This post was originally published on this site

The growing use of payment for order flow in U.S. equity markets may be increasing volatility and costs for all investors by moving a greater share of money from exchanges to market makers.

Payment for order flow, or PFOF, drives some commission-free brokers’ orders to off-exchange market makers including Citadel and Virtu rather than traditional exchanges. Last year the 12 largest U.S. brokerage firms earned a combined $3.8 billion from PFOF, up 33% from 2020, according to information compiled by Bloomberg Intelligence released Feb. 1.

This marked shift should not be underestimated. Gary Gensler, chairman of the Securities and Exchange Commission (SEC), said in a speech in June 2021 that “[i]n January, nearly half of the trading interest in the equity market either is in dark pools or is internalized by wholesalers.”

Instant profits

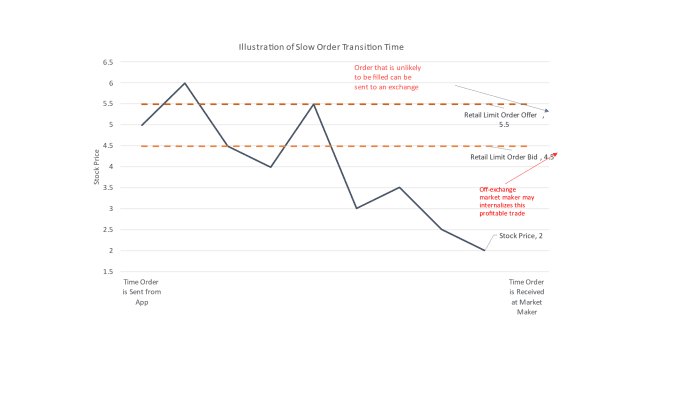

Orders from commission-free brokers have comparatively slow transmission times, making them attractive for off-exchange market makers. The longer it takes for orders to reach market makers, the greater the likelihood that prices move. As a result, there is a bigger opportunity for market makers to book an instant profit.

Due to PFOF, the popular trading app Robinhood

HOOD,

routes roughly 40% of its trades through only three places, all off-exchange market makers. Citadel alone executes 25% of the daily volume of U.S.-listed equity options and 28% of U.S. retail equity trades.

Due to PFOF, an investor who places a limit order on a trending stock or option may find themselves chasing the market or paying more. Limit orders can only be executed at, or better than, a specified price. The orders, like market makers’ bid/ask spreads, provide liquidity to other investors who look to buy or sell at the best available price called “market orders.”

Off-exchange market makers use high-speed-trading technology to execute orders in real time. When the market moves before a limit order arrives at an off-exchange market maker, the market maker is able to execute on that profitable limit order and send orders that have moved further from the market to an exchange. The market makers are allowed to put these winning positions on their own books in a process known as “internalizing.”

In the example above, the off-exchange market maker will internalize the customer’s limit bid at an instant profit and send the limit offer to an exchange where the investor will have to wait for the market to rise again before execution or replace the order with a lower limit price.

Order imbalances

Combined with trading algorithms, this practice may result in more artificial order imbalances and higher volatility for investors. For example, in a stock trending down due to unfavorable news, off-exchange market makers might repeatedly internalize profitable trades in a stock while passing unprofitable orders on to the exchanges. This may cause unfilled sell orders to build behind a falling stock, while limit buy orders, having been internalized, are not available to investors looking to exit. That drives down the price artificially.

Commission-free brokers know that slow order transmission can affect their customers, but with PFOF they have no incentive to prioritize speed. With nearly all their revenue coming from PFOF, they may well have an incentive to ensure slow transmission times.

For example, there are a few indicators that Robinhood has ignored its relatively slow transition times. Despite having founders who previously managed a high-frequency-trading hedge fund and started a firm that sold high-frequency-trading software, reports suggest Robinhood’s apps are noticeably slow, resulting in poor execution for their customers.

New entrants

The problem may get worse. When market structure enables insiders to profit at the expense of retail investors, it often attracts new entrants. Other alternative trading systems are moving into the U.S. retail market, including a recent announcement from Jump Trading, and Revolut recently announced it is offering commission-free trading using PFOF.

While this problem continues to grow, the U.S. seems reluctant to ban PFOF even when studies show individual investors often have higher all-in costs with commission-free brokers rather than traditional brokerage accounts.

In contrast, payment for order flow is forbidden in the U.K. In November 2021, the European Union made a formal proposal to ban it.

Commenting on a potential SEC ban on PFOF, Citadel’s Ken Griffin said at the Economics Club of Chicago on Oct. 4: “Payment for order flow is a cost to me. So, if you’re going to tell me that by regulatory fiat that one of my major items expense disappears, I’m OK with that.”

His statement assumes these trades would be routed to Citadel without such payments, which seems unlikely.

When it comes to eliminating their information advantage due to slow data transmission, these market makers become openly defensive. When the SEC approved IEX’s “D Limit” order type, which was designed to give investors a way to buy or sell stocks at the exchange while protecting investors against unfavorable price moves (stale orders) due to slower data transmission times, Citadel objected and sued the SEC.

The history of firms taking advantage of retail investors raises additional red flags:

- One commission-free broker settled SEC charges that it failed to disclose that it sells order flow to high-frequency trading firms; and was fined by FINRA for failure to ensure customer orders were filled at the best price.

- One leading market maker was fined by FINRA for intentionally delaying customer order executions and by the SEC for misleading customers on pricing.

Regulators need to ask:

- Is the U.S. market structure, including PFOF, which allows slow transmission retail orders to be routed (for a fee) to high-speed-trading firms, impacting the costs for all U.S. investors?

- If so, given the checkered past of industry breaches in transparency and best execution, should regulators ensure slow retail order transmission is not intentionally built in to increase profits for both commission-free brokers and off-exchange market makers?

Regulators such as the SEC, FINRA and state securities administrators should use their powers to access data from exchanges, commission-free brokers and market makers.

Today’s forensic market experts are well-prepared to use this data to analyze and answer these important questions. No matter what final decisions regulators make, the results of these inquiries would help bring back needed investor confidence in U.S. markets.

Tom Glynn is the former CEO of DEPFA Bank PLC and a former board member in charge of capital markets and asset management for Hypo Real Estate Bank AG. John Padrnos is the founder of Devon Capital Advisors Ltd. and a former counsel for Bankers Trust Co. Both are members of the leadership team at Devon Capital Advisors.