This post was originally published on this site

Although the pace of consumer-price inflation cooled slightly in April, don’t think for a minute that America’s inflation problems are in the past. Gasoline prices may have temporarily softened in April, but prices for the things that really count the most—shelter, food and medical care—are still blisteringly hot.

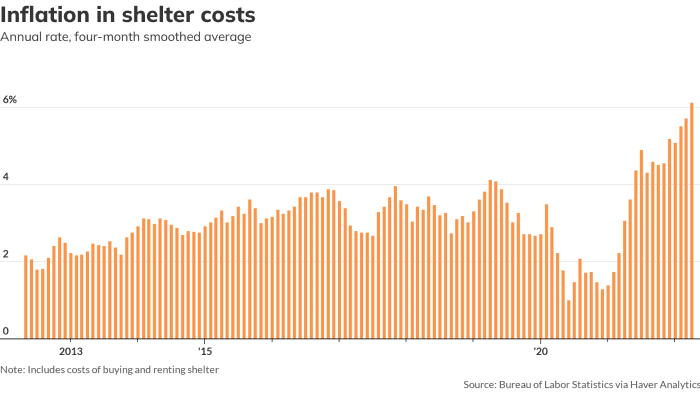

Shelter costs rose at a 6.4% annual rate in April. Food prices increased at a 10.9% rate. Out-of-pocket medical care prices, which had been pretty quiet for much of the pandemic, jumped at a 5.5% rate.

Follow the inflation story on MarketWatch

Those three items account for about 55% of the typical family’s monthly budget, and inflation is accelerating in all three. So far in 2022, shelter costs are rising at the fastest pace in 31 years, food prices are rising at the fastest pace in 41 years, and medical-care prices are going up at the fastest pace since the pandemic hit.

Shelter costs are the biggest item in the family budget — and they are rising fast.

MarketWatch

Harder to fix

The stock market

SPX,

DJIA,

COMP,

took the news well, but the Federal Reserve is not going to like this consumer price index report one bit.

Sure, the year-over-year pace of inflation fell from 41-year highs, but the report confirms that inflation is migrating away from primarily goods—where prices often go up or down at the drop of a hat—to services, where prices are slower to move but rarely reverse course (who ever heard of someone lowering the rent?).

That means that inflation, once embedded, is harder to get rid of.

The prices of services, which account for 60% of consumer spending, rose a 5.4% annual rate in April, the fastest pace since 2001. Meanwhile, the price of goods, which had risen a record 14.2% in the previous 12 months in March, dropped at a 3.5% annual rate in April.

The April CPI adds additional confirmation that inflation, like an army of termites, has burrowed its way into the biggest item in the typical family’s budget: shelter. The cost of buying or renting a home accounts for a third of the typical family budget (and for low-income families, it’s often half or more of their disposable income).

These costs—what the Bureau of Labor Statistics calls “rent of shelter”— have been rising at a 6.3% annual pace so far this year. That’s the fastest four-month increase since 1991.

Mismatch in supply and demand

And that’s a major worry for policy makers at the Fed, because raising interest rates and reducing the central bank’s balance sheet can’t solve the underlying mismatch in supply and demand in shelter: Everyone needs to sleep under a roof, but there aren’t enough.

Easy monetary policy certainly has contributed to the unearthly rise in home prices over the past two years. Raising interest rates and cutting back on the Fed’s ownership of mortgage-backed securities will certainly help slow home sales and, with it, the rise in house prices.

But the Fed can’t build more houses and apartments in the places that people want to live. Slowing the pace of appreciation in home prices and rents will ultimately reduce construction, putting more pressure on existing supply.

Solving our inflation problems ultimately depends on increasing supply, but that’s not something the Fed can do.

More on inflation

There’s a big hole in the Fed’s theory of inflation—incomes are falling at a record 10.9% rate

Inflation inequality is hitting the working class harder than at any other time on record

Gas prices are way up, but real cost of driving a mile was higher for most of the past century

Why interest rates aren’t really the right tool to control inflation