This post was originally published on this site

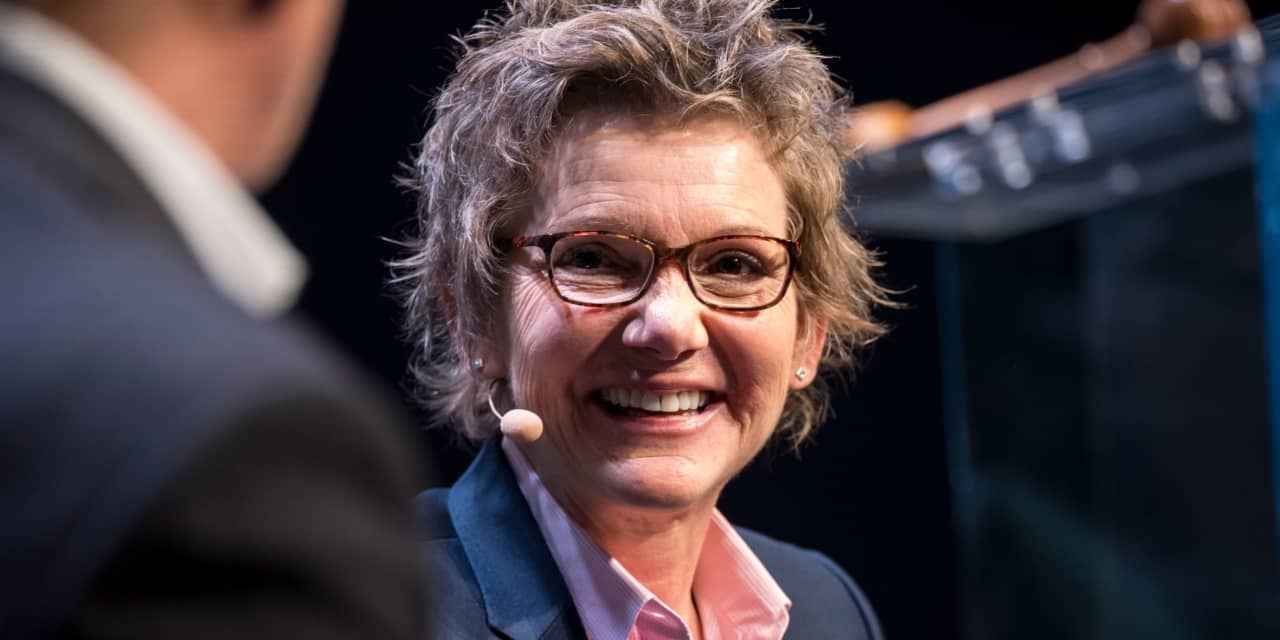

The Federal Reserve can move gradually away from its ultra-easy monetary policy stance without derailing the U.S. economic expansion, said San Francisco Fed President Mary Daly on Wednesday.

In an exclusive interview with MarketWatch, Daly said that she expects to fully support the initial benchmark interest rate hike at the Fed’s next meeting in March.

“It is clear that inflation is too high and the labor market is strong, so we do need to act,” Daly said.

But after that, the timing of “gradual” further rate hikes depends on the data.

“I do absolutely expect the policy rate to rise over the course of the year, but by how much and how quickly and during what meetings – those things I’m going to leave open,” Daly said.

The San Francisco Fed president, who is not a voting member of the Fed’s interest-rate committee this year, said the economy would continue to expand, just at a slower pace.

“I have no sense that our policy adjustments will derail the basic fundamentals” of a strong labor market, Daly said.

In the interview, Daly refused to be drawn into a definition of a “gradual pace.”

“People want to put a lot of parameters on gradual. And I want to define gradual for myself,” Daly said.

“I don’t want to pronounce today what I think we will be doing at each and every meeting for the rest of 2022,” she said.

“I’m very open minded – very data dependent on this,” she added.

See: The Fed is determined to stop wages from rising

On the plans to shrink the balance sheet, Daly said that she thought the Fed could start to run off its balance sheet earlier than in the last cycle and at a faster clip, but didn’t provide any specifics – saying that the full FOMC would ultimately make that decision.

While there is widespread agreement on how increasing the balance sheet bolsters the economy during economy downturns, there is much less agreement about what the effect is as the Fed reduces the balance sheet, she said.

“I see it as a secondary tool,” she said.

See also: Fed’s Mester backs shrinking balance sheet ‘as fast as we can’ without pushing markets off track

Asked about her forecast for inflation by the end of the year, Daly said it is unlikely that the Fed can push it all the way back to 2%. Headline inflation using the Fed’s favorite personal consumption expenditure price index, is running at a 4.9% rate in December.

“We want to see downward movement in inflation and I feel confident we can get downward pressure on inflation,” she said.

It will be hard to get back to the 2% target this year as supply-chain bottlenecks don’t seem to be recovering and the supply of workers will continue to lag, she said.

There are signs that the economy is slowing in the first quarter as a result of a spike in workers coming down with the omicron variant, but this slowdown shouldn’t be long-lasting, Daly said.

Read: Private sector shed over 300,000 jobs in January

“I feel very optimistic that, once that’s past, and we get data in that is not affected by omicron, we’ll be back” growing the economy in a “robust” fashion, Daly said.

There are already some positive signs that as the omicron wave recedes, production and distribution are looking like they are recovering, she added.

Daly said the goal of the Fed rate hikes will be to achieve a soft-landing for the economy. A sustainable growth rate was likely in the range of 1.8% – 2.% annual rate of GDP growth, she said. The economy grew at a 5.7% rate in 2021.

Even four or five rate hikes this year would still mean that the Fed policy rate would remain below a “neutral” level of 2.5% and thus still supporting the labor market, she said.

“I don’t see a lot of indication that we’re behind the curve or that we have to move the policy rate above its neutral rate,” she said.

“Ultimately what’s best for the labor market, in all my years of studying it, is a long and sustained expansion – not a short and volatile one,” she added.

While some economists are worried that wage gains might spark higher inflation, Daly sees the gains as temporary.

“I don’t see evidence the labor market is overheated,” Daly said.

At the moment, as the economy reopens, employers want to staff up all at the same time, so workers have multiple offers.

“Is that going to be our forever? I don’t see it that way,” she said.

Once the period of transition is over, firms will want to replace workers at a steady state.

“I see some of this current heat that people point to as just a temporary factor,” she said.

Asked about what she got wrong in her view that inflation was going to be transitory in 2021, Daly said she was too optimistic about when the COVID pandemic would end.

“I felt that we would be able to beat back the disease, nationally and globally much more effectively than we have,” she said.

The waves of the delta and omicron variant of coronavirus have caused imbalances that ultimately pushed up inflation, she said.

U.S. stocks

DJIA,

SPX,

were higher in midday trading on Wednesday on positive earnings reports, while the yield on the 10-year Treasury note

TMUBMUSD10Y,

slipped below 1.8%.