This post was originally published on this site

Watching the US dollar index these days is like watching paint dry. After a wild tide in March that took the index that measures the king of currencies to its lowest level since 2018 and then to the highest level since 2002 over just two weeks, the action stopped.

Political and economic stability in the United States is the reason why the dollar is the king. Until 2016, the Secretaries of the Treasury in the US, that serve at the pleasure of the President, followed mostly a strong dollar policy. The strength of the dollar versus other world currencies was another symbol of US dominance in the world. President Trump told the world his administration would depart from that policy until the playing field on international trade became more balanced. He argued, and his Treasury Secretary Steve Mnuchin agreed, a weaker dollar was good for the US for two compelling reasons. First, it makes US exports more competitive in global markets boosting corporate earnings for US multinational corporations. Second, a weaker currency is a potent tool when negotiating new trade agreements with partners around the world.

When President Trump took office in January 2017, the dollar index was at its high at 103.615. Thirteen months later, in February 2018, it had declined to a low of 88.15. Since then, the dollar index climbed steadily, reaching a new eighteen year high during the wild market action on the back of the spread of the global pandemic in March. In April and May, the index went into a coma. The Invesco DB US Dollar Index Bullish Fund (UUP) and its bearish counterpart (UDN) are hardly moving these days as they follow the index higher and lower.

Volatility evaporates in the dollar index

The dollar index traded in its widest range since 2008 in March. The June index futures contract fell to a low of 94.53, the lowest since 2018. It then rose to a high of 103.96, the highest since 2002.

Source: CQG

The chart shows that the measure of daily historical volatility peaked at 21.53% on March 30 and fell to around the 6% level at the end of last week. The midpoint of the broad trading range is at the 99.25 level, and the June index was at around the 99.84 level on Friday, May 22. The dollar index has been trading around the 100-pivot point since early April and has rarely moved below 99 or above 101.

Massive manipulation in the foreign exchange arena

The currency market has all the hallmarks of the big hands of governments and monetary authorities that are managing the dollar and other currencies to provide stability to markets during the global pandemic.

Source: CQG

The daily chart illustrates that any time the index rises above 100, it edges towards overbought territory, at below the century mark, the technical metrics move towards an oversold condition. The total number of open long and short positions in the dollar index has been flatlining on either side of 30,000 contracts since March as speculative interest has dried up.

Free markets eventually expose imbalances

There are good arguments on both sides of the debate when it comes to free markets. I believe there are no truly free markets in the world, but some are freer than others. The bond market is far from free these days, and the US Fed and other central banks worldwide use an expanded monetary toolbox to suppress interest rates along the yield curve. While the US central bank sets the Fed Funds rate, market forces are typically responsible for rates further out along the yield curve. There is no secret these days that the Fed and ECB installed a giant put option under the bond market for all maturities. The central banks are encouraging borrowing and spending and inhibiting saving, which drives capital into the stock market in search of returns. One could argue that stocks and bonds are far from free markets in the current environment.

When it comes to currencies, governments have even more of a reason to hold exchange rates in a tight band and intervene in the foreign exchange market to create stability. Eventually, free markets will expose the vulnerability of government intervention. The most memorable occasion in the currency market came on September 15, 1992, when George Soros dumped massive amounts of British pounds into the currency market that overwhelmed the Bank of England’s attempts at intervention to keep the pound within the band of Exchange Rate Mechanism.

The US economy went into the global pandemic in the best financial shape in the world. While the latest economic data is the worst since the 1930s, the dollar remains a haven of safety. If it were not for the intervention, the dollar index would most likely be appreciably higher.

The U.S. election could cause volatility

A cap on the dollar would come as no surprise as the Trump Administration has been highly transparent regarding the desire for a weak dollar versus other world currencies. Both the President and Treasury Secretary have spent the past three and one-half years, and longer if you count the campaign trail in 2016, advocating for a decline in the dollar to support the competitiveness of US exports and as a tool in trade negotiations.

