This post was originally published on this site

Supernus Pharmaceuticals (SUPN) is a commercial-stage biopharma focused on treating CNS diseases. Supernus has been profitable each year since 2015, but the company has traded at a low earnings multiple lately due to concerns about future growth after a late-stage clinical failure last year. Rather than sitting on its hands, Supernus management went out and made an acquisition that looks very complementary to the company’s strategic direction. In this article, I’ll take a look at that acquisition, Supernus’ other pipeline assets, and why I think the company is substantially undervalued.

Supernus has a Solid Record of Profitability and is Reinvesting to Compound Returns through Acquisitions and Pipeline Development

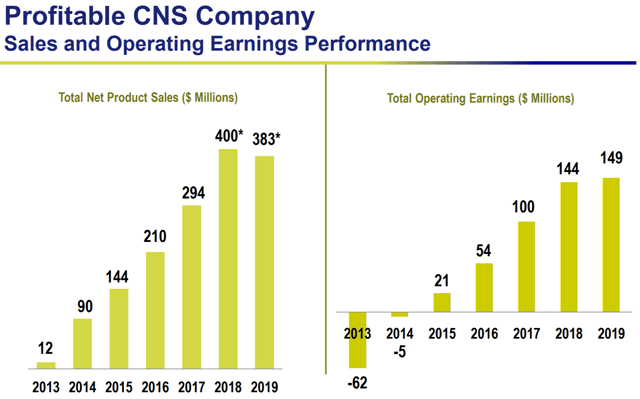

As I said above, Supernus has been profitable every year since 2015, but the most noteworthy thing to me is the high level of profitability compared to the company’s current market cap.

Figure 1: Supernus Sales and Earnings Data (Source: corporate presentation)

As you can see in Figure 1, Supernus earned $149 million last year. But at a market cap of around $1.26 billion, this results in a price-to-earnings ratio of around 8.4, far below the 15 P/E that is often considered average. Supernus achieved those earnings off of two currently marketed products: Oxtellar XR and Trokendi XR, which are both once-daily anti-epileptic drugs. While not an immediate problem, Trokendi XR and Oxtellar XR will start facing generic competition in 2023 and 2027, respectively. Because Trokendi XR sales are about triple that of Oxtellar XR, the 2023 patent cliff will leave a big hole to be filled for Supernus.

Previously, Supernus had been using its cash flow to develop internal pipeline assets, but late last year the company announced that its late-stage product to treat impulsive aggression in ADHD patients had failed its Phase 3 trial. This one setback removed about $336 million in estimated 2024 sales, right after the time when Trokendi XR sales were already projected to drop off. That potential drop-off in earnings is exactly why Supernus had been trading for such a low earnings multiple.

Management, however, has not sat idly after the setback. Supernus went out and acquired a complementary portfolio of CNS therapies from US WorldMeds, both marketed and in development, to help bridge the gap. This is in addition to getting an NDA filed for its ADHD treatment that now has a PDUFA date in November 2020. The acquisition should be immediately accretive to earnings, and I view it as a very positive development for the company.

The market seems to agree that these recent moves have added value, rallying substantially of late.

Figure 2: Supernus Stock Chart (Source: finviz)

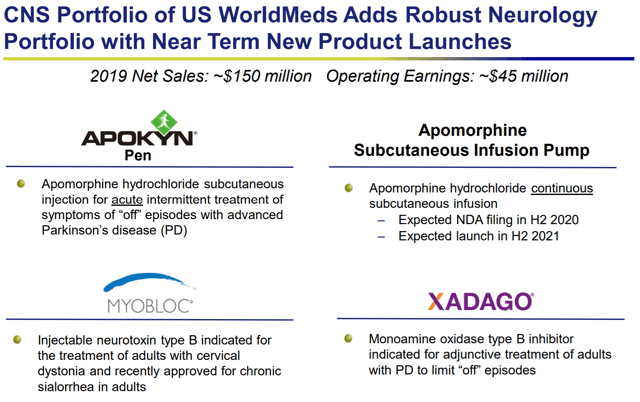

This new acquisition adds 39% to the revenue base with 3 additional marketed products. US WorldMeds’ CNS portfolio generated $150 million in 2019 net sales and $45 million in earnings. Two of these products are for Parkinson’s disease: the Apokyn pen for acute treatment of off-episodes and Xadago which is designed to limit the frequency of off-episodes. Myobloc is the other marketed therapy and is an injection for cervical dystonia and chronic sialorrhea.

Figure 3: Newly Acquired Products (Source: corporate presentation)

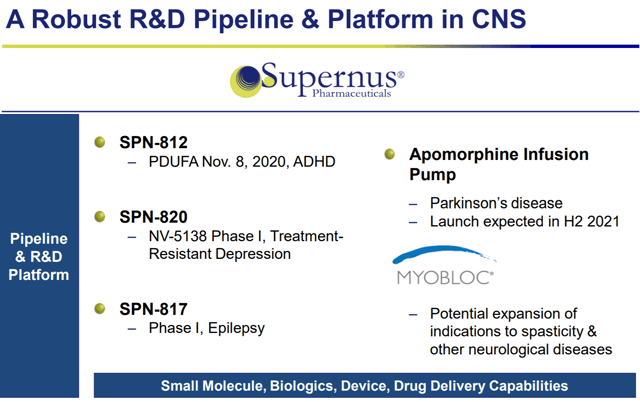

One more product from US WorldMeds’ CNS portfolio could hit the market in 2021: an apomorphine infusion pump for Parkinson’s disease which will likely have an NDA filed later this year and will hopefully launch in late 2021. Peak sales estimates for the apomorphine pump are $100 million to $175 million. This is in addition to the SPN-812 which Supernus hopes to get on the market later this year. SPN-812 is a non-stimulant ADHD treatment that has a PDUFA November 8, 2020. Supernus projects SPN-812 could garner a 5-10% share of the overall ADHD market. Given that the ADHD market was estimated to be over $16 billion in 2018, SPN-812 could go a long way towards replacing Trokendi XR sales if approved.

