This post was originally published on this site

We constantly look for opportunities to add high-quality companies to our portfolios at attractive prices. Omnicom (OMC) offers impressive quality with profitability and return on investment that are remarkably steady through cycles and industry transformations alike. The market punished the company’s stock price in February and March this year as the COVID-19 crisis intensified, and it has stayed down about 35% for the year despite the overall market largely recovering. Investors may be concerned about a temporary COVID-19 related drop in ad spend, but the value of the company is determined by its long-term ability to produce cash flows, and that will not be materially affected by a year of weak ad spend. The market is also likely over-concerned about lower recent growth and transformation in the advertisement space, leaving an excellent value proposition in Omnicom shares for long-term investors.

Company info and evidence of quality

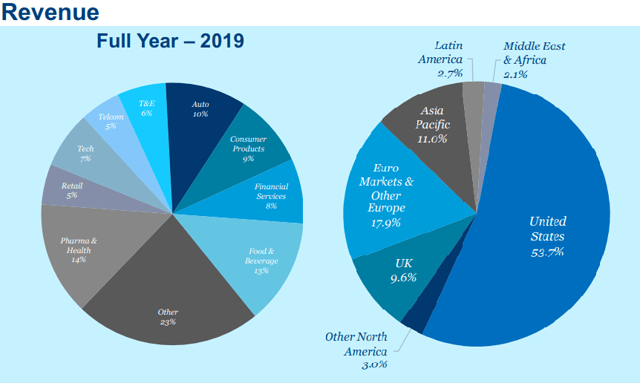

Omnicom is a global leader in marketing communications with over 5,000 clients in more than 100 countries. The company is the second-largest in its industry (by revenue) where the top 5 companies dominate the market. WPP (WPP), Interpublic Group (IPG), Publicis (OTCQX:PUBGY) and Dentsu (OTCPK:DNTUF) round out the group. Omnicom’s scale and diversification across end markets and geographies make it one of the few ad companies able to fully service large global clients.

Source: Omnicom Fourth Quarter 2019 Results Presentation

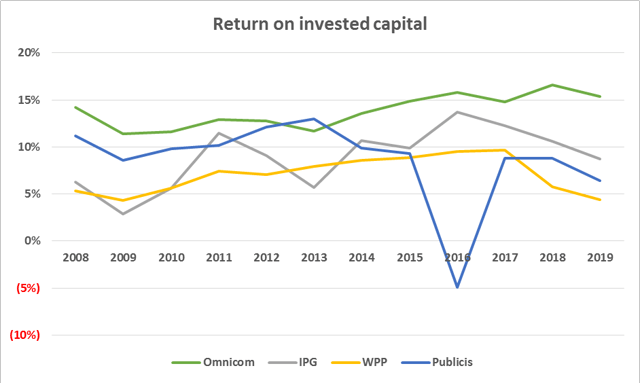

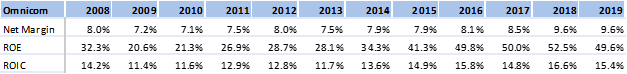

It’s informative to view the company’s general profile and important to recognize the advantaged industry positioning, but perhaps more interesting is the resulting proof of quality demonstrated by Omnicom’s financial performance over time. We partially view quality through the lens of return on equity and invested capital, with both absolute levels and consistency being critical. The graphic below offers a high-level view into the impressive quality of Omnicom.

Source: Refinitiv

Omnicom’s value creation is even more impressive when viewed in relation to that of its close peers. Note that not only the level of value creation, but also its consistency over time is clearly superior.

So why aren’t investors more excited about Omnicom?

Ignoring COVID-19 for now, let’s look at a number of longer-term concerns skeptics have for Omnicom. The most cited is the transformation of the ad industry to digital media and advertising. The story goes that traditional ad sales related to TV, print, radio and other legacy media formats are now losing out to digital sales and so ad companies active in the legacy business will somehow crumble and fail. But when we look at industry dynamics and what is actually happening at Omnicom, this simple conclusion seems to miss the mark. It’s clear that industry transformations often result in the need for increased investment and strategic adjustment, but that doesn’t need to be a long-term negative for incumbents. When we evaluate the ad industry structure, we actually see the transition to digital media benefiting companies like Omnicom in the long term, assuming they are adapting effectively.

