This post was originally published on this site

Proteostasis Therapeutics (NASDAQ:PTI) is developing a combination therapy for cystic fibrosis that is ready to enter Phase 3 trials. The cystic fibrosis space has gotten a lot more competitive over the last few years as Vertex Pharmaceuticals (NASDAQ:VRTX) has released several combination therapies that netted it about $4 billion in 2019. Proteostasis will have a tough challenge distinguishing its therapies from Vertex’s, but the reward for success is clear, especially given that Proteostasis’ current market cap is only about $90 million. In this article, I will describe how Proteostasis might be able to differentiate its products from Vertex’s and whether the risk/reward is right for an investment in the company currently based on my present value estimate.

The CF Market is a Huge Opportunity and is Still Growing

I want to start off by highlighting how big of an opportunity the CF market presents. CF is caused by mutations in genes that code for the CFTR protein that is responsible for moving chloride to the surface of cells. Normally, chloride at the cell surface attracts water, and without it, the mucus on the outside of cells can thicken and become sticky. This often leads to the lung infections and other respiratory problems that characterize CF. The market for CF therapies is already over $5 billion and is expected to hit nearly $14 billion by 2025.

Because CF is such a huge market, Proteostasis is a steal at under $100 million if it can get its treatment on the market. Again, Vertex made $4 billion on CF therapies last year, including $420 million in 2019 on a product that had just launched that year. Vertex’s therapies generally target patients with either one or two copies of the F508del mutation, but 15% of CF patients don’t have even one copy of that mutation. Given the size of the CF market, even just the 15% that is currently largely left out represents a lot of potential money if a treatment targeting it gets approved.

As I will describe in more detail below, Proteostasis is using a novel process of testing individual patients’ responses to its therapies using tissue samples prior to initiating treatment. This will hopefully allow it to help patients in that current treatment gap whose tissue samples show a treatment response. Proteostasis is undervalued currently even if that is all it could potentially target, but its therapy has a much larger potential market than that because if approved, it would likely take at least some market share from Vertex for patients with an F508del mutation.

Proteostasis is Distinguishing its Pipeline by Targeting Rare Mutations and Using Theratype not Genotype

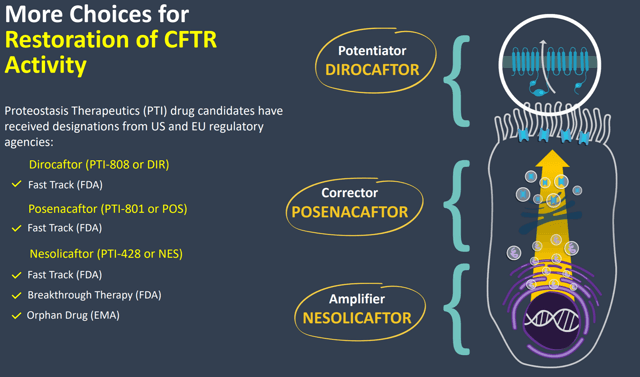

Proteostasis is developing three drugs to be used in combination to target improvement in the underlying cause of CF: PTI-801/posenacaftor, PTI-808/dirocaftor, and PTI-428/nesolicaftor. These drugs all target effects on the CFTR protein that doesn’t function properly in CF patients.

Figure 1: Diagram of Proteostasis’ CFTR Modulators (Source: Corporate presentation)

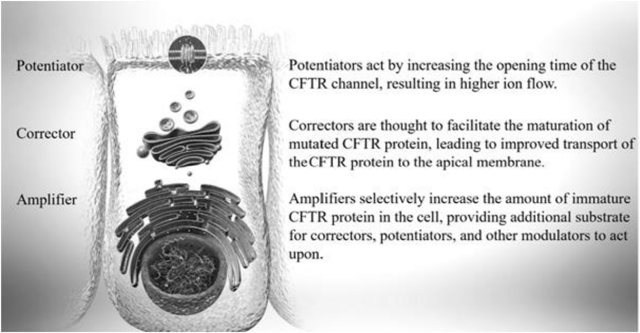

PTI-801 is a CFTR corrector, PTI-808 is a CFTR potentiator, and PTI-428 is CFTR amplifier. Potentiators have been on the market the longest and work by keeping open the CFTR protein channel for a longer period of time, allowing for a greater level of CFTR activity. Correctors were next to be approved and are supposed to correct the actual misfolding of the CFTR protein. Finally amplifiers are something that distinguishes Proteostasis’ potential treatment because Vertex did not include one in its recently approved triple combination therapy. Amplifiers help to create more CFTR protein that can then be positively affected by correctors and potentiators.

