This post was originally published on this site

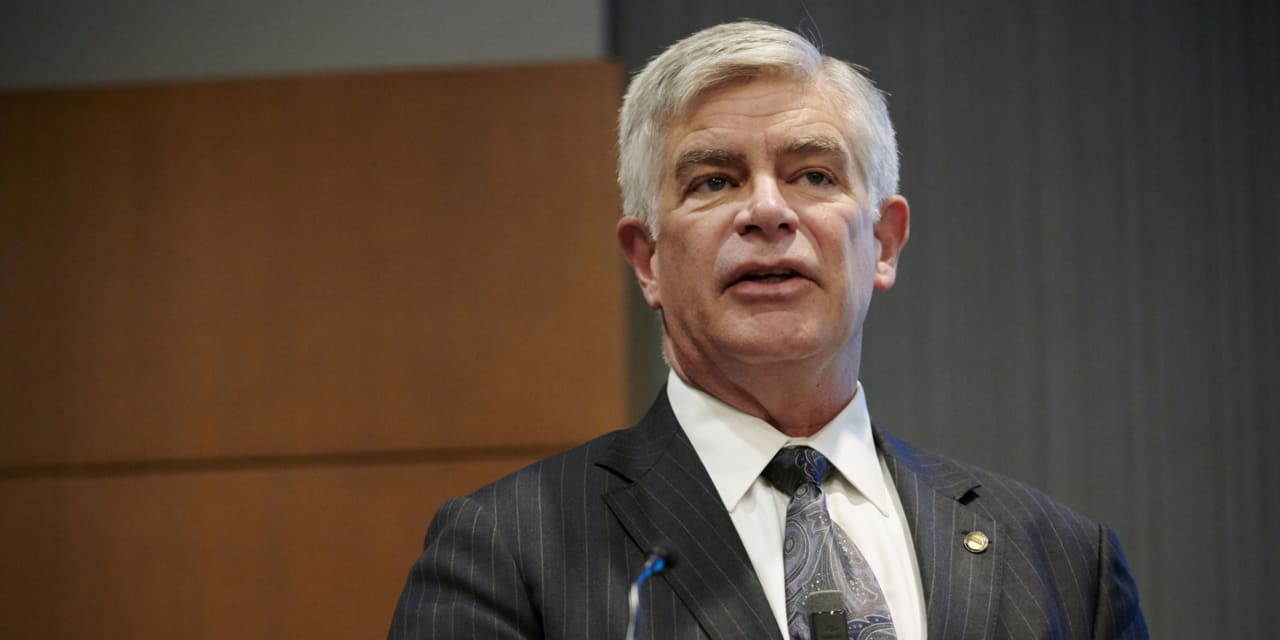

The Federal Reserve needs to keep raising interest rates at a gradual quarter-percentage point pace until they get above 5%, said Philadelphia Fed President Patrick Harker on Tuesday.

“It is going to be above 5% – how much is going to depend,” Harker said, during a talk at La Salle University.

In his talk, Harker said that the January consumer price index report was “good” with continued moderation in inflation. But the pace of improvement is not quick, he added.

“Food inflation is still really high,” Harker said, as the sector continues to be impaced by supply chain woes.

“Inflation is going to take some time to come down,” he said.

See: CPI shows U.S. inflation still sticky and slowing grudgingly in January

He forecast that core inflation will come in at around 3.5% this year, still well above the central bank’s 2% target, “but suggestive of clear movement in the right direction.”

Harker said he was not forecasting a recession.

“The labor markets are simply too hot to indicate a significant downturn at this point,” he said.

Harker says he sees the U.S. economy growing at a slim 1% rate this year before strengthening to about 2% next year.

Stocks

DJIA,

SPX,

were lower on Tuesday while the yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 3.76%.