This post was originally published on this site

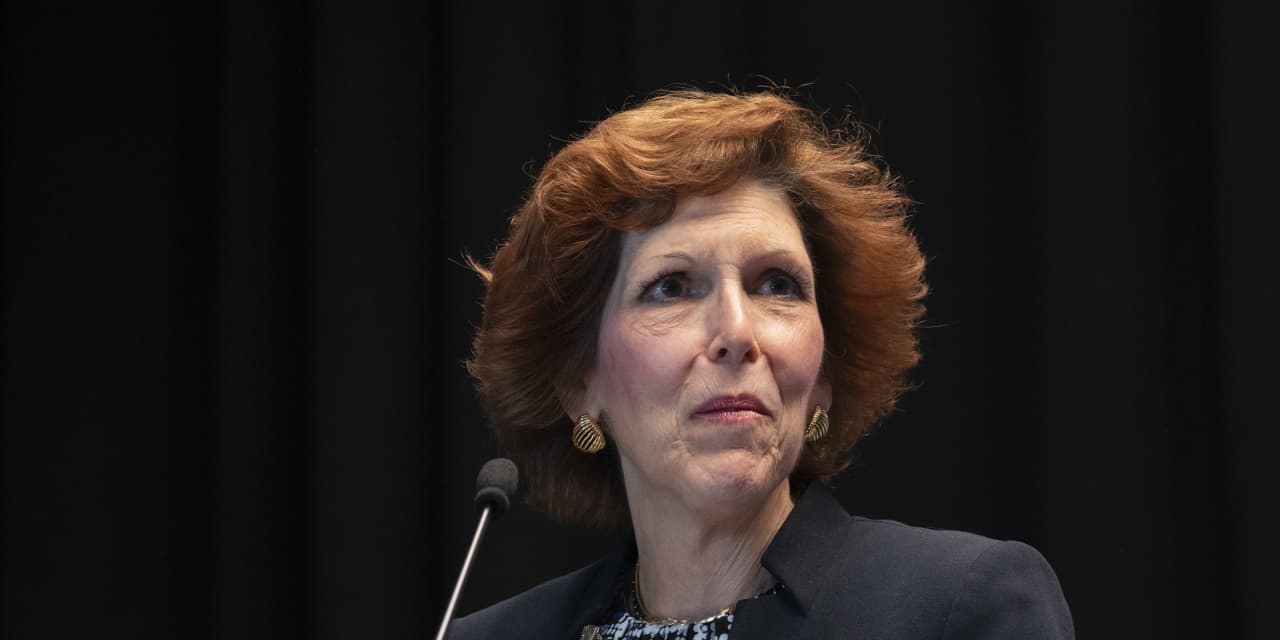

The Federal Reserve should raise its benchmark policy rate to about 2.5% this year and follow up with more increases next year to get inflation under control, said Cleveland Fed President Loretta Mester on Tuesday.

“In my view, inflation, which is at a 40-year high, is the number one challenge for the U.S. economy at this time,” Mester said in a speech at John Carroll University.

Last week, the Fed raised its Fed funds rate by 25 basis points to a range of 0.25%- 0.5%. Mester said this rate was still at emergency easy levels that were needed earlier in the pandemic.

The median forecast of 16 Fed officials is to get the funds rate up to 2%, putting Mester on the hawkish end of the spectrum.

“Given the underlying strength in the economy and the current very low level of the funds rate, I find it appealing to front-load some of the needed increases earlier rather than later in the process because it puts policy in a better position to adjust if the economy evolves differently than expected,” Mester said.

If, by the middle of the year, inflation has not begun to moderate, the Fed could speed up its rate increases. If inflation is moving down, the Fed could slow the pace of increases in the second half of the year, Mester said.

She said she was “optimistic” the Fed could bring inflation under control while sustaining the health of the labor market. Mester said her base case was for growth above a roughly 2% annual rate this year, which will sustain healthy job gains.

The Cleveland Fed president is a voting member of the Fed’s interest-rate committee this year.

Stocks

DJIA,

SPX,

closed sharply higher on Tuesday despite hawkish talk from the Fed. The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 2.38%, the highest level since May 2019.