This post was originally published on this site

Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

The U.S. economy added 1.8 million jobs in July, one of the highest one-month jumps on record, bringing total employment to 139.6 million. While that is substantial progress compared to April, when only 130.3 million were employed, it’s still significantly less that the 152.5 million people who made up the U.S. paid workforce in February.

Simply put: Employment is improving, but it’s still really bad.

And that rate of recovery is destined to slow. Over the past few months hiring was driven by states reopening businesses, like nail salons and dental offices, which don’t attract huge crowds. But unless the virus is tamed, businesses that do and are therefore not able to fully reopen—including amusement parks, cruise lines, and bars—will hold back a broader recovery.

The economy also faces a series of headwinds: Expired $600 weekly federal pandemic assistance for around 30 million unemployed Americans threatens to drag down consumer spending—two-thirds of the economy—and looming business failures and household bankruptcies could cause a financial crisis. And unlike in March when the $2.2 trillion CARES Act was passed, this go-around Democratic and Republican leaders have thus far been unwilling to compromise on more economic stimulus.

To give Fortune readers a better understanding of where the economy is and where it’s heading, we rounded up nine charts of economic data we’ve been tracking throughout the crisis:

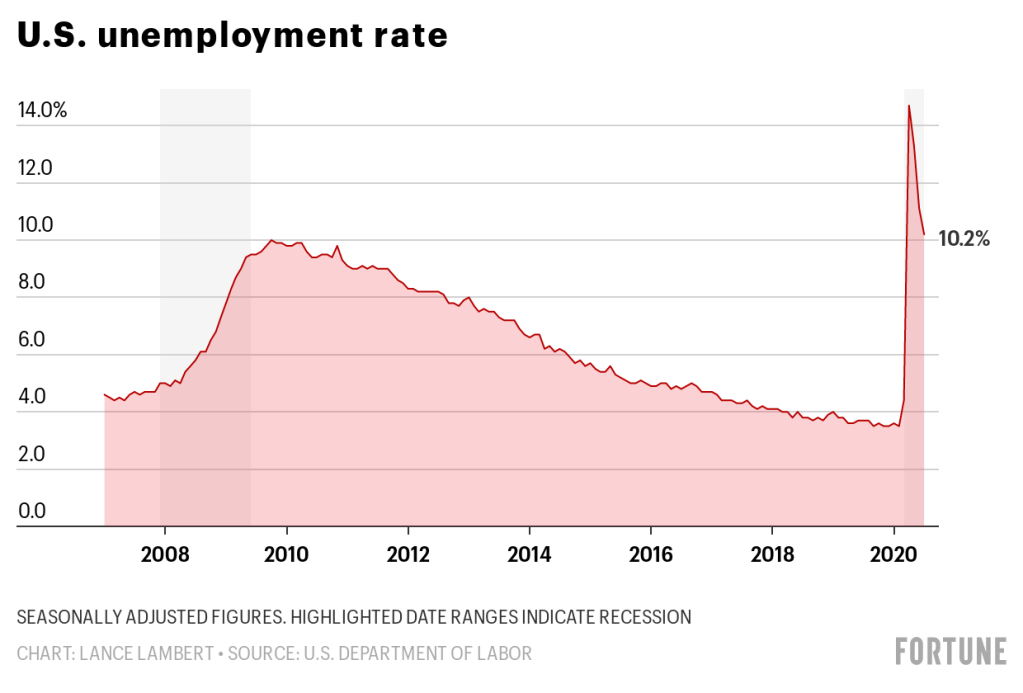

Jobless rate

The economic contraction following the March shutdowns was the sharpest in U.S. history: The jobless rate jumped from 3.5% in February—a 50-year low—to 14.7% in April——the highest level since 1940.

We’ve since shifted into a recovery that is moving faster than many economists expected. The unemployment rate dropped from 11.1% in June to 10.2% in July. That beats the timeline the Congressional Budget Office projected in May, when it forecasted a 9.5% unemployment rate at the end of 2021.

