This post was originally published on this site

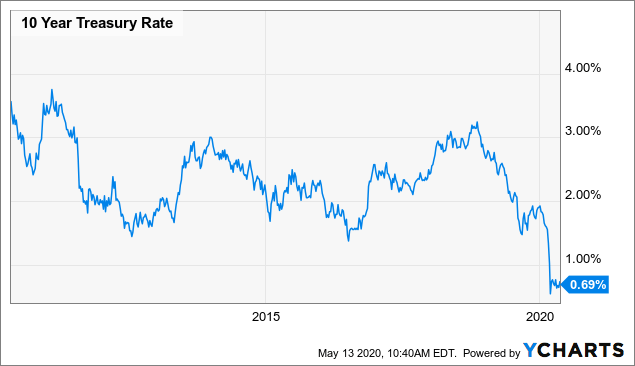

Over the past decade, retirees and other income investors have been pushed out of Treasuries due to insufficient yields. For most of the 2010-2020 period, interest rates were hovering around 1%-3%, which after inflation and taxes, isn’t sustainable for most retirees:

Data by YCharts

Data by YCharts

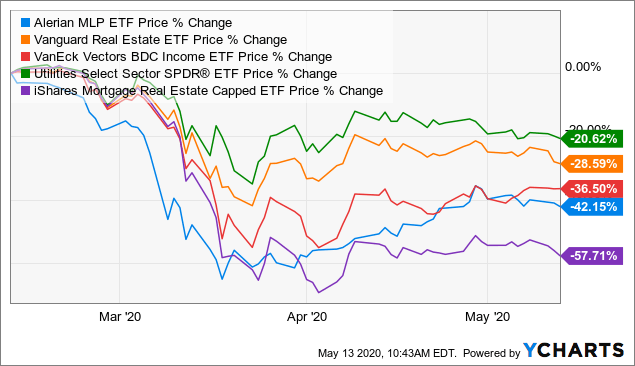

It forced retirees to invest into higher-yielding instruments that carry greater risks. Good examples include MLPs, BDCs, utilities, and REITs.

Unfortunately, those were some of the worst performers in the last market crash:

- MLPs (AMLP) are down 42%.

- BDCs (BIZD) are down 36%.

- Utilities (XLU) are down 21%.

- mREITs (REM) are down 57%.

- eREITs (VNQ) are down 29%.

Data by YCharts

Data by YCharts

A lot of dividend cuts already have been announced. More will follow. And unfortunately, some of these higher-yielding companies may never recover.

Think for instance about lower quality mall REITs, which are closed down and quickly losing market share to Amazon (AMZN). Maybe they will recover, but “maybe” is not good enough for retirees who rely on steady income to fuel their retirement.

We believe that most of these higher-yielding companies are uninvestable for retirees in this uncertain environment. Risks are high and you need to be more selective than ever before to sustain maximum income in this crisis.

You shouldn’t shy away from taking risks, but these risks should be carefully vetted and diversified with other income sources. At High Yield Landlord, common equity investments such as REITs are just one component of our Retirement Portfolio.

Below we discuss the three core asset classes that allow us to generate safe maximum yield in retirement:

Safe Income Component #1: Blue-Chip REITs

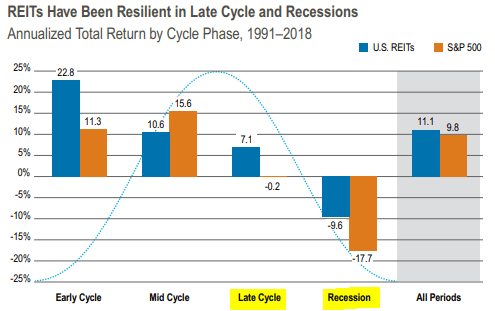

REITs own properties that are leased on a long-term basis and generate steady rental income. It’s a defensive business model that has historically provided nearly 2x better downside protection and income stability during recessions:

However, this does not mean that every REIT is suitable for retirees. Many of them are either overleveraged, poorly managed, or they operate in a risky property sector such as hotels or malls.

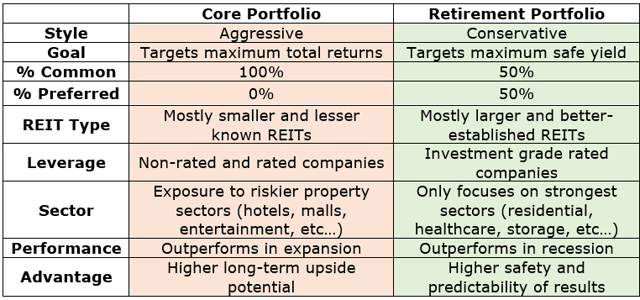

Retirees should stay away from those and look instead for large, well-established REITs that enjoy investment grade credit ratings, steady fundamentals and a strong track record of steady dividend payments. That’s exactly what we target with our Retirement Portfolio:

Source: High Yield Landlord Retirement Portfolio

Finding a high-quality REIT is not very difficult. What’s difficult is to find high quality at a deep discount to fair value. Such opportunities are very rare, but if you want to lock in a high yield, you need to get a good deal on your purchase.

In a universe of 200 REITs, there are only ~20 of them that would pass our selection criteria.

What would be a good example of a retiree-friendly REIT?

