This post was originally published on this site

Take a moment this week to wish Social Security a happy 86th birthday.

Its exact birthday is on Saturday, August 14. It was that day in 1935 when then-President Franklin Roosevelt signed the Social Security into law.

To help celebrate, I’m devoting this column to appreciating Social Security’s contribution to retirement financial security.

I first want to focus on how big a difference Social Security makes to the retirement financial security of many elderly. Without Social Security, many of them would be unable to make it financially.

We often miss this sobering fact because many in the retirement financial arena pay inordinate attention to retirees who are relatively well off. I am as guilty of this as anyone. When I focus a Retirement Weekly column on the future expected returns of stocks and bonds, for example, as I did several weeks ago, I am implicitly assuming that retirees (or near retirees) have amassed sufficient wealth such that it makes a difference how well the various asset classes will perform in the future.

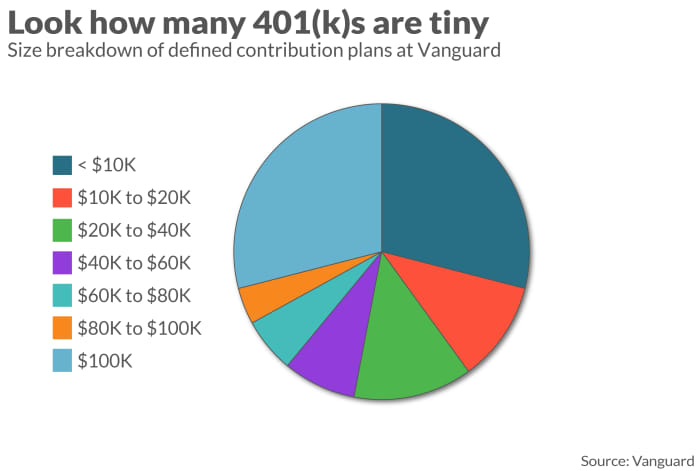

But such a discussion is irrelevant to a disturbingly large number of retirees and near-retirees. According to Vanguard, for example, 29% of the 401(k) accounts at Vanguard have less than $10,000 in assets. And that’s among those investors who have a 401(k) in the first place. Many others have nothing.

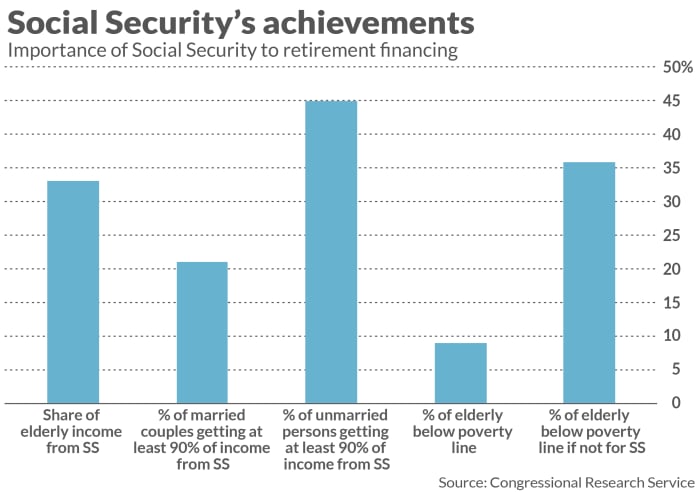

For retirees and near-retirees in these groups, needless to say, Social Security inevitably represents the lion’s share of their retirement income. This proportion will almost certainly grow in coming years, but it’s already sizable: According to the Social Security Administration, “21% of married couples and about 45% of unmarried persons rely on Social Security for 90% or more of their income.”

One way of appreciating the significance of these sizable percentages is what the poverty rate would be among the elderly if Social Security did not exist. According to the Congressional Research Service, the proportion of those over 65 who live below the poverty lines would grow from 8.9% to 35.8% without Social Security benefits and assuming no other changes.

Crisis is such an overused word today. But a poverty rate that high would most certainly be a crisis of the first magnitude.

Social Security’s finances

As is widely known, the Social Security trust fund is slated to run out of money in the mid-2030s. If Congress doesn’t make changes by that time, Social Security recipients would begin receiving only about 75 cents on the dollar of amounts otherwise owed to them.

It’s perhaps inevitable that our politicians will want to postpone as long as possible making the necessary changes to restore the Social Security trust fund’s long-term solvency. This is what happened the last time that this fund was about to run out of money, in 1983. As I’ve written before, Congress on that occasion didn’t make the necessary changes until there were just four months to spare.

So it’s a good bet that it will be at least another decade before Congress finally makes these changes. But that’s a shame, since the sooner they are made the less onerous they need to be.

Perhaps the best birthday present we can give Social Security would be to urge our elected representatives to makes changes that will insure Social Security’s solvency for decades to come.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.