But the pace of job growth slowed during the summer. In June the economy added 4.8 million jobs, followed by 1.8 million in July.

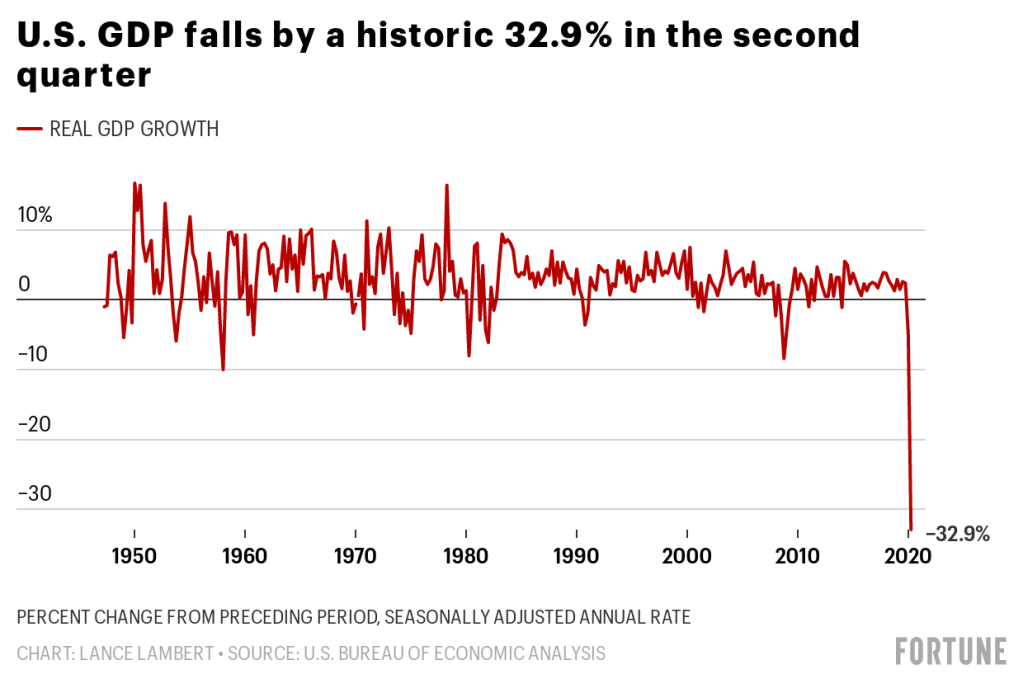

Gross domestic product

Second quarter real GDP, in the period from April to June, declined by 32.9% from the preceding quarter, according to the U.S. Bureau of Economic Analysis. That’s the largest single quarterly decline on record for data going back to 1947 and represents more than $1 trillion in economic output wiped out by the coronavirus pandemic.

That 32.9% decline follows a 5% decline in the first quarter, which only included the first few weeks of the pandemic. But economists believe the worst is over. Indeed, Goldman Sachs projects third-quarter GDP will jump a record 25%, as the economy benefits from those states that were able to reopen. But even with that rebound, GDP would still end the year down 4.6%.

State-by-state unemployment rate

The economies of some state are already seeing a V-shaped recovery, but others remain at Great Depression–era unemployment levels.

In Kentucky, the seasonally adjusted jobless rate soared from 4.2% in February to 16.6% in April, according to the U.S. Bureau of Labor Statistics. But as Gov. Andrew Beshear reopened the Bluegrass State’s economy, the jobless rate sunk to 4.3% by June—the lowest in the nation.

Other more rural states like Utah (5.1%), Idaho (5.6%), and North Dakota (6.1%) have jobless rates that also indicate V-shaped recoveries. These states, including Kentucky, don’y rely heavily on industries like leisure and hospitality that were decimated by the pandemic. And they’ve reopened more segments of their economy.

Then there are places that have seen little to no recovery. The jobless rate in New Jersey was 16.3% in April, but by June had climbed to 16.6%. Northeast states like New York and New Jersey, were among the early epicenters of the virus and are reopening their economies at much slower rates.