With the Presidential election just six months away, the future path of the US dollar could be determined on November 3, 2020. Since President Trump and his rival, former Vice President Joe Biden, agree on little, a Biden administration would likely switch gears and support a strong dollar policy. It has become apparent that the 100 level on the dollar index is acceptable to the incumbent President. A new occupant in the Oval Office in 2021 could lift the target level.

Call spreads and put spreads that straddle the election

I believe that the US dollar index is not likely to move all that much between now and November. However, we could see lots of volatility in the immediate lead-up to the contest and in the aftermath. I have been looking at selling straddles, or at the money put and call options on the Invesco DB US Dollar Index Bullish Fund (UUP) for expiration on September 18, 2020. At the same time, I would purchase the same strike prices for expiration on December 18, 2020.

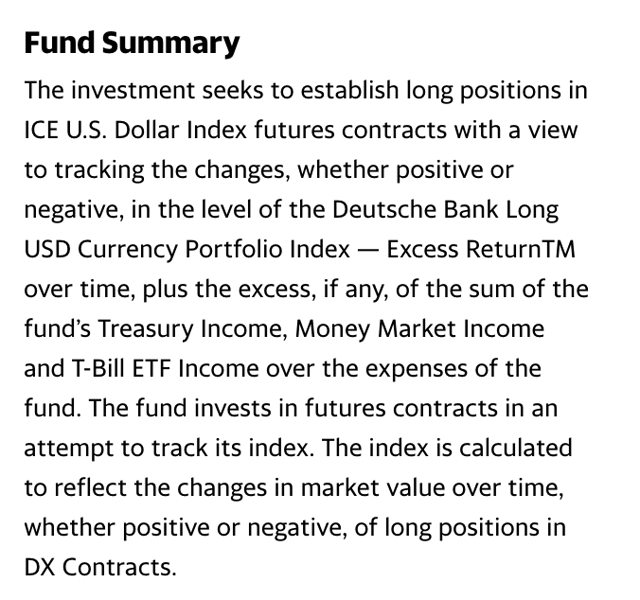

The fund summary for UUP states:

Source: Yahoo Finance

UDN is the inverse product. UUP has net assets of $1.01 billion, trades an average of over 2.1 million shares each day, and charges an expense ratio of 0.75%.

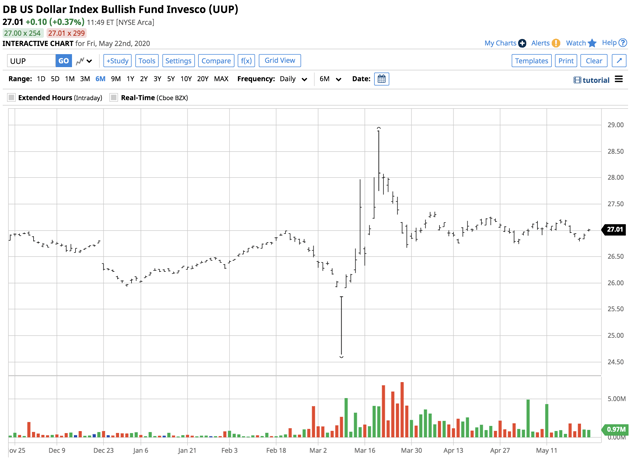

Source: Barchart

The chart shows that UUP has been trading on either side of $27 per share since late March. September 18,2020, $27 put and call combination, or straddle, settled at $1.19 (49 cents for the put option/70 cents for the call option) on May 21.

December 18, 2020, $27 straddle settled at $1.53. Selling the options for mid-September and buying the same strike price for mid-December at around 34 to 40 cents debit or cost, allows for a short-volatility between now and more than one month before the election, and a long volatility position in the dollar index for the run-up and aftermath of the November 3 contest.

I believe that the big hand of government is sitting on the dollar index, but the election could cause volatility in the greenback to rise.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.