This post was originally published on this site

So much for investing in the work-from-home trend.

Steep declines in the shares of Netflix Inc.

NFLX,

and Peloton Interactive Inc.

PTON,

this week highlighted how far many former pandemic beneficiaries have fallen in recent months, even as COVID-19-related hospitalizations keep rising to daily records and daily deaths top 2,000.

While many on Wall Street have argued that the work-from-home (WFH) trend will continue in some form long after the pandemic fades away, the new “sector” has hit quite a rough patch, and has been underperforming the broader stock market by a wide margin.

Basically, the view is that companies that saw an “accelerated uptake” in a COVID-prompted shutdown environment will likely see “a near-term plateauing of growth,” according to Art Hogan, chief market strategist at National Securities Corp.

But whether the high-profile selloffs in Netflix and Peloton shares are company specific or not, MKM Partners Trading Desk Specialist Charles Campbell says together, they highlight “concerns among some market participants about the prospects of other stay-at-home stocks.”

The Direxion Work From Home exchange-traded fund

WFH,

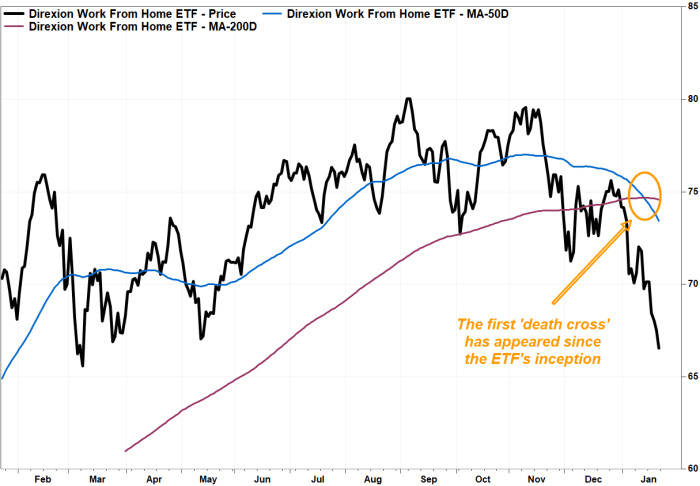

fell 1.0% in afternoon trading Friday, putting it on track to close at an eight-month low. The ETF (WFH) has tumbled 16.5% since closing at a since-inception peak of $80.04 on Sept. 3, while the S&P 500 index

SPX,

has slipped 2.0% over the same time. Read more about the WFH ETF.

Although many on Wall Street would say the WFH hasn’t yet entered a bear market, which is defined by a decline of 20% or more from a bull-market peak, it has traded below its 50-day moving average (DMA), a widely followed short-term trend tracker, since November. It has also been below its 200-DMA, which many view as a dividing line between longer-term uptrends and downtrends, since the end of 2021.

Also, an ominous technical signal known as a “death cross” has appeared this week.

A “death cross” occurs when the 50-day moving average (DMA) crosses below the 200-DMA. Many believe it marks the spot a short-term pullback graduates to a longer-term downtrend. Read more about the “death cross” pattern.

The WFH’s “death cross,” the first since the ETF’s inception in June 2020, appeared on Jan. 18, according to FactSet data.

FactSet, MarketWatch

Among the WFH’s 42 equity components, 31 (74%) were below their respective 200-DMAs, while “death cross” signals have appeared in 22 (52%) of the components’ stock charts.

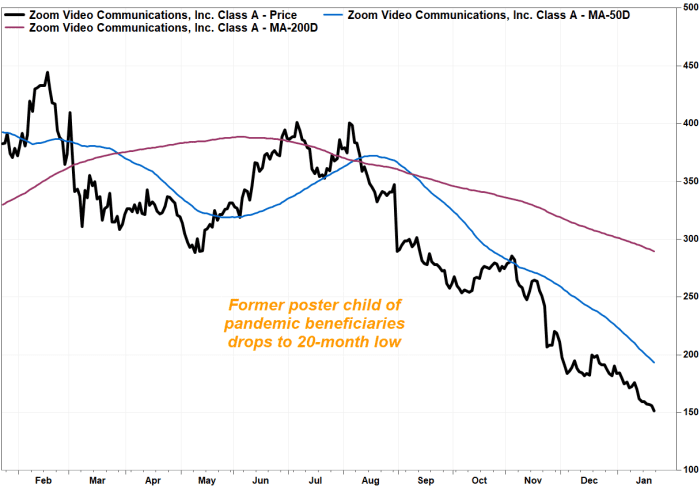

The WFH member stocks trading the furthest below their 200-DMAs are Intrusion Inc.

INTZ,

at about 53%, DocuSign Inc.

DOCU,

at about 51% and Zoom Video Communications Inc.

ZM,

at 48%.

FactSet, MarketWatch

Netflix’s stock is currently about 29% below its 200-DMA and Peloton shares are 69% below. But keep in mind that neither Netflix nor Peloton are WFH components.

Don’t miss: Netflix is shedding more than $50 billion in market cap after ‘borderline catastrophic’ forecast.

Also read: Peloton stock plunges below IPO price for first time in two yers after report of production halt, and Peloton stock bounces back after CEO disputes reports of massive layoffs, production halts.

They are, however, included in the iShares Virtual Work and Life Multisector ETF

IWFH,

which peaked much earlier than the WFH. That ETF (IWFH) was little changed on Friday, but has plummeted 42.0% since reaching its post-pandemic peak of $35.24 on Feb. 12, 2021. Read more about the IWFH ETF.

The IWFH, which also includes shares of non-U.S.-listed companies, hasn’t traded above its 200-DMA since July 7, 2021, and its “death cross” appeared back on May 10, 2021.

In comparison, the S&P 500 dipped below its 200-DMA in intraday trading on Friday but has bounced back above it. The last time the index closed below its 200-DMA, which currently extends to 4,429.41 according to FactSet, was June 26, 2020. And the 50-DMA is still 5.4% above the 200-DMA at 4,666.63.

Less than half of the S&P 500’s components (242) are trading below their 200-DMAs, and about one-third (171) have produced “death cross” signals.