Figure 2: Chart Describing the Function of Potentiators, Correctors, and Amplifiers (source: Proteostasis’ 10-K)

Proteostasis is definitely late to the market with its triple combination compared to Vertex, so it will be incredibly important for Proteostasis to find a specific niche that will help it grab market share. That is exactly what the company seems to be doing by targeting rare mutations and using theratype screening for treatment efficacy rather than genotype. Proteostasis says that theratyping is “the process of matching individuals with therapies by their response to treatment and not their genotype.” This theratyping is a huge distinguisher from current treatments that are based mostly on mutation types rather than the patient’s actual response.

Proteostasis’ approach to accomplishing this theratyping is through the use of organoids created from rectal biopsies taken from prospective patients. These biopsies are supposedly quick and easy for the patient, and then Proteostasis is able to test whether that individual’s cells react well to the treatment. If Proteostasis’ therapies get approved, this would potentially allow the company to crack into a broader swath of the market than mutation-based therapies.

In addition to the obvious benefit to patients that might not be affected at all by current CFTR modulators, this could also lead to broader use of CFTR modulators through alleviating cost issues. Currently, access is sometimes limited to CFTR modulators because their cost is very high and mutations are not always good predictors of the actual therapeutic effect in individuals. These governments and companies in charge of approving payment for healthcare treatments that are currently skeptical whether the current cost is worth it would probably be more likely to accept use of CFTR modulators when a test on the patient’s own cells had already demonstrated efficacy.

In December 2019, the company announced top-line results from its Phase 2 clinical trial assessing the combination over a four-week period. Based on these results, Proteostasis’ triple combination stacks up ok with Vertex’s in terms of efficacy, but the data was somewhat underwhelming which resulted in a big sell-off of the company’s stock.

Figure 3: Proteostasis Stock Chart (Source: finviz)

Figure 3: Proteostasis Stock Chart (Source: finviz)

After digging into the data, there appeared to be some bright spots though that give me confidence that Proteostasis will be able to get its triple combination to the market. Again, I don’t think Proteostasis has to show data overwhelmingly better than Vertex’s triple combination for Proteostasis to still be undervalued. First though a quick look at the underwhelming part of the data is needed. Vertex’s triple combination showed about a 10% increase in FEV1, a common measure of lung function, compared to placebo, while Proteostasis’ only showed an 8% increase. Also, the FEV1 change from placebo did not reach statistical significance in the subgroup of patients that only had one copy of the mutated F508del gene. This is important because a big part of Proteostasis’ value proposition is a potential treatment effect independent of the F508del gene mutation (heterozygous), so it’s concerning to see stronger results in the population with two copies of the mutated gene (homozygous).

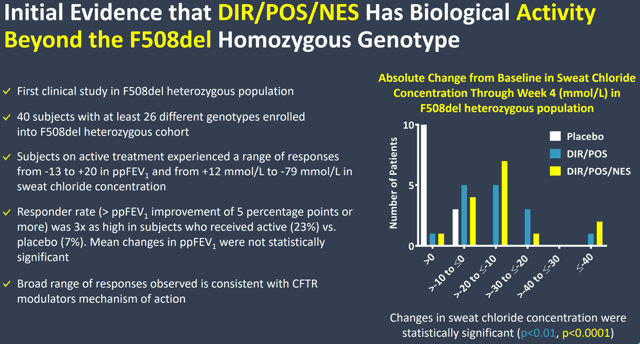

Despite not reaching statistical significance on that measure, Proteostasis’ triple combination did show some promising activity in heterozygous patients.

Figure 4: Chart Detailing Evidence of Effect Beyond Just Homozygous Patients (Source: Corporate presentation)

Reductions in sweat chloride levels are another indicator used to tell if CFTR modulators are working, and as you can see in Figure 4, changes in sweat chloride were statistically significant for the heterozygous patients and show substantial improvement versus placebo. Because statistical significance can sometimes be tough to achieve in trials with a small number of patients like this one with just 16 in each arm, seeing a significant treatment effect on sweat chloride levels limits my concern over the non-significant FEV1 measures. It’s also worth noting that both the sweat chloride and FEV1 measures were only secondary endpoints for the Phase 2 trial.

Additionally, this Phase 2 trial showed 12% improvement in FEV1 over baseline in patients who had already unsuccessfully used other CFTR modulators. This result in particular supports Proteostasis’ idea that its treatment fills a gap left by currently approved CFTR modulators. In sum, the Phase 2 results could certainly have been better, but to me they don’t raise a huge red flag over whether Proteostasis’ triple combination will ever receive approval.

Proteostasis is also hopefully stacking the deck towards success for its Phase 3 European trial because they will be theratyping first to qualify patients before enrolling them in the actual trial. Proteostasis already has over 500 rectal biopsies to test, and the company hopes to start the actual patient trial in the second half of this year. This Phase 3 trial is in partnership with the HIT-CF consortium which is providing some funding for the trial in addition to the biopsies I just mentioned.

