This post was originally published on this site

Tensions surrounding Russia and Ukraine may mean that European consumers will see little respite from volatile natural gas prices this winter.

“Russian gas flows are the largest single source of price risk for European energy, and the future of those flows are closely tied to rising tension between Russia and Ukraine,” wrote analysts at Schneider Electric, in a Wednesday research report.

Russia has massed thousands of troops on Ukraine’s border, stoking fears of an invasion and heightening worries that Russian gas that flows through the country could be cut off. Meanwhile, the Nord Stream 2 pipeline from Russia to Germany, which has been completed but hasn’t yet been certified to operate, is seen by the Biden administration as a potential source of leverage should Russia invade, The Wall Street Journal noted.

The Biden administration has sought assurances from Germany that it won’t let the pipeline become operational if Russia invades Ukraine, the report said, while Germany has been less clear on the potential consequences. A German regulator paused certification of the pipeline last month, on the condition that Swiss-based Nord Stream 2 AG incorporates in Germany or transfers ownership of the pipeline to a German subsidiary.

Meanwhile, Russia is seen with leverage of its own amid tight supplies of natural gas in Europe.

Natural gas on the TTF trading hub in the Netherlands fell 3.3% on Wednesday to 173.95 euros per megawatt hour, but remain up nearly 89% in December alone, and the equivalent of around $58 per million British thermal units — nearly 15 times the level for benchmark U.S. natural-gas futures

NG00,

A surge earlier this week came as Russian pipeline flows temporarily reversed.

“Traders were right to be nervous about Russia to Europe gas flows in December, when Gazprom chose to rely on day-ahead bookings on the Yamal-Europe pipeline. On Tuesday and Wednesday, Russian flows were in reverse mode, moving from Germany to Poland — the last thing Europe wanted to hear,” said Kaushal Ramesh, senior analyst at Rystad Energy, in a note.

Unplanned outages announced last week at four of EDF’s nuclear reactors in France, meanwhile, were likely to increase demand for coal, gas and fuel oil, Ramesh said, noting that weather forecasts for coming weeks point toward colder-than-average temperatures across much of the continent.

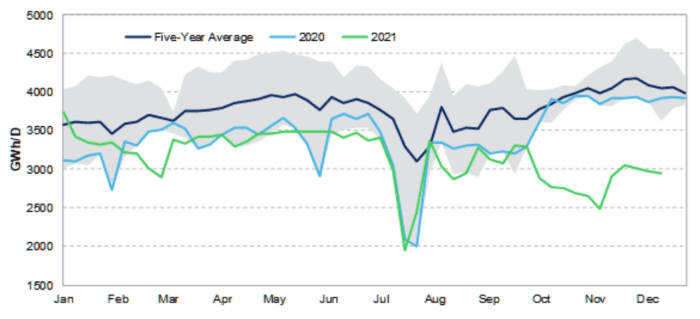

It’s the drop in Russian exports in recent months that is arguably the most important factor driving European gas prices to records, the Schneider analysts said (see chart below).

Russian gas flows

Schneider Electric Global Research & Analytics

“Amid significant tension between Russia and Ukraine, the Nord Stream 2 pipeline that once appeared likely to bring a new wave of Russian gas into Germany and connected markets has been delayed indefinitely,” they said. “That’s been paired with a clear drop in Russian flows through existing pipelines into Europe, raising speculation that Russia is artificially limiting supply to Europe to boost prices and pressure the start of commercial flows through Nord Stream 2.”

With Nord Stream 2 potentially not operational until the second half of 2022, weak gas flows from Russia to Europe might continue through spring and early summer, said Rystad’s Ramesh.

“Consequently, the TTF forward curve has shifted upwards to hold above $30 (per million BTUs) throughout 2022, suggesting another year of volatility and a continued high-price environment,” Ramesh said.