This post was originally published on this site

Shares of Peloton Interactive Inc. extended their plunge toward a 21-month low Friday, after Nasdaq said it was booting the at-home fitness company from its Nasdaq-100 Index just 13 months after it was added.

The stock

PTON,

sank 5.3% in afternoon trading, putting it on track for the lowest close since April 2020.

Nasdaq said late Thursday that Peloton will be replaced in the Nasdaq-100 by trucking company Old Dominion Freight Line Inc.

ODFL,

before the Jan. 24 opening bell.

Old Dominion’s stock fell 2.0% on Friday, but has soared about 50% over the past 12 months, to lift its market capitalization to about $35.9 billion from about $24.3 billion last year, according to FactSet data.

The Nasdaq-100

NDX,

is composed of the 100 largest nonfinancial companies by market cap that are listed on the Nasdaq exchange. Peloton currently has the lowest market cap in the index at $10.05 billion, or nearly half the next-lowest market cap, which is Splunk Inc.’s

SPLK,

$19.04 billion.

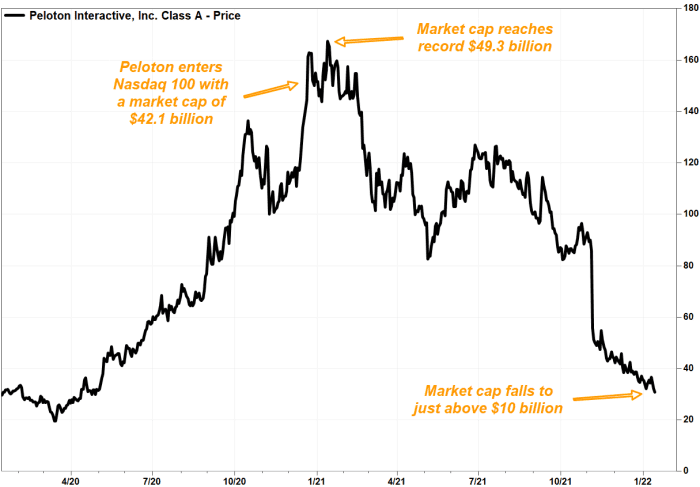

Peloton was one of Wall Street’s hottest post-pandemic plays in 2020, as gym closures sparked a “work-in” boom. From the March 2020 closing low of $19.51, which was hit the day after the World Health Organization declared the COVID-19 outbreak a pandemic, through Dec. 21, 2020, which was Peloton’s first day as a Nasdaq-100 component, the stock had skyrocketed 640%.

FactSet, MarketWatch

Peloton’s market cap on Dec. 21, 2020 was $42.1 billion. The stock rose even further to reach a record $167.42 on Jan. 13, 2021, for a market cap of $49.3 billion, as daily average of COVID-19 cases surged to what was then record levels.

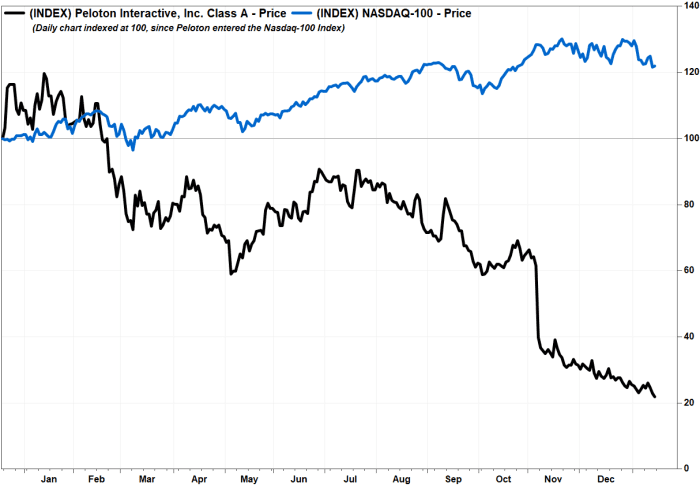

Peloton’s fall from grace since then as been nothing short of stunning. The stock has now plummeted 79% since it entered the Nasdaq-100, wiping away about $32 billion in market cap, even as daily COVID-19 cases are now more than triple the January 2021 record. Read MarketWatch’s daily “Coronavirus Update” column.

Don’t miss: Peloton stock keeps falling as J.P. Morgan analyst slashed price target, but remains bullish.

Also read: Peloton stock is a buy, but with an ‘asterisk’, analyst says.

FactSet, MarketWatch

Here’s how the shares of the other companies that entered the Nasdaq-100 at the same time as Peloton have performed since then, and their current market caps:

-

American Electric Power Co. Inc.

AEP,

+0.08%

— rallied 10.7%, $45.80 billion. -

Atlassian Corp. PLC

TEAM,

-2.29%

— climbed 15.7%, $72.55 billion. -

Marvell Technology Group Ltd.

MRVL,

+3.41%

— soared 71.0%, $68.17 billion. -

Match Group Inc.

MTCH,

-2.31%

— dropped 22.7%, $33.75 billion. -

Okta Inc.

OKTA,

-0.43%

— slid 28.1%, $30.80 billion.

The Nasdaq-100 has gained 21.8% over the same time, while the S&P 500 index

SPX,

has advanced 25.1%.

Meanwhile, Truist analysts Michael Swartz and Youssef Squali said Friday that they remain high on the at-home fitness trend, and believe Peloton will be a “prime” beneficiary.

The analysts said a recent survey of about 1,400 adults showed that despite widespread gym re-openings and vaccine availability, there hasn’t been a corresponding reduction in at-home exercise interest or participation.

“This reinforces out belief that habitual changes made over the past 22 months will ultimately yield a structurally larger at-home fitness TAM [total addressable market],” the analysts wrote in a note to clients. “For [Peloton], we’re starting to warm up to the name again on the back of several positive takeaways from this survey, although we believe it’s too early to turn constructive on the name given near-term performance uncertainty.”

Truist has rated Peloton at hold since Nov. 5, 2021, after being at buy for the two years prior. The company went public in September 2019, at an initial public offering price of $29.

The stock had suffered a record 35.4% plunge on Nov. 5, 2021, after Peloton had reported a wider-than-expected fiscal first-quarter loss and revenue that came up short of forecasts, with Chief Financial Officer Jill Woodworth admitting the impact of reopening was “underestimated.”

The company’s next earnings report is projected to be released in early February.