This post was originally published on this site

With winter looming, a global energy crunch has sent prices soaring worldwide. In Europe, natural gas prices hit a record in early October, with some contracts for future delivery surging to four times their normal price. The problem? Too much demand and too little supply, a formula that spells higher prices for energy consumers worldwide, including U.S. businesses and families.

Volatile energy markets and supply crunches are nothing new, of course. We’ve seen this many times before. What is new is the current Biden administration and Congressional effort – driven by climate change – to overhaul the country’s energy and power systems.

As policymakers at both the federal and state level evaluate their options, it is more important than ever that they focus on long-term, durable solutions like competitive markets.

In a recent Executive Order, President Biden underscored the importance of competition by noting that “excessive market concentration threatens basic economic liberties, democratic accountability” as well as the welfare of consumers. While the president wasn’t focusing on energy in his order, the principles that he cites are just as applicable to the electric power industry and its customers. And so at the federal level, the Energy Department and Federal Energy Regulatory Commission should encourage competition by ensuring that energy investors and stakeholders have greater flexibility to construct, retain or expand any fuel resource for power generation.

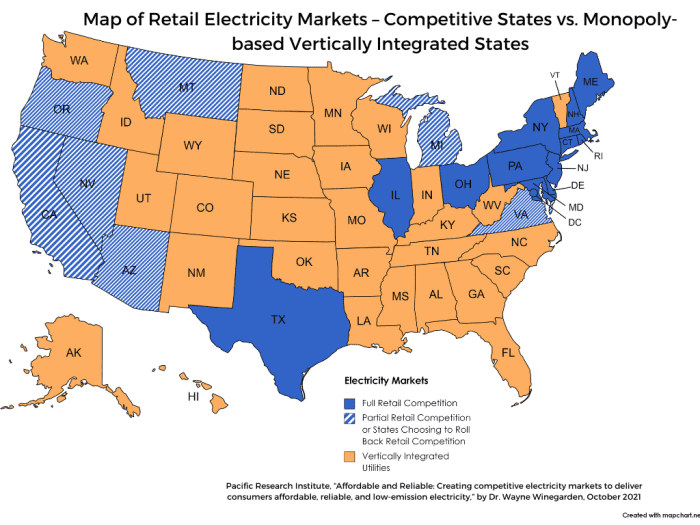

Unfortunately, millions of Americans still buy their power from monopoly suppliers, with no competition to ensure that customers are offered the best services and prices.

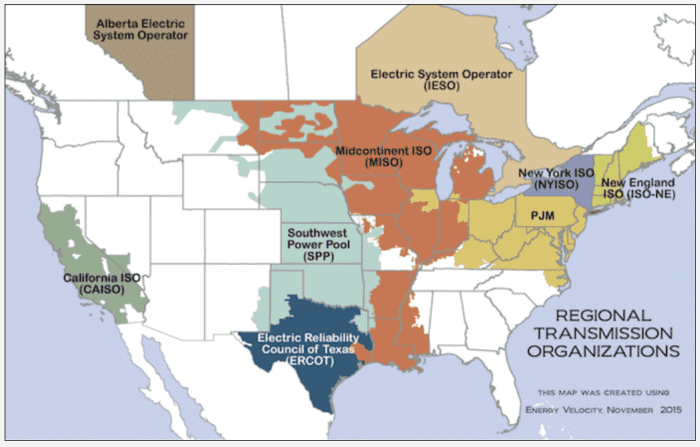

So states in monopoly-based systems – primarily in the Southeast and West – should, at a minimum, enact legislation similar to a bill passed recently in Oregon. That bill mandated a report on the benefits, opportunities and challenges of developing or expanding a regional transmission organization (RTO), which is a necessary component of a competitive market.

Many expect that the state report will outline results consistent with a Energy Department study in June that found that an RTO could save the West $2 billion yearly by 2030.

“The 37 states with monopoly or partial competition models saw power prices rise 20.7% from 2008 to 2020, while the 14 jurisdictions with retail electricity competition saw prices decline 0.3%.”

We know that competition works, with years of data showing that competitive wholesale and retail electricity markets provide more affordable energy prices and reliable service. Those competitive markets also help to reduce carbon emissions by fostering innovation and attracting investment in renewable energy sources.

According to a new report written by Pacific Research Institute senior fellow Wayne Winegarden, states with competitive retail electricity markets have had lower prices than states with monopolies. From 2008 to 2020, for instance, the 37 states with monopoly or partial competition models saw power prices rise 20.7%, while the 14 jurisdictions (13 states and the District of Columbia) with retail electricity competition saw prices decline 0.3%.

With the price of natural gas rising to its highest level since 2008, competition could be the difference in limiting future impacts to consumers’ pocketbooks.

Competition can also be a difference maker when it comes to climate change. In a June 2021 letter, nine former FERC commissioners endorsed wholesale competitive markets, noting that 80% of renewable generation in the U.S. has been deployed into these markets. This is one reason why federal data from 2008 to 2018 shows emissions in competitive states down 12.1%, compared with just 7.3% in monopoly states.

Within PJM, the competitive wholesale electricity market that comprises all or part of 14 states in the Mid-Atlantic and Midwest, data shows that emissions went down 39% during the same period.

Reliability should also be a key factor for electricity market design. In competitive electricity markets governed by an RTO – such as PJM – power producers pool their energy resources and have them redistributed to where it is most needed. This means that providers are able to share and dispatch the lowest-cost electricity for their customers, even several states away.

Recognizing that competitive wholesale markets reinforce reliability while continuing to drive prices down, lawmakers in Colorado and Nevada recently passed laws requiring their states to join RTOs by 2030.

As policymakers at all levels of government grapple with the global energy crunch and look for ways to transition to a lower-carbon energy grid, they need to focus on market-based solutions.

We’ve already seen that competition is the best way to achieve the energy future that customers want – one that fosters innovation, combats climate change, promotes reliability, and drives down prices. Competitive markets – not monopolies – should be the path forward.

Jeffrey Kupfer, a former acting deputy secretary of energy in the George W. Bush administration, is an adjunct professor of policy at Carnegie Mellon University’s Heinz College.