This post was originally published on this site

Be on your guard against sensational headlines about the latest Social Security Trust Fund’s status.

Some of the more doomsday of those headlines have led some to believe that Social Security is about to completely run out of money and therefore be unable to pay any benefits. In fact, according to the latest report from the actuaries at the Social Security Administration, Social Security will still be able to pay about 75% of scheduled benefits after 2033, the year in which the Social Security trust funds are projected to become depleted.

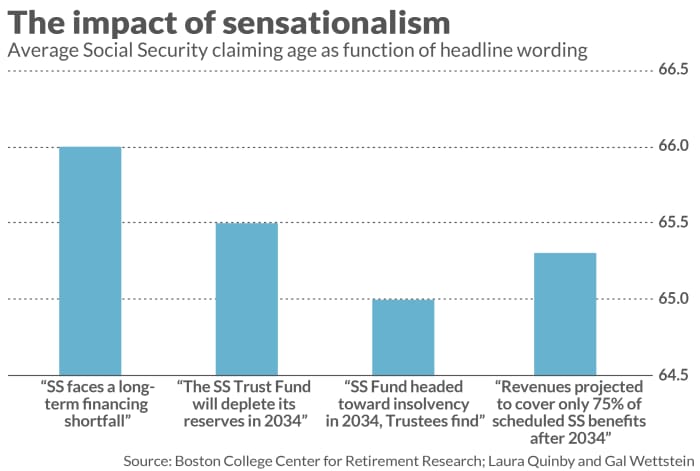

How this issue is framed makes a big difference, according to a recent study from Boston College’s Center for Retirement Research. Near-retirees who read more sensational and doomsday headlines are more likely to claim their Social Security benefits at an earlier age, for example. This runs counter to the consensus advice from most financial planners.

The study is entitled “Does Media Coverage of the Social Security Trust Fund Affect Claiming, Saving, and Benefit Expectations?” It was conducted by Laura Quinby and Gal Wettstein, both research economists at Boston College’s Center for Retirement Research. The study is timely, since the Social Security Administration just two weeks ago released its latest report on the financial status of its trust funds.

For their study, the economists created a simulation in which respondents’ reported their attitudes toward Social Security. The respondents were broken into four groups, and each group was presented with a single article reporting on the Social Security trust funds’ solvency. For all four groups the article was identical except for the headline.

The four headlines were the following:

- Social Security Faces a Long-Term Financing Shortfall

- The Social Security Trust Fund Will Deplete its Reserves in 2034

- Social Security Fund Headed toward Insolvency in 2034, Trustees Find

- Revenues Projected to Cover Only 75 Percent of Scheduled Social Security Benefits After 2034

(Note that the questions assumed the trust fund deletion date would come in 2034, not 2033 as is projected in the latest report from the Social Security Administration. That’s because the survey was conducted this summer, before this latest report was released. In last year’s report, the projected deletion date was 2034.)

One of the questions that survey participants were asked was when they would claim their Social Security benefits. As you can see from the accompanying chart, those who were confronted with more alarmist headlines were more likely to pick an earlier claiming age.

You might be inclined to downplay the significance of the differences plotted in the chart, since they might seem modest in the context of the range of possible claiming ages—as early as 62 and as late as age 70. But note that the sole cause of these differences, which are statistically significant, is the wording of the headline. I find it noteworthy that there is any difference at all.

The issue is tricky, however, since each of the four headlines that the economists used in their survey is technically accurate. Their differences are a matter of emphasis. But now that we have the benefit of this new study, columnists and headline writers can’t claim ignorance of the consequences of what they write. Alarmist headlines might elicit more reader interest, but they also make “many workers fear an unrealistically severe cut to their future Social Security benefits,” as this study’s authors put it.

The headlines that the economists used in their survey are just some of those that appear regularly and which needlessly alarm retirees and near retirees. One theme that often emerges is the implication that Social Security’s financial position has deteriorated significantly in recent years. The corresponding headlines suggest that it’s breaking news that Social Security is slated to run out of money in the 2030s.

It’s not news, as I’ve pointed out many times before. As long ago as four decades ago, the last time that changes were made to augment Social Security’s finances, actuaries at the Social Security Administration were projecting that their trust funds would be unable to pay full benefits beginning at some point in the mid-2030s. The real story here is how accurate they were in their projections.

Another common alarmist headline is that the Social Security trust fund is already bankrupt—we don’t have to wait until 2033. That’s because the federal government supposedly has already taken all the money from that trust fund and spent it.

But only in a trivial sense is that true. By law, the Social Security Administration must invest its trust funds in U.S. Treasurys, and on those trust funds’ balance sheets you’ll find a corresponding line entry for those Treasurys. They are one of the safest assets in the market, and can be redeemed at any time. It’s no different than for a corporation that invests some of its cash surplus in U.S. Treasurys; yet I know of no one who claims that such a company no longer owns that asset because the government “has taken the money and spent it.”

The bottom line? Don’t base your retirement decisions on headlines.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.