Figure 4: Supernus Pipeline Opportunities (Source: corporate presentation)

Supernus also has Phase 1 programs in treatment-resistant depression and epilepsy in its pipeline. Supernus has said that 30% of medically diagnosed depression patients are treatment-resistant, so this is a sizable patient population in need of a good therapy. The company is also seeking a potential expansion of Myobloc to spasticity and other neurological diseases.

Supernus’ Balance Sheet is Impressive

Supernus has said that it is paying the upfront $300 million for the US WorldMeds acquisition out of cash, which is certainly suggestive of balance sheet strength before even taking a look at the numbers. At the end of Q1 2020, Supernus reported having nearly $1.2 billion in assets against just $576 million in liabilities. Supernus should be adding about $200 million per year to its cash pile at the 2019 rate with the acquisition factored in, so the company will have no trouble covering the additional $230 million in potential commercial milestone payments to US WorldMeds.

Supernus looks Undervalued on both an Earnings and Sales Basis After Factoring in the Acquisition

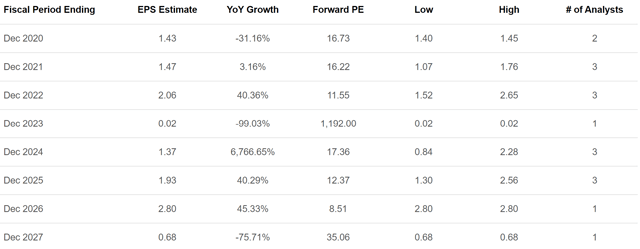

Based on current analyst estimates, Supernus looks roughly fairly valued based on the next 3 years’ worth of earnings and somewhat undervalued based on sales over that same time period.

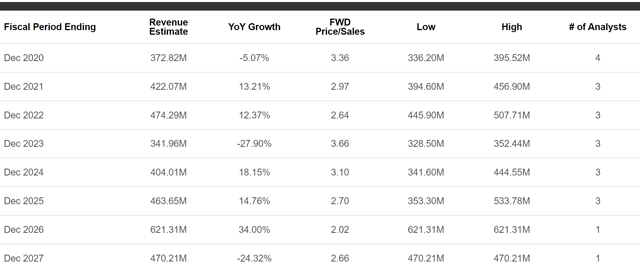

Figure 5: Supernus Earnings and Sales Estimates (Source: Seeking Alpha)

These estimates looked conservative even pre-acquisition, and it’s clear that none of them factors in the acquisition of the US WorldMeds’ CNS portfolio at all. Sales were set to grow over at least the next 3 years before the Trokendi XR patent cliff and Supernus is expected to remain profitable throughout, albeit maybe narrowly during some of that time.

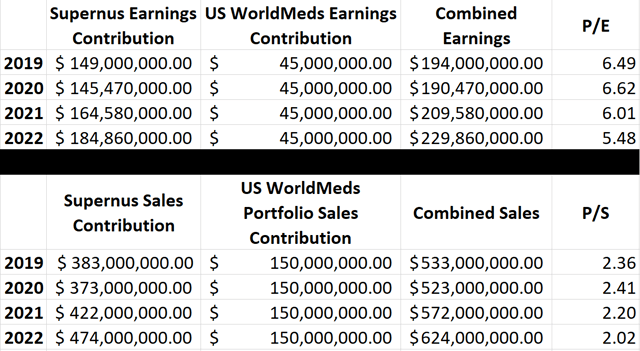

Based on Supernus’ current market cap of only about $1.26 billion, I estimated what the company’s earnings and sales ratios could look like over the next few years with the acquisition factored in.

Figure 6: Supernus Earnings and Sales Figures Adjusted for the Acquisition (Source: Seeking Alpha, Supernus’ corporate presentation, and my calculations based on them)

As you can see from Figure 6, both the earnings and sales ratios after factoring in the acquisition are less than half of the 15 P/E and 5 P/S that are commonly considered average. At these levels, Supernus looks substantially undervalued.

This is also just factoring in 2019 sales and earnings levels for the US WorldMeds portfolio which is likely conservative for at least 2 reasons. First, because of the similarities between Supernus’ and US WorldMeds’ portfolios, there will likely be some expensive savings that will increase the earnings contribution from the US WorldMeds portfolio. Second, by holding the US WorldMeds sales and earnings constant, I am completely ignoring the impact of the apomorphine infusion pump that will hopefully start earning money for the company in 2021.

Of course, getting a CRL for either the apomorphine pump or Supernus’ ADHD treatment would be a tremendous setback and could lead to a decrease in the company’s share price. The downside potential should be somewhat limited from here though, given the company’s strong current cash flow and low earnings multiple.

Conclusion

Supernus has struggled some over the last few years to find a revenue replacement for the upcoming Trokendi XR patent cliff, but the company finally seems to have hit paydirt with its acquisition of US WorldMeds’ CNS portfolio. Supernus looks meaningfully undervalued based on current sales and earnings ratios, but the company has a chance to increase revenue despite the Trokendi XR drop-off through 2 new drugs that will hopefully hit the market by 2021. I own a full position in Supernus and intend to hold it for the next several years as the potential of the acquisition is realized. My fair value estimate for the company is in the $40/share range, well above where it is currently trading.

Disclosure: I am/we are long SUPN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor the timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself without notification. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance as financial circumstances are individualized.