This post was originally published on this site

The powerful body at the Federal Reserve that controls U.S. interest rates appears ready to raise the cost of borrowing in March for the first time in four years, bringing to an end an extraordinary period of economic stimulus.

Yet the voters on the so-called Federal Open Market Committee appear less sure about when they will begin to chip away at the Fed’s gigantic $8.8 trillion balance sheet. Or how fast.

Several presidents of regional Fed banks, such as Esther George of Kansas City and James Bullard of St. Louis, want the process to get underway shortly after the central bank lifts interest rates.

Most others, including Fed Chairman Jerome Powell, have taken a wait-and-see attitude. They support the idea of reducing the balance sheet this year, but are unsure of the timing or size of the asset reductions.

Uncredited

Wall Street

DJIA,

expects Powell to shed more light on the Fed’s strategy after next week’s two-day meeting of the FOMC. He’ll hold a press conference on Wednesday.

“The January FOMC meeting should continue the Fed’s hawkish policy pivot by signaling that it will soon be appropriate to begin removing accommodation,” economists at Deutsche Bank said in a note to clients.

The bank expects Powell to confirm that “liftoff” — or the first rate increase — will take place in March.

How we got to this point?

A quick review of the past and how we got here:

The Fed in 2020 quickly slashed a key short-term interest rate to near zero early in the pandemic.

The central bank also bought more than $4.5 trillion in Treasury bonds and mortgage-back securities to drive long-term rates lower. The purchases are winding down now but won’t end until March.

These moves pushed mortgage and other interest rates to historic lows and helped the economy survive the early onslaught from the coronavirus.

All the stimulus from the Fed and lawmakers in Washington, who also shoveled trillions of dollars into the economy, has also contributed to the worst outbreak of U.S. inflation in almost 40 years. The cost of living surged by 7% in 2021.

The Fed’s pending decision to raise rates and cut its balance sheet are aimed at bringing inflation back under control. The economy has also largely recovered and Fed officials say it no longer needs to remain on life support.

The latest on the FOMC

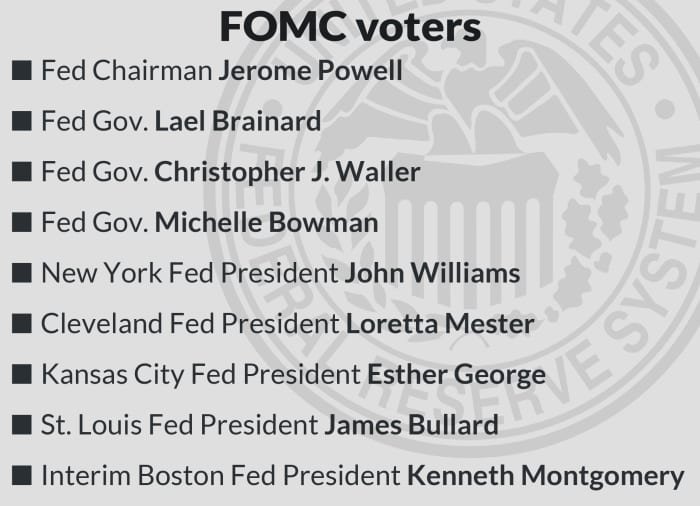

The current makeup of the FOMC only includes nine voters, leaving it three members short after a recent pair of resignations.

The Biden White House has put forth three new nominees for the Fed’s seven-member Board of Governors, but it’s unclear if they will receive Senate confirmation by the March meeting.

Even if they do, Fed watchers expect they will go along with an increase in interest rates in March given the high level of inflation and worries emanating from both parties in Washington.

The partly rotating membership of FOMC this year includes a trio of regional Fed bank presidents who are viewed as more hawkish on inflation: George, Bullard and Loretta Mester of Cleveland Fed.

The rest of the FOMC is viewed as more middle of the road or “dovish.”