This post was originally published on this site

The Federal Reserve is not expected to change the stance of its interest-rate policy or say anything definitive about its near-term outlook at this week’s policy meeting. But Fed watchers know where to look for subtle hints about the Fed’s thinking regarding the outlook for the economy and interest rates.

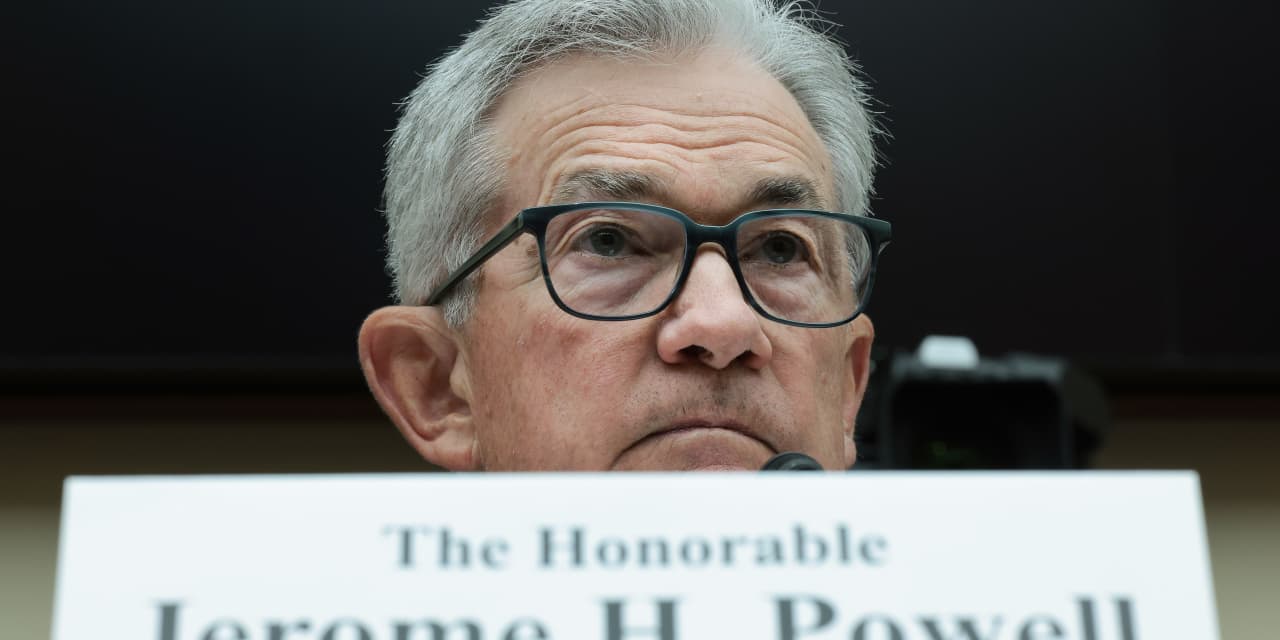

Read: Powell to tread carefully next week

Most of the focus will be on the Fed’s economic forecast, known as the Summary of Economic Projections.

“The SEP is arguably the most important aspect of the September meeting for markets,” said Aditya Bhave, senior U.S. economist at Bank of America, in a note to clients.

Here are four things that economists will be paying the most attention to:

Will the Fed maintain its projection of four interest-rate cuts in 2024?

Fed officials have insisted that they intend to keep their benchmark interest rate high to continue to push inflation down. The rate is now in a range of 5.25%-5.%.

In June, Fed officials projected the equivalent of four 25-basis-point cuts next year. Some economists think the Fed will pencil in fewer cuts.

Bhave said the Fed is likely to project only three 25-basis-point cuts next year.

“They have been pushing this view of ‘higher for longer,’ and I think they go further in that direction.” Bhave said in an interview.

“They will say, given the resilience of the economy, there is less need to cut,” he added.

There is even a chance that the median dot plot shows fewer cuts.

“If that were to occur, it would be a significant hawkish surprise for markets,” Bhave said in a research note.

How many Fed officials think rates have peaked?

In June, only six of 18 Fed officials thought the central bank was finished hiking rates.

Krishna Guha, vice chairman of Evercore ISI, said he thinks that total will rise to nearly half of the committee.

“We think Powell will characterize this more as a split vote than a clear bias to hike further, keeping market pricing around 50-50,” Guha said in a note to clients.

What changes will the Fed make to its economic forecast?

Economists at Bank of America think the Fed’s forecast for 2023 growth will be revised up to 2% from 1%, given how strong the economy is.

In terms of inflation, the Fed could lower its core PCE inflation forecast to 3.7% from 3.9%. But core inflation could be revised up two-tenths, to 2.8% for 2024, given how resilient the economy has been.

The Fed is likely to show inflation reaching 2% in 2026.

Will the Fed’s projection of the neutral rate begin to drift higher?

Economists think the Fed might boost its estimate for the longer-term neutral rate. That is more important than it sounds. It means “the whole level of rates moves higher,” said Yelena Shulyatyeva, senior economist at BNP Paribas.

That means that Americans might not see the ultra-low mortgage rates and other lending rates that were common after the global financial crisis in 2008.

At the moment, the Fed projects a 2.5% neutral rate, but the range of estimates spans from 2.375% to 3.625%.