This post was originally published on this site

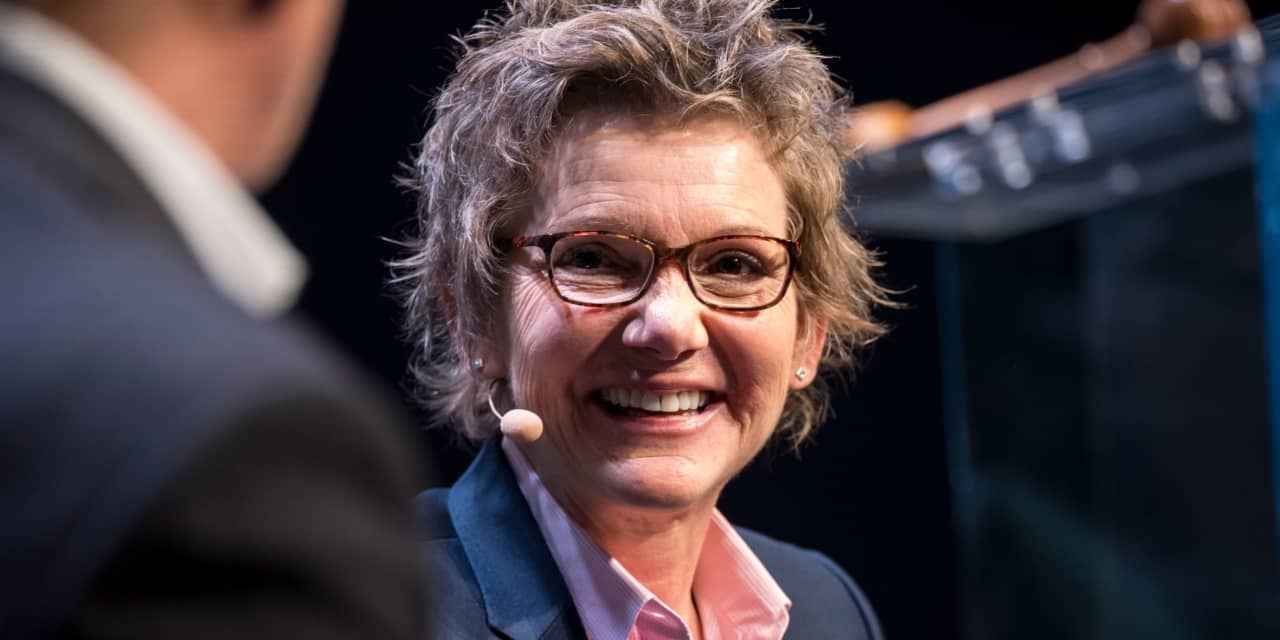

Bumpy progress on lowering inflation means that interest rates will likely need to be raised further and stay higher for longer, San Francisco Federal Reserve President Mary Daly said on Saturday.

U.S. inflation has come down from its high last summer but “the work is far from done,” Daly said, in a speech at Princeton University.

Recent inflation data has been “bumpy” and the most recent personal consumption expenditure price index, the Fed’s favorite measure, showed inflation actually ticked higher in January, Daly noted.

“Putting it all together, it’s clear there is more work to do. In order to put this episode of high inflation behind us, further policy tightening, maintained for a longer time, will likely be necessary,” Daly said.

The San Francisco Fed president did not say how high interest rates needed to go or how long she thought they should remain high.

In a conference call with reporters after her speech, Daly said it was too early to talk about the specifics of the policy adjustment at the Fed’s next policy meeting on March 21-22 because there will be more economic data released over the next two weeks.

And Daly said she never discusses her own personal interest-rate forecast.

Last month, the Fed nudged up the federal funds rate by a quarter-percentage point to a range of 4.5%-4.75%.

In December, Fed officials penciled in a 5%-5.25% rate as the likely peak.

Fed Chairman Jerome Powell is going to testify for two days before Congress next week and economists think he will open the door for a higher end-point for rate rises.

Read: Powell likely to talk to Congress about more rate hikes

Daly told reporters the Fed can cool inflation without causing a recession.

Daly focused her remarks on the longer term. She said the U.S. economy might not return to the low interest-rate economy that prevailed since the financial crisis in 2008 until the COVID pandemic struck in 2020.

During that time the Fed struggled to get inflation up to its 2% target. One advantage was the economy was able to run hot, driving down unemployment, without spurring inflation. Low-interest rates boosted asset prices and home-buying.

Four new factors could keep inflation higher going forward, Daly said.

First, any effort by companies to “re-shore” production is going to raise prices, she said.

Secondly, there is an ongoing labor demand shortage that looks like it will keep driving up wages over the near and medium term.

Thirdly, moving to a greener economy will be costly.

And lastly, U.S. consumers and businesses might begin to expect higher inflation. Research shows that expectations of higher prices makes higher inflation almost inevitable.

“Any or all of these factors could influence the natural tilt of inflation and the monetary policy approach necessary to maintain price stability over the long term,” Daly said.

Due to higher inflation readings, the 10-year Treasury yield

TMUBMUSD10Y,

rose to close above 4% last week for the first time since November, although yields subsequently retreated a bit on Friday to close just under that benchmark.