The view that a digital transformation in the advertising space is detrimental to Omnicom ignores the following key points:

- Omnicom clients are often large global organizations that use an array of media formats and want a one-stop shop for advertising needs, including legacy formats that are not disappearing overnight. A new ad-industry participant offering digital ad services cannot easily take clients from Omnicom. Fortune 500 type companies need multichannel marketing solutions that smaller players simply can’t offer, even if the market is transitioning to their area of focus. These larger clients want to simplify and coordinate campaign design and implementation (which also reduces costs), which means they want to minimize the number of agencies they work with while still covering all media formats and aspects in the space. That may even include public relations and other services few smaller firms can offer effectively. The big five remain essentially the only companies that can provide the complete advertising solutions that large clients need around the world despite growth in digital media and digital ad platforms.

- Omnicom is not standing still. Omnicom has organically developed digital expertise or acquired various smaller agencies that focus on the growing digital advertising niche. Omnicom’s purchase of Smart Digital is just one example. The transition is not happening overnight, and Omnicom is actively adjusting to developing client needs, making the company perfectly capable of offering a complete suite of solutions to larger clients, which is ultimately exactly what they want. It does take investment and strategic awareness, but Omnicom is on the move. The company launched Omni, its data analytics platform that can be leveraged across its agencies, which more recently includes Q, the first of its kind SaaS platform that combines human and AI-powered intelligence to help organizations predict change before it disrupts their business. Omnicom’s various agencies consistently win awards as the industry’s most creative and innovative, providing third-party recognition for a competitive offering in today’s transforming ad industry – and several awards to begin 2020 are promising for the years ahead.

- Google (GOOG) (NASDAQ:GOOGL), Facebook (FB) and now perhaps Amazon (AMZN) are not going to put Omnicom out of business. There is some friction around adtech and data ownership, but these companies aren’t even really competition, and are often more like partners. Omnicom provides the advertising, branding and communications strategy and services for many of the world’s largest companies. Google and Facebook (and digital ads in general) really just represent another advertising medium that Omnicom’s clients need. Google and Facebook are not replacing Omnicom, they are replacing legacy advertising formats like TV, newspapers and billboards. Omnicom integrates areas such as content creation, data analytics, market research, creativity, crisis management and distribution, much of which Google and Facebook don’t do and likely won’t be trusted to take over in the future. The tools available from companies like Google and Facebook will allow some smaller businesses to in-source the process, but smaller companies are not Omnicom’s target customer. In the end, it’s hard to argue with Omnicom’s customer retention rates near 95% despite Google and Facebook being the digital ad kings for many years.

Low growth and other elements of the bear case

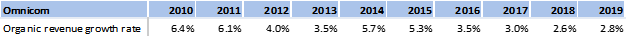

For all the doom and gloom and dire predictions about the large ad agencies, we just don’t see reason to panic in Omnicom’s performance. Recent organic growth hasn’t perhaps been stellar in recent years when compared to more distant history, but it has been reasonable even if reflecting some of the current industry headwinds. It’s interesting to note that currency fluctuations and divestments have often pushed the overall revenue growth rate in recent years below that of the organic growth rate as the company has subtly transformed its business model to fit its changing industry, perhaps resulting in many investors penalizing the company undeservedly for weak revenue figures. Our strategy is simply not to pay for much growth, leaving the prospect for a return to mid-single digit revenue gains as a potential source of substantial upside.

Source: Omnicom Annual Reports

It may very well be that the bear case against ad agencies is overblown. Digital transformation is moving in quickly, but it does not eliminate the need for creativity, and ad agencies have a solid track record over decades of adapting to changing media formats and client needs. We view the change as more of an opportunity for rebirth rather than hopeless destruction. As Omnicom CEO John Wren phrases it, “While data and analytics remain a top investment priority for us, we understand that data can only take us so far. It is our IP, our creativity that truly sets us apart. It is creativity and innovation, informed by data and analytics that will drive the most meaningful business results.” The future is still creativity, creativity powered by automation and technology.

