This post was originally published on this site

Investing.com — Riot Blockchain Inc (NASDAQ:RIOT) shares fell 3.5% on Thursday despite an optimistic research note from Northland analyst Mike Grondahl, who initiated coverage of the Bitcoin mining firm with an outperform rating.

The analyst set a $30 price target on the stock, telling investors Riot is an “energy-efficient, high-capacity, low-cost crypto asset mining company.”

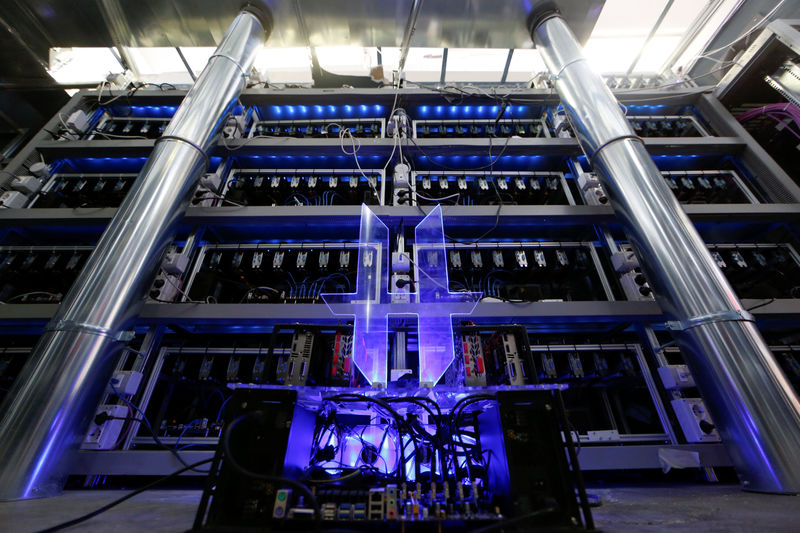

Riot has the largest Bitcoin mining facility in the U.S., the analyst noted. It’s located on 100 acres in Rockdale, Texas, with a total current capacity of 300 MW and 750 MW total when complete. It “has an industry leading power rate of 2.4c/kWh which has resulted in high developed capacity, robust outlook for future capacity, leading hash rates and number of Bitcoin mined, and low cost of production,” explained Grondahl.

The analyst cited the company’s deployment of miners and purchase agreements for new miners, which will give it an expected hash rate of 12.8 EH/s, as being significant.

In addition, Grondahl pointed to Riot creating an industrial-scale immersion-cooled mining operation that he says will result in increased hash rates and more significant financial output than traditional mining.

“We believe Riot is a thought leader in the space and is well-positioned for robust growth in the near future,” he concluded.