This post was originally published on this site

U.S. Federal Reserve Chair Jerome Powell’s recent testimony prompted investors to revisit many of their assumptions about the market. Investor soul-searching has revealed at least one truth—the IPO bubble is finally bursting. As the era of easy money looks to be coming to an end, we are beginning to witness the simultaneous end of the “duration trade,” in which investors bet on profits that will come very, very far out in the future.

While 2021 was a fantastic year in terms of the number of initial public offerings—which is up around 80%—it was quite the opposite for actual IPO stock performance. At this moment, roughly 60% of all 2021 U.S. IPOs have already busted—traded below the IPO listing price—and many of these broken IPOs have even further to fall.

Many investors in these 2021 IPOs knew they were holding unprofitable companies that had no proven path to profitability. But investor excitement for new IPOs that promised high growth allowed bankers and the companies going public to get greedy. After all, a higher listing price means more money for the company going public, for private investors selling out on the deal, and for the underwriting banks gathering fees.

Since Powell stated that tapering may come sooner than many had hoped, the same investors are now scrambling to make sure they are not the ones left standing when the music stops. They have reason to be fearful. While many 2021 IPOs have already fallen significantly, they are nowhere near a valuation floor and could go down quite a bit more.

There are some companies in this IPO bubble that do have solid business models with promising growth prospects and a proven ability to generate profits. But some of these companies were initially priced too high and had listing prices that reflected expectations for future growth that were aggressive and not very realistic. LegalZoom

LZ,

is a good example of this kind of IPO, with its initial pricing at $28, about 70% higher than the current quote.

MarketWatch

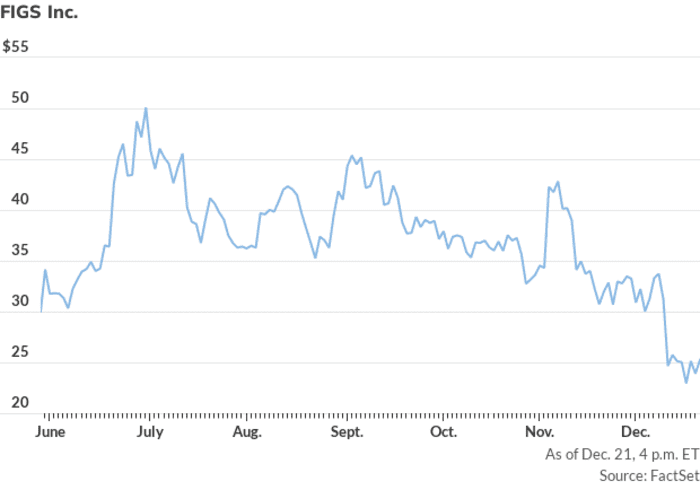

Other IPOs soared too fast and too high out of the gate, leaving them susceptible to big corrections. Figs

FIGS,

is a good example of this type of IPO. Figs priced at $22 in May and hit $50 the next month. Now it’s almost all the way back to its listing price. Whether through initial pricing that is too high or irrational exuberance in the early weeks of trading, there are quite a few decent businesses that got set up for an eventual bust.

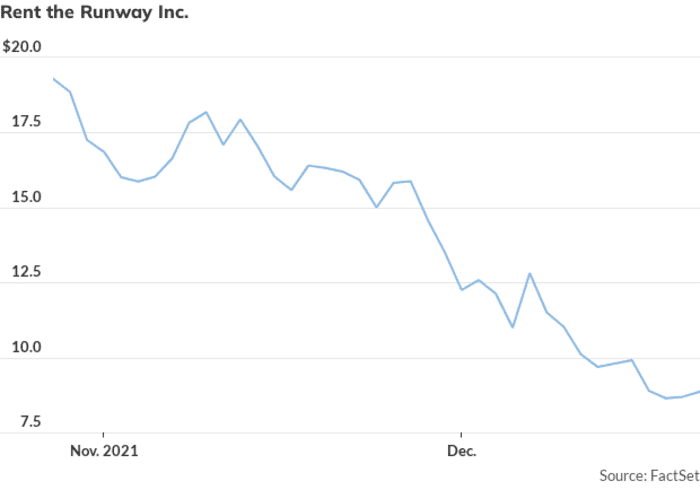

Of course, there are also the companies that lose money presently, have no clear path to profitability, and historically bumpy growth trajectories. Rent the Runway

RENT,

Sweetgreen

SG,

Oatly

OTLY,

and ThredUp

TDUP,

are prime examples of this kind of 2021 IPO.

MarketWatch

Rent the Runway in particular is emblematic of the bust trend, as it is already down almost 60% since it went public less than two months ago.

Some may say that this type of IPO bust is nothing out of the ordinary. And while it is true that many public companies inevitably trade below their listing price in the years after they IPO, the concern now is not just the bust itself but the speed at which IPOs are busting.

Recent Dealogic data show 495 of the 43 IPOs that raised $1 billion or more this year in London, Hong Kong, India, and New York are trading below their issuance prices. By comparison, among large IPOs that listed in 2019, about 33% were below issuance price a year after hitting the market, while 27% of those priced in 2020 were in the red after 12 months of trading.

Smaller IPOs have fared worse. Through Dec. 7, Renaissance Capital reports that only 41% of U.S. IPOs are trading above their listing price.

There is no denying it: these deals are busting faster than normal. There is still hope for the traditionally “good” companies like LegalZoom and Figs that were simply overvalued. With enough time, they can grow into their peak valuations and recover the recent drops.

The bad news is, even with big pullbacks, for many of the overvalued 2021 IPOs, we are not even close to a rock-bottom valuation yet, so it could be a bumpy ride for some time.

For many companies with unproven business models that are still searching for a path to profitability, even time can’t save them. These companies always relied on the hopes and creative scenarios concocted by investors. With Powell throwing cold water on some of these hopes and dreams, it is not too late to short them.

On top of stock market losses, this bubble burst will have long-lasting impacts on the IPO market and all the players involved.

Problems may be first to strike in the consumer sector, where the Class of 2021 IPOs are performing particularly badly. Underwriting banks will increasingly face challenges pushing out new consumer IPOs for companies that have questionable profit histories and simultaneously high valuations. This should inevitably cause a significant slowdown in the amount of activity in 2022. The bar for companies going public is about to be significantly raised.

Berna Barshay is an editor at Empire Financial Research