CEO outlook

Among U.S. CEOs, 42% foresee a U-shaped recovery—that is, a more moderate rebound—while 26% expect the dreaded L-shaped recovery, and 23% a W-shaped recovery, or a double-dip recession. Only 9% of U.S. CEOs predict a V-shaped recovery when an economy rebounds nearly as quickly as it contracted, according to a recent CEO survey conducted by the Conference Board.

A sour economic outlook can mean CEOs are less likely to pull the trigger on the business investments, which could translate into a slower recovery.

Confirmed COVID-19 cases

Over the past few weeks COVID-19 cases spiked across the South, West, and Midwest. But according to a Fortune analysis of New York Times data this week, 18 states have seen a seven-day moving average daily decrease of at least 150 cases when compared with two weeks ago. The largest declines were in Florida and Arizona.

Receding coronavirus cases is a hopeful sign that the recent outbreaks alone can’t pull us back into recession.

Initial unemployment claims

On Thursday we learned initial weekly jobless claims dropped under 1 million for the first time since the start of the crisis. But that 963,000 jobless claims is still more than three times the level typically seen before the crisis.

This means that even as the economy continues to recover, employers are still turning to layoffs. And unlike the spring layoffs or furloughs during the shutdowns, these job cuts are usually permanent.

Americans receiving unemployment benefits

The total number of Americans currently receiving unemployment benefits—called continued claims—came in at 15.5 million in the week ended August 1. That is down substantially since the peak of 24.9 million the week ending May 9, but a far cry from the 1.8 million on the unemployment rolls back in early March.

Frankly, we’re in period of mass joblessness, and getting out of this hole could take years.

And as of the week ending July 25, those 15.5 million jobless Americans—along with another 11.9 million jobless on Pandemic Unemployment Assistance or Pandemic Emergency Unemployment Compensation—are no longer receiving the $600 enhanced unemployment benefits. President Donald Trump signed a memorandum last week to extend $300 per week enhanced benefits to those on state unemployment rolls, however, it’s unclear when those funds will start to get dispersed or if the executive order is even legal.

Manufacturing

The Great Recession hammered construction and manufacturing. But this time housing—which is still seeing bidding wars—and manufacturing are among our bright spots. The Institute for Supply Management’s Purchasing Managers Index (PMI) came in at 54.2 in June, up from 41.5 in April and 52.6 in May. A PMI below 50 signals a contracting manufacturing sector. So that means U.S. manufacturers are growing again.

The factory shutdowns in the spring have caused shortages in everything from cars, lumber, coins, to Dr Pepper. In the immediate future, manufacturers will be busy making up for those shortfalls.

Employment in hospitality and leisure industries

The pandemic was a gut punch to tourism and service jobs. In fact, the number of U.S. leisure and hospitality jobs fell from 16.9 million in February to 8.5 million by April—fewer than the 9 million employed in the sector back in 1989.

Leisure and hospitality jobs have recovered to 12.5 million, however, those jobs simply can’t reach Feb 2020 levels—or anything close to it—until the virus is tamed and travel is back to normal.

Big picture, what do these nine charts tell us? The economy clearly moved into recovery sometime in May as states reopened; however, the pace of that recovery is now slowing. And that slowdown comes as fiscal stimulus runs out and business bankruptcies are starting to rise.

“The economy is starting to go sideways … without extra $600 unemployment insurance, more PPP, and help for state and local governments we’re going to go off a fiscal cliff,” Mark Zandi, chief economist at Moody’s Analytics, tells Fortune. “I think an effective vaccine is the necessary condition for getting the economy going again, the longer it takes the more likely we’re going back into recession or even worse: A depression.”

More must-read finance coverage from Fortune:

- Want to find the next $10-billion-plus takeover target? Watch executive stock sales carefully

- Rent and mortgage relief: How to find out if you’re eligible for new programs in your area

- What is Trump’s payroll tax holiday and how will it affect you? Everything you need to know

- A fuller picture is emerging about what jobs will—and won’t—be coming back after the coronavirus

- Most Americans now fear touching cash, survey says