark, N.J. headquarters.

“The students we’re honoring have a sense of possibility that drives them to look beyond themselves,” said Charles Lowrey, Prudential Financial’s chairman and CEO. “Their vision and dedication are key to creating fully inclusive communities, and we are humbled and inspired by their work.”

Hertenstein still has two more years of high school before he needs to think about college majors and beyond. As he gets older, Hertenstein said he wants to keep pursuing his interest in business and finance, using that as a means to others.

Meanwhile, Hertenstein has immediate goals in mind for Students Teaching Finance, which he hopes will yield future dividends. “The goal is to plant seeds in these young students now,” he said.