This post was originally published on this site

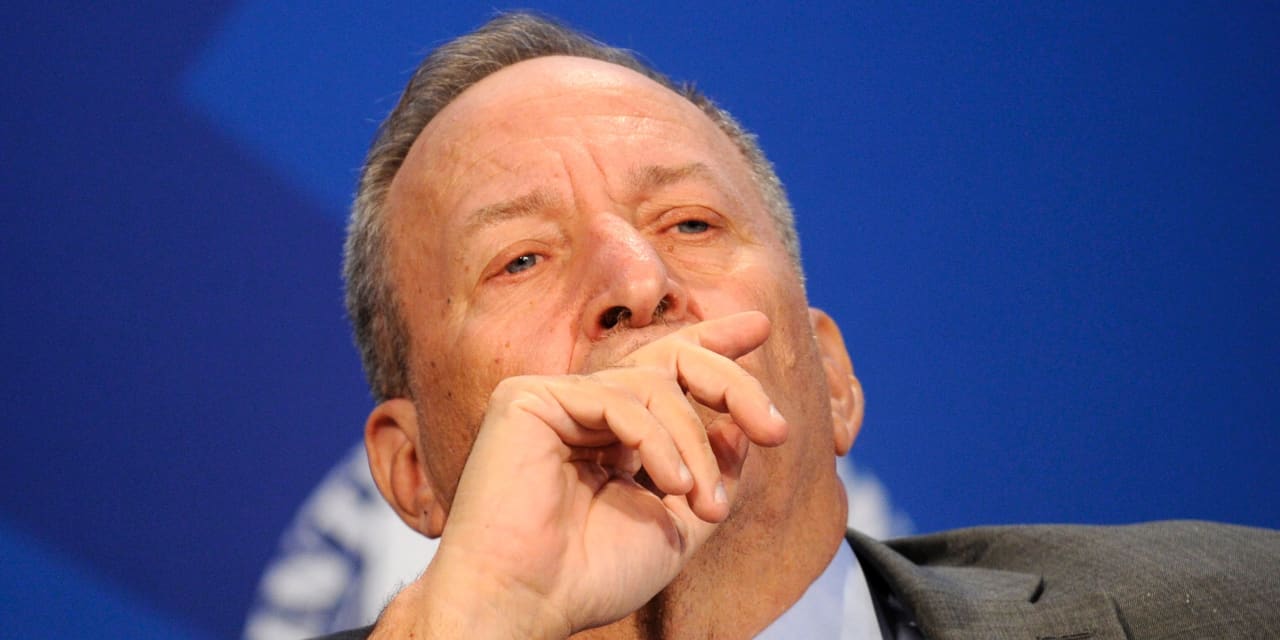

A witches brew of a tight labor market and loose monetary policy has powered the U.S. economy to speed recklessly down the highway, risking a crash down the road, former Treasury Secretary Larry Summers said on Friday.

The only solution is much tighter Federal Reserve policy than either the market or the central bank now anticipate, Summers said during a talk to the American Economic Association annual meeting.

“I believe we are now driving above the speed limit. The central challenge is to achieve a gradual soft landing, and I believe that will require monetary policy substantially tighter than the Fed or the market now anticipate,” Summers said.

The Fed has begun to pivot away from its easy policy stance of zero interest rates and monthly asset purchases.

At its meeting in mid-December, the Fed decided to end its asset purchases in March and penciled-in three rate hikes. Since then, even the most so-called “dovish” Fed officials have expressed support for rate hikes this year.

Summers said it was approaching absurdity to suggest inflation was caused by bottlenecks. Wages are rising at a 7.5% annual rate, he noted.

“No doubt used car prices will rise less rapidly over the next 12 months than over the past 12 months, but that is not a reason to think that inflation will revert to anywhere near normal,” he said.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose sharply on Friday in the wake of the December job report.