The need for creativity and content creation, supported by employees with the associated talent and company culture, is also a reason why encroachment by large technology consultants might be kept at bay. There has long been a concern that technology consultancies such as Accenture (ACN), PwC and Deloitte are ready to pounce on ad agencies. Both technology consultancies and ad agencies have been acquiring businesses in the gray zone between their respective core businesses, but large clients are reluctant to give creative work over to a technology consultant. And it’s unlikely that technology consultants can easily create a culture of creativity backed by a talented array of content producing employees. Technology consultants have also been kept at bay by the traditional ad agencies themselves as they have aggressively added to their own technology expertise. In the meantime, technology consultants seem to have no interest in the non-digital services that are still required by ad agency clients. We do see technology consultancies as a threat to be wary of, but also as an opportunity. What better way would Accenture have to enter the ad agency business than to buy Omnicom trading at below 10x 2021 earnings estimates?

COVID-19 is just a temporary setback

2020 is not going to be an easy year for ad agencies. Omnicom recently reported its first-quarter 2020 results, which largely finished before COVID-19 had an impact. The company actually had respectable organic growth of approximately 3% through the end of February before weakness in March brought the quarter total down close to zero. The rest of the year will likely be exceptionally weak with revenue dropping substantially despite continued strength in areas such as healthcare. Consequently, Omnicom is aligning its cost structure as it digs in for what will likely be a few tough quarters. Even if companies aren’t affected directly by the COVID-19 related shutdowns, economic uncertainty will lead to cuts in advertising budgets while spending on large event promotion may be dismal in the near term.

But investors need to keep in mind that a few challenging quarters have essentially no impact on the valuation of a company like Omnicom that should be creating value and producing cash for many years to come. When the COVID-19 crisis passes, companies will need to advertise. In fact, many are already working with Omnicom to refresh their creative message during these unique times. And keep in mind, Omnicom is quite effective at adjusting its cost base when necessary, as demonstrated by the profitability metrics presented earlier, which include the 2009 financial crisis.

To give you some idea how immaterial one year of grim results are to the valuation of Omnicom, we dropped earnings per share for 2020 to zero, a scenario that is perhaps unrealistically negative, but the fair value only dropped by about 3% in our model.

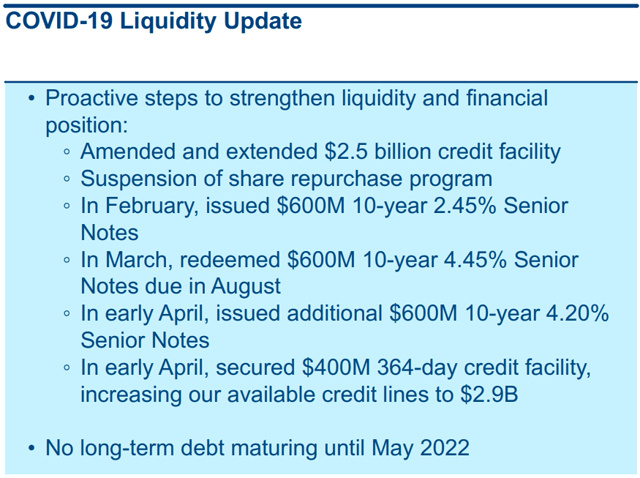

Omnicom’s financial position is strong

Another topic that often comes up around COVID-19 discussions is the financial position of companies and whether or not they will be able to survive the crisis. We have no concerns in the case of Omnicom. The company has already taken several steps to further strengthen its balance sheet as can be seen in the slide below. Some key points are certainly that the company has no long-term debt maturing until May 2022 and that newly issued debt comes with very reasonable interest rates. Don’t forget, Omnicom is also skilled at maintaining profitability and substantial free cash flow through even the deepest recessions.