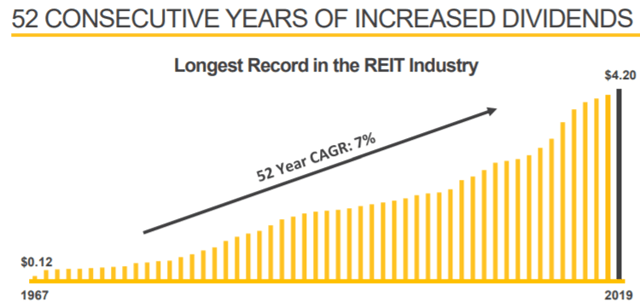

Federal Realty Trust (FRT) is one of the best retiree-friendly REIT investment opportunities in the current marketplace. It’s one of the bluest blue chips in the REIT market with an A-rated balance sheet, high-quality assets, and a 52-year track record of rising dividends.

FRT has never cut its dividend in over half a century. Not even in 2008-2009 when most other REITs were slashing dividends.

Today, FRT is going through a temporary crisis with tenants missing rent payments due to store closures. It will cause a hit to FRT’s results in 2020, but rent payments will resume as soon as we open up the economy and FRT’s A-rated fortress balance sheet should allow the company to maintain its dividend.

Right now, FRT is priced at an even lower valuation than in 2008. It’s offered at a 50% discount to net asset value and pays a 6% dividend yield that is safely covered at a 69% payout ratio. As valuations normalize, the company has ~100% upside potential, which is quite exceptional for a company of this quality.

Our Retirement Portfolio includes nine similar blue-chip REIT investment opportunities to generate safe income and protect us against long term inflation.

Safe Income Component #2: Discounted Preferred Shares

If there’s one downside to common equity investments, it’s that they can occasionally become extremely volatile and the yield level is generally below 6% for high quality companies.

Our Retirement Portfolio invests in preferred shares in order to achieve three things:

- Lower the volatility of the portfolio

- Boost its yield

- Increase the income safety

Preferred shares generally do not have as much as upside potential. However, their yield is often greater and also safer because it must be paid ahead of the common dividend.

We are especially interested in preferred shares that are backed by real assets that generate steady contractual income. From our experience, they provide the best risk-to-reward for retirees. They are very rare to suspend preferred dividends, even in times of crisis.

A good example of a preferred share opportunity is the series D preferred shares of UMH Properties (UMH.PD). It yields 7% and has an additional 15% upside potential to par value.

We believe that the income is very safe because it’s backed by a diverse portfolio of manufactured housing communities. Affordable housing always is in great need, and especially so in times of crisis. The company has low leverage and resilient fundamentals. The 7% yield must be paid before even a penny can paid to common shareholders. The management owns 11% of the equity, and therefore, they are very motivated to pay the preferred in full and on time.

Our Retirement Portfolio includes six similar preferred share investment opportunities to boost the average yield of the portfolio and stabilize its value.

Safe Income Component #3: Property-Backed Loans

Finally, the third component of our Retirement Portfolio is private property-backed loans. They serve two main purposes:

- They boost the average yield of the portfolio.

- They diversify the portfolio away from publicly traded equities.

In other words, it allows us to earn greater income with lower overall volatility.

But what are these loans and how risky are they?

First of all, you must understand that these are private investments and therefore they do not enjoy the same liquidity as common or preferred shares.

On the flip side, the yield is generally much greater at 8%-12% depending on the risk of the loan. Each loan is backed by a property and the loan-to-value is generally below 65%, which leaves good margin of safety in case of trouble. This also means that if and when the property is foreclosed, it can be sold to recoup the principal and possibly even more.

Importantly, the duration of these loans is very short, generally just 12 months. It allows us to quickly get our money back to then reinvest in REITs or preferred shares if and when new opportunities come available. Otherwise, we can just reinvest in another loan.

To be clear, these are not risk-free investments. We have had several cases of foreclosures and delayed payments, but because the LTV is below 65%, the first 35% loss is taken by equity investors. It provides margin of safety for us and results in a lower risk profile than most stocks.

Ever since we started investing in these loans, our average yield has been a steady 10% per year. We use two different crowdfunding services to access these investments and discuss them in great detail at High Yield Landlord.

Our Retirement Portfolio invests roughly 20% of its assets into such opportunities to boost yield and lower volatility through diversification.

Bottom Line

Not all high-yield portfolios are created equal. If you are heavily invested in MLPs, BCDs, CEFs, and riskier REITs, you are likely to suffer many dividend cuts in the coming weeks and months.

Our Retirement Portfolio strategy is not looking for homeruns or >10% yields on risky equities. Instead, we are more strategic in the risks we take and aim to generate maximum safe income in this environment.

Today, the average yield of the portfolio is 6%, but this is income that comes from blue-chip REITs, solid preferred shares, and property loans, which are safer than traditional equity investments.

Is the portfolio immune to losses? It sure isn’t, but we are very confident that it will outperform most other retirement portfolios and pay more consistent income. It’s structured with this goal in mind.

Launch of Retirement Portfolio!

At High Yield Landlord, we recently launched our Retirement Portfolio to target undervalued blue-chips with sustainable dividends. It currently yields 6% and has up to 50% upside potential.

- We are the #1 rated service on Seeking Alpha with a perfect 5/5 rating.

- We are the #1 ranked service for Real Estate Investors with 1600 members.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

Disclosure: I am/we are long FRT; UMH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.