This timing hopefully means that Proteostasis could be reading out data from this European Phase 3 in late 2021 and then file an MAA for approval in Europe in 2022. As far as the US goes, Proteostasis’ first quarter business update just says that it will talk to regulators throughout this year. I would certainly hope that these discussions lead to a Phase 3 trial being initiated early next year, leading to a potential PDUFA and launch by 2023.

If Proteostasis does have any substantial delay with US regulators, that could lead to further losses for the stock, and it certainly bears mentioning that the company’s triple combination therapy might never receive approval anywhere which almost certainly leads to heavy losses for shareholders.

Proteostasis has a Decent Balance Sheet and a Helpful Development Partner

Proteostasis’ balance sheet is in decent shape, but I think it’s pretty clear the company will need to raise a substantial amount of additional cash before it could ever get its triple combination therapy onto the market. At the end of the first quarter, Proteostasis reported having about $60 million in current assets versus only about $8 million in current liabilities, with no long-term debt. These first-quarter numbers also show a $10 million loss which would annualize to about $40 million.

This cash burn rate implies a cash runway into mid-2021, so it would certainly not be a surprise to see Proteostasis raising cash sometime later this year. The lack of long-term debt is a plus though because the company might be able to meet some of its future cash needs through a non-dilutive credit facility. The HIT-CF consortium is also providing a lot of funding for the upcoming European Phase 3 trial which will certainly help Proteostasis make its funding last as well.

Proteostasis Looks Undervalued Despite Lacking a Marketed Therapy

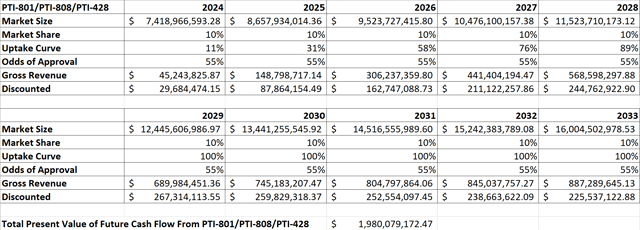

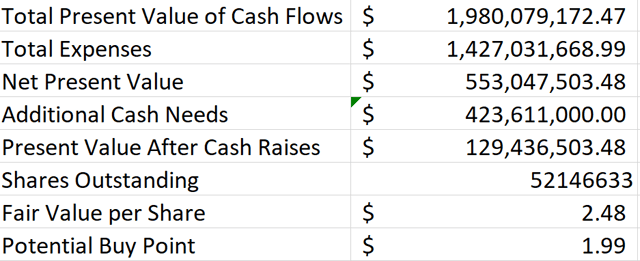

I attempted to model Proteostasis’ present value using very conservative assumptions given that it has no approved therapy at this point. First, I created a model that looked at discounted cash flows assuming that Proteostasis is only ever able to achieve 10% of the current revenue that Vertex’s CF therapies generated in 2019, scaled up to account for overall market growth each year. I also operated on the assumption that Proteostasis might not be able to get its therapy on the market until 2024 which is hopefully later than what it will really achieve if successful.

Figure 5: Discounted Cash Flow Analysis Assuming Proteostasis Can Gain Market Share Equivalent to 10% of Vertex’s Current CF Revenue (Source: Proteostasis’ 10-K and 10-Q and my calculations based on them)

Given that Proteostasis is targeting rare mutation combinations not addressed by Vertex’s therapies in addition to those that are, modeling Proteostasis to only ever gain 10% of Vertex’s current market share seems extremely conservative if Proteostasis can get its triple combination therapy approved. I factored in estimated R&D costs for the next several years, and I estimated SG&A and marketing expenses at 35% and 5% of gross product revenues respectively. I also factored in the potential for the company to raise a substantial amount of additional cash which I view as likely to occur.

As you can see from Figure 5, even with what I consider overly conservative assumptions of peak market share, launch timing, expenses, and cash burn, Proteostasis’ shares appear undervalued at their current price under $2. I also ran the model with all of the same inputs except changing the peak market share to 10% of the total CF market rather than just Vertex’s current share. That model shows a fair value estimate of $17.31, making clear the potential upside if Proteostasis is successful in bringing its triple combination therapy to market.

Conclusion

Proteostasis is an interesting clinical-stage company developing a much-needed therapy for treating patients with rare types of CF who currently do not have a great treatment option. Although I estimate the odds of approval as little better than a coin flip at this point – about 55% – the substantial size of the CF market makes an investment in Proteostasis attractive. Obviously a Phase 3 failure could make such an investment lose most or all of its value as could significant delays in getting the drug to market. However, I view Proteostasis as presenting a good risk/reward ratio under $2 where it is trading currently.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor the timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself without notification. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance as financial circumstances are individualized.