Source: Omnicom First Quarter 2020 Results Presentation

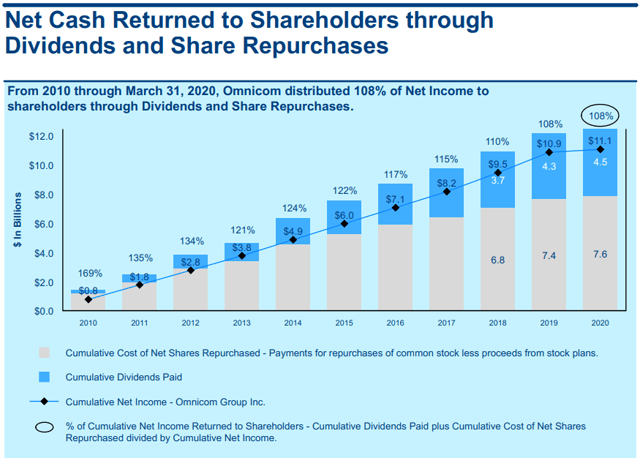

Shareholder-friendly capital allocation decisions

Cash returns to shareholders have long been impressive at Omnicom. We think the below chart sums up the situation nicely, and besides a possible short-term COVID-19 dip, see no reason why impressive returns shouldn’t continue going forward.

Source: Omnicom First Quarter 2020 Results Presentation

Omnicom’s valuation is attractive

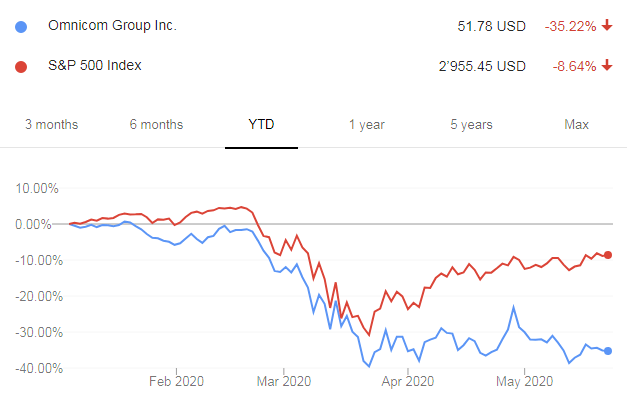

The S&P 500 (SPY) has been on a wild ride so far in 2020. At one point in time, the index was down over 30%, but is now down only about 8.5%, and is actually positive when looked at over the past 52 weeks. Omnicom, on the other hand, dropped steeply in February and March with the market, and then stayed down as the market recovered. The stock is down about 35% year-to-date and over the past 52 weeks, vastly underperforming the market.

Source: Google Finance

The result, from our perspective, is an overvalued market and an undervalued Omnicom. Our own modeling, which assumes a rough 2020 followed by 2% revenue growth and margins in-line with historical averages, puts the fair value around $90. We note that Morningstar has a fair value estimate of $79.

If we instead take the average organic revenue growth rate of the last ten years of about 4.3% (after a rough COVID-19 impacted 2020), the estimated fair value jumps to $112, demonstrating the potential upside of a realistic bull case.

We conclude that Omnicom is a quality opportunity

Omnicom is an exceptional company when it comes to the level and consistency of return on invested capital. Return on equity is even more impressive as the company employs a reasonable amount of leverage for a company that is so reliably profitable and cash-flow productive. The bear case against Omnicom has been misunderstood and wide-ranging for many years, with listed threats including attacks from Google and Facebook as well as technology consultants, but Omnicom has refused to buckle and has consistently provided reasonable organic growth over the past decade while improving margins. The company has subtly transformed its business and added competitive technology, the effectiveness of which is evident in recent additions to its trophy case. The company’s financial position is solid, and it has shored up the balance sheet recently with attractive refinancing and extended credit facilities. The COVID-19 impact will be severe, but also temporary, and won’t have a material impact on the company’s valuation.

Omnicom’s stock price has not recovered with the market following its substantial drop in February and March, and investors can now buy this quality company with a strong market position at a substantial discount to fair value.

Disclosure: I am/we are long OMC, PUBGY, ACN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information enclosed in this article is deemed to be accurate and reliable, but is not guaranteed to or by the author. This article does not